Most Important 2 Minutes of the Fed News Conference.

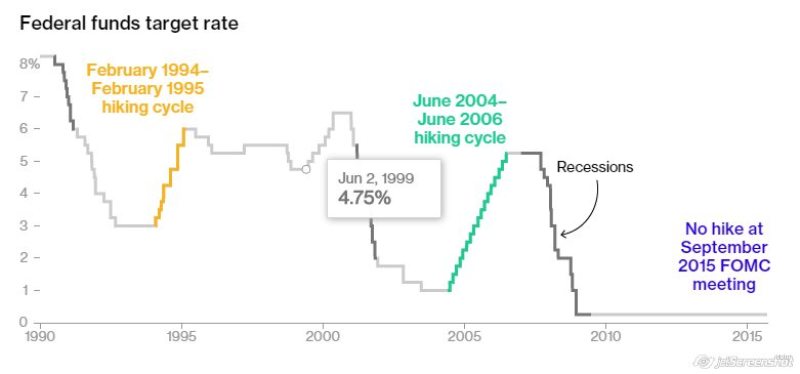

Central bank authorities left premium rates unaltered, selecting to postpone an increment in the midst of persistently low swelling, a questionable viewpoint for worldwide development and late budgetary business sector turmoil.

"Late worldwide monetary and money related improvements may control financial action to some degree and are liable to put encourage descending weight on swelling in the close term," the Federal Open Market Committee said in an announcement Thursday in Washington.

Perused the full articulation here.

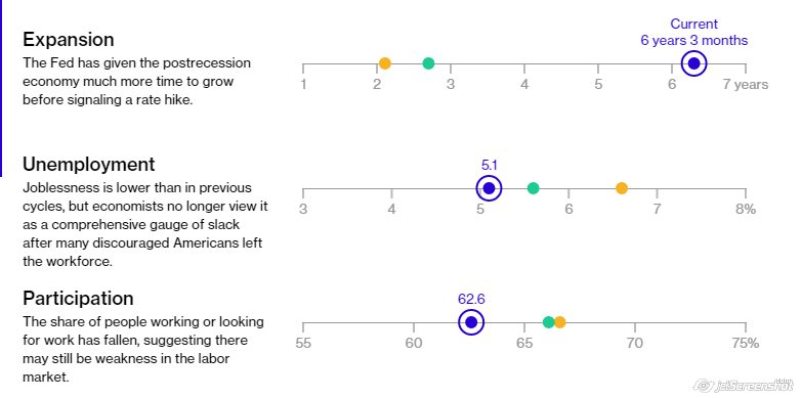

In holding their benchmark government trusts rate at zero to 0.25 percent, arrangement producers indicated they are still not persuaded swelling will move slowly back to their 2 percent focus, in spite of proceeded with increases in the work market. Unemployment in August tumbled to 5.1 percent, its most minimal level subsequent to April 2008.

"On equalization, work market pointers demonstrate that underutilization of work assets has reduced subsequent to ahead of schedule this year," authorities said.

The yield on the 10-year U.S. Treasury note tumbled to 2.23 percent at 2:10 p.m. in New York taking after the announcement's arrival from 2.30 percent late on Wednesday. The S&P 500 pared before increases.

Lacker Dissents

Richmond Fed President Jeffrey Lacker contradicted, saying he wanted to raise the objective rate by 0.25 rate point.

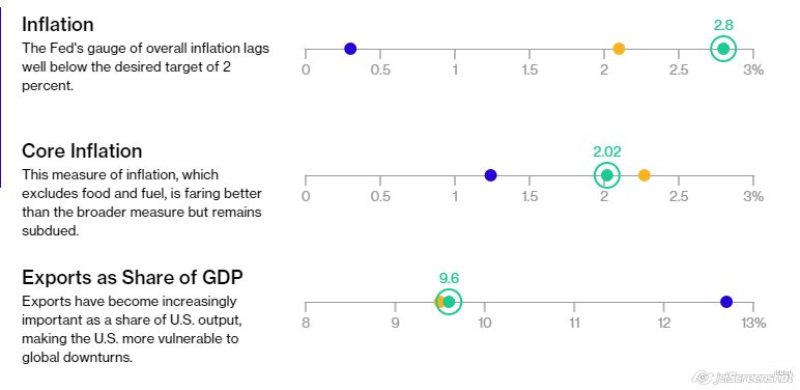

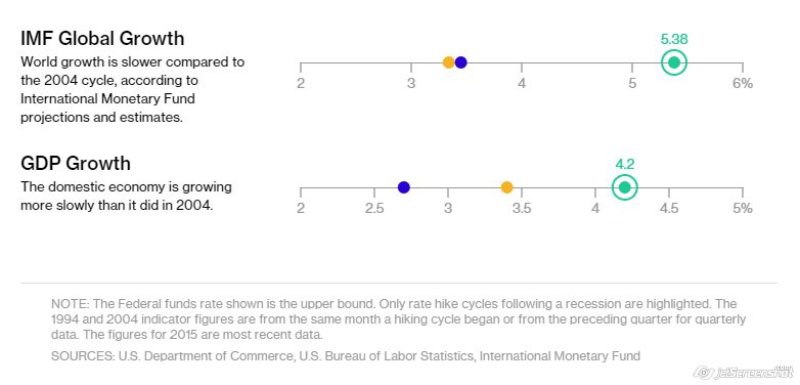

Numerous business analysts have stressed that late misfortunes in China's value markets reflect more profound stresses over development prospects for the world's second-greatest economy. Abating interest from China has likewise helped trigger a worldwide droop in merchandise expenses, adding descending weight to costs in the U.S.

Swelling, as measured by the Fed's favored gage, was 0.3 percent in the 12 months through July and has waited underneath 2 percent for over three years.

Trekking Without a Map

The U.S. Central bank voted Thursday to hold up to start a cycle of premium rate climbs. Monetary conditions scarcely take after the last time the Fed mulled over raising rates, leaving arrangement creators without similar experience to direct their way as they attempt to shepherd the economy to stable development.

The board of trustees rehashed that it will raise rates when it has seen "some further change in the work showcase and is sensibly sure that swelling will move back to its 2 percent target over the medium term."