AUD/USD: under pressure of prices of commodities. Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

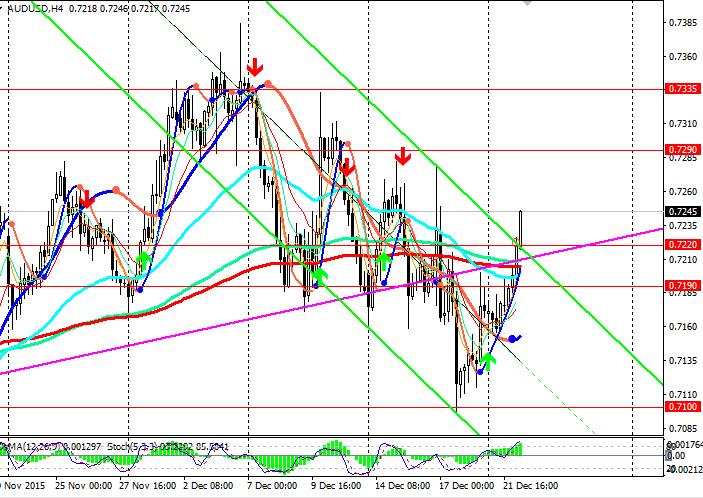

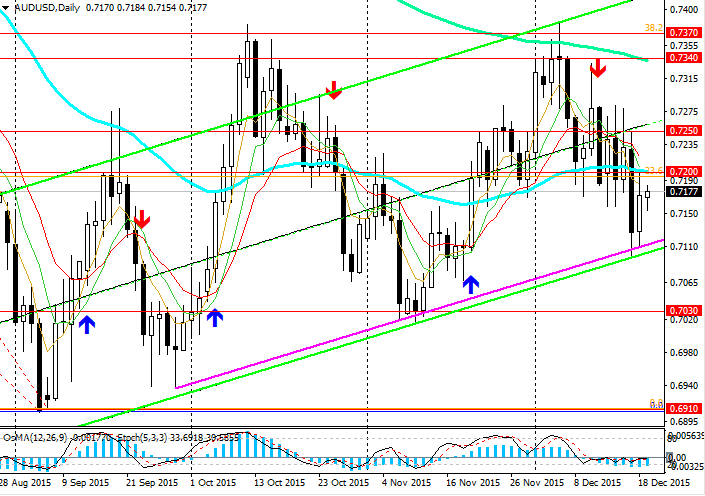

Despite increased volatility in connection with important events regarding the actions of the fed and the BOJ, the pair AUD/USD ended the week at the opening level of last week.

Market participants are enthusiastically greeted the fed's decision, which showed optimism about the recovery of the world economy as a whole.

For the immediate future, the fed plans to gradually raise the interest rate, up to 1,375% by the end of 2016, up 2,375% by the end of 2017 and to 3.25% by the end of 2018.

On the other hand, RB Australia retains the tendency to easing of monetary policy. The decrease in interest rates in Australia to 2016 is expected to double.

The Australian dollar is putting pressure, as decreasing world prices for oil and commodities, including iron ore and weak prospects for economic growth and inflation in the country.

The slowdown in China, as the largest partner of Australia has a negative impact on the Australian economy due to the reduction of the country's Chinese imports, particularly commodities.

On the other hand, the key interest rate in Australia is 2%, which is one of the highest among major world currencies. It will support the Australian currency.

According to some economists, the pair AUD/USD can stay above 0.70 to mid-January and will be stable in the 1st quarter of 2016 due to the influx of capital in Australia in the context of mergers and acquisitions.

By the end of the year and this week activity of investors in financial markets will decline. However, it may increase the number of short-term speculative transactions, which can cause increased volatility.

See also review and trading recommendations for USD/JPY!