"We push back our first Fed tightening view to March 2016 and square EUR/USD shorts. However we want to keep some short EUR exposure as more ECB policy makers speak of upsizing QE. We are confident QE2 is coming this year as Euro area inflation expectations slide anew. Stay short EUR/JPY (we are less convinced that Bank of Japan eases policy further) and open EUR/GBP shorts."

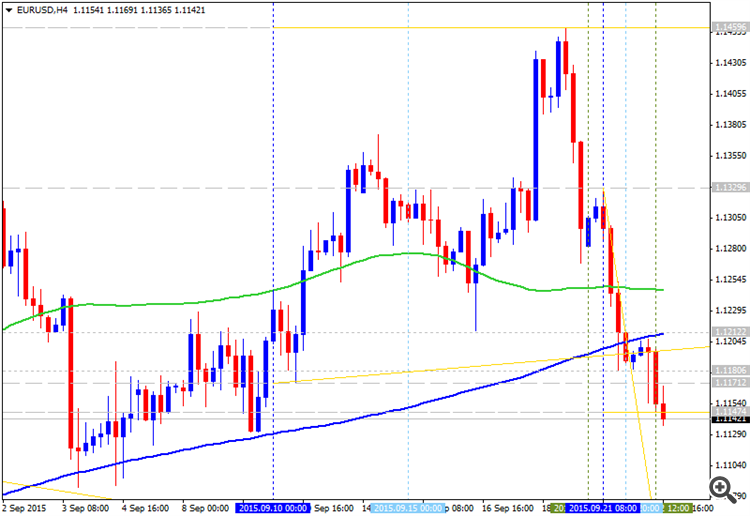

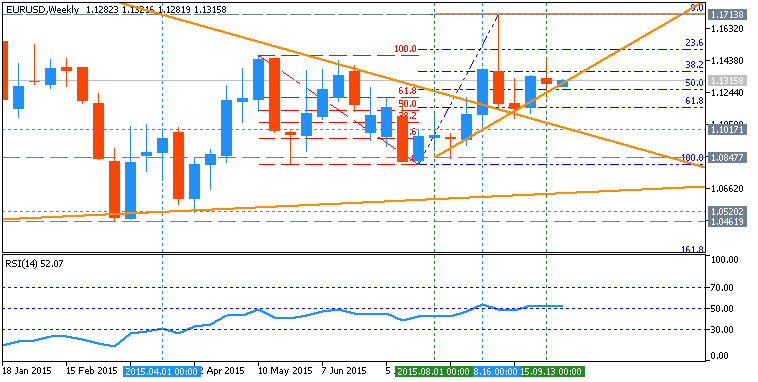

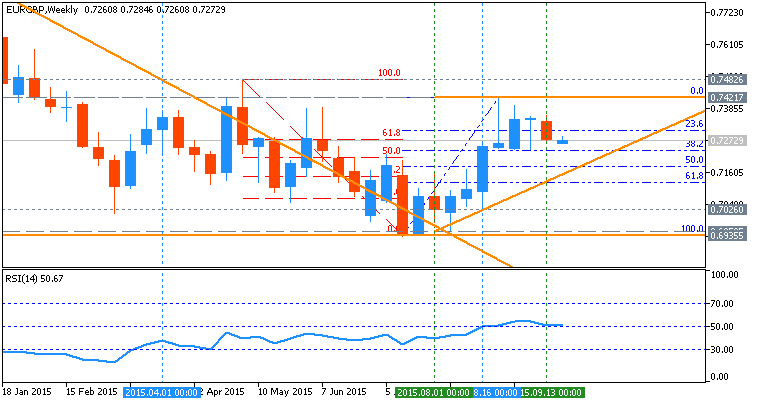

As we see from the chart - the EUR/USD is moved to be around 50.0% Fibo level at 1.1260 located below 100-SMA and 200-SMA for the ranging bearish market condition. The price for EUR/JPY is located between 100-SMA and 200-SMA for the ranging market condition to be moved around 38.2% Fibo level at 135.62 within 139.01 resistance and 132.22 support. The price for EUR/GBP is below 100-SMA/200-SMA for bearish ranging between 0.7421 Fibo resistance and 0.6935 Fibo support: the price is going to 38.2% Fibo support level at 0.7234 as the nearest bearish target for now.

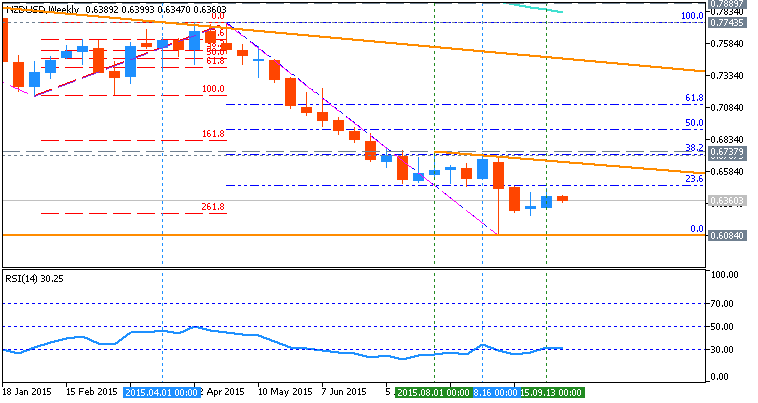

"Stay short NZD/USD where we anticipate more RBNZ monetary easing but square AUD/USD shorts and square USD/CAD longs pending better re-entry levels."

As to NZD/USD so this pair is on promary bearish market condition with 0.6084 as the nearest bearish target.

Thus, RBS is suggesting to sell EUR/USD, EUR/JPY, EUR/GBP, NZD/USD and AUD/USD, and to buy USD/CAD.