Many analytics are talking about fundamental factors, about Fed hike in December or in March and so on. But there are good technical reasons to sell EUR/USD:

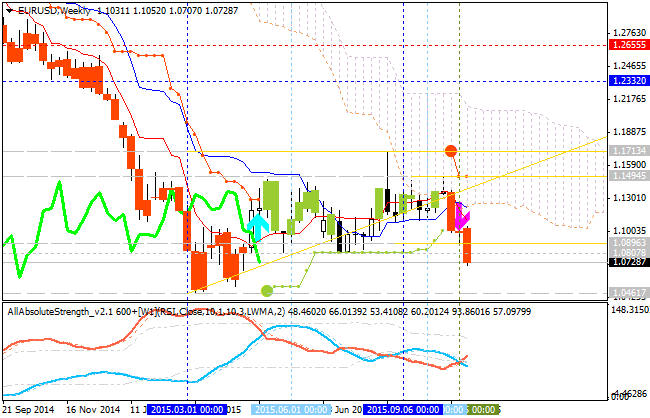

#1. Weekly price is below Ichimoku cloud.

The prise is on bearish market condition to be below Ichimoku cloud and below 'reversal' Senkou Span line which is the border between the primary bearish and the primary bullish on the chart. This downtrend (bearish market condition) was started in July 2014 when ichimoku cloud was broken by the price from above to below, and no any way for the price to be reversed back to the bullish condition in this year and in 2016 for example.

#2. Chinkou Span line is crossing the price from above to below for good breakdown. It is already crossing so soon or later - we may see the breqakdown of the price movement. And 1.0807 support is going to be broken in easy way on close weekly bar.

#3. The price broke 1.0807 support with 1.0461 as the real bearish target. Yes, it is already crossed. The nearest support level for now is 1.0461.

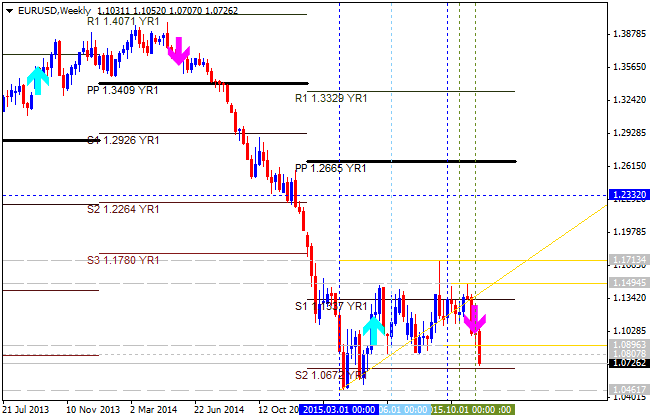

#4. Strong Bearish Signal to S2 Pivot at 1.0672. The price is located between S1 Pivot at 1.1337 and S2 Pivot at 1.0672 with the strong bearish signal. S2 Pivot at 1.0672 is a good bearish target which will be reached soon. And Central Pivot at 1.2665 is too far for the price to be reversed to the bullish condition in this year and next year for example.

#5. The price is breaking Fibo support level from above to below on weekly bar with 1.0059 as the next Fibo target.

Thus, there are strong technical reasons to sell EUR/USD.