FOREX POSITIONS WITH THE HELP BRILLIANT TECHNICAL ANALYZERS

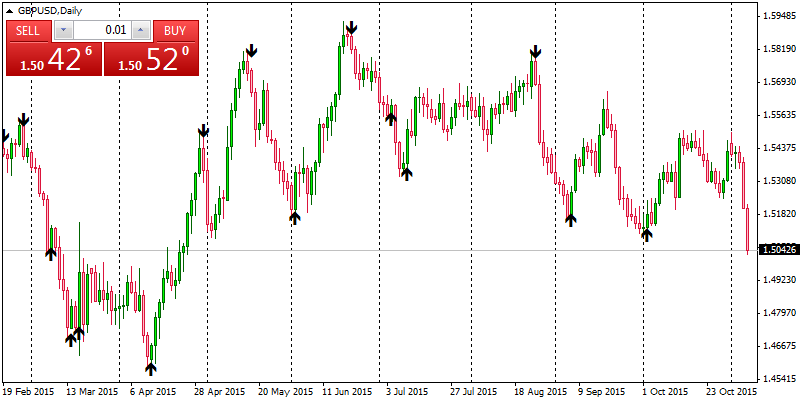

GBPUSD

The graceful upward trajectory staged by the GBP/USD on the daily chart, finds an offsetting bearish harami, a pattern comparable to an Western inside bar.

Prices challenged the 21-period 2-standard deviation upper band by printing outside of its boundaries in the last two days. The bearish pattern also happens in the context of a 14,3,3-sensitive stochastic tracking above the 80 mark. Although this oscillator assumes that prices tend to close near their high in an upwardly trending market, it should now react with any eventual daily close near the lows.

Traders might seach for this price confirmation as well as an invalidation of the pattern in the form of a new daily high.

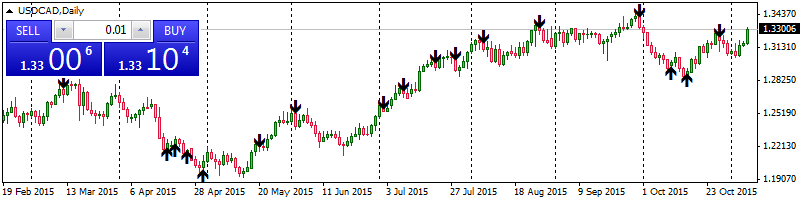

USDCAD

A well bid USD/CAD elevates the ADX above its 50 level, signal of a highly

constructive trend on 1hr charts.

What makes the higher settlement in the

ADX rare -although not unprecedented- is the fact that it was printing below 35

ten hours ago.

Such an outperformance encourages momentum traders to pile

in, and adjust positions by means of trailing stops. This may have the opposite

effect of a corrective slide, driving the prices towards the 200-hour SMA to

find less impulsive buyers.

US Position

US stocks ended mixed on Friday following the release of better than

expected US

nonfarm payrolls.

The Dow Jones Industrial Average rose 46

points, or 0.26%, to 17,910. The S&P 500 index closed 0.03% lower at 2,099.

The Nasdaq Composite ended up 19 points, or 0.38%, at 5,147.

Data showed

US economy added 271,000 new jobs in October versus 180,000 expected and up from

237,000 the previous month, according to the nonfarm payrolls report. Meanwhile,

the unemployment rate dropped to 5.0% versus 5.1% expected.

The dollar strengthened across the board as a much stronger than expected US jobs report lifted expectations of a Fed rate hike in December after Yellen said earlier this week the decision would still depend on incoming data.

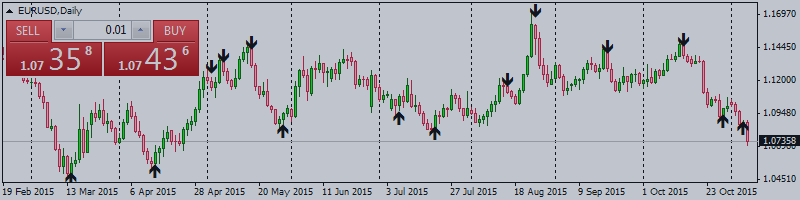

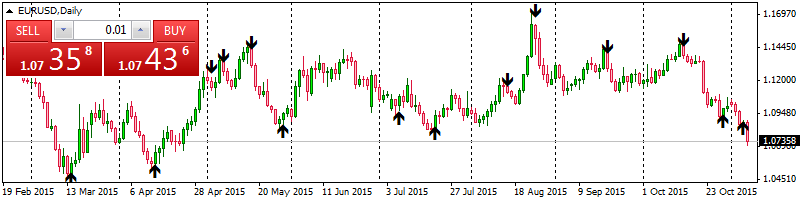

EURUSD

Like two weeks ago, EUR/USD

dropped sharply in the market falling more than 250 pips. A strong US dollar

pushed the pair sharply to the downside.

The pair finished the week

trading around 1.0735/55, after finding support at 1.0700, down 2.30% from the

level it had seven days ago as it continues the decline that started after

approaching 1.1500 three weeks ago. It posted the lowest weekly close since

April 22.

EUR/USD: Another hit from the

NFP

Today’s US jobs numbers pushed the pair sharply to the

downside, but even before the report the euro was already falling against the US

dollar and moving with a bearish bias.

“The pair seems to have set the

tone for the rest of the year, or at least, until the December FED's meeting, as

all of the ongoing dollar's strength is based on speculation that the US Central

Bank will raise its rates then”, said Valeria

Bednarik, Chief analysts at FXStreet.

From a technical perspective, the trend remains bearish. Bednarik noted that advances up to the 1.0840 region, the base of these last months' range, will be seen as selling opportunities. “Given the extreme oversold readings present also in the shorter term, the pair can extend above this region, and rally up to 1.0960, where another bout of selling waits, and still unable to harm, the dominant bearish trend”, she concluded.

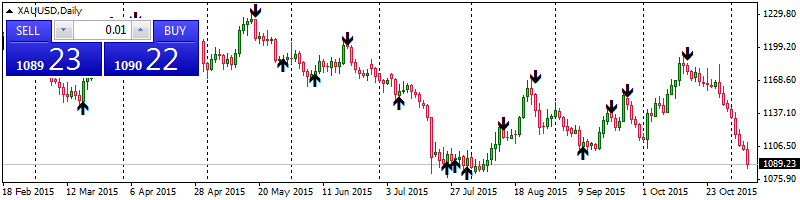

XAU

Gold faced a strong sell-off on Friday and scored a fresh 3-month low sub $1,100

an ounce, with the metal poised to post its eight daily loss in a row and its

third weekly decline.

The dollar strengthened across the board, dragging

oil prices to a 3-month low, as a much stronger than expected US jobs report

lifted expectations of a Fed rate hike in December after Yellen said earlier

this week the decision would still depend on incoming data.

US economy

added 271,000 new jobs in October versus 180,000 expected and up from 237,000

the previous month, according to the nonfarm payrolls report. Meanwhile, the

unemployment rate dropped to 5.0% versus 5.1% expected.

Gold scored a low of $1,085 an ounce and it was last trading around $1,090 an ounce, recording a 1.18% daily loss.