Oil Traders Hire Tanks on Tiny Island to Profit From Global Glut.

16 September 2015, 19:15

0

186

- Glencore employs capacity tanks in St. Lucia to stow oil.

- Costs near making coasting stockpiling monetarily feasible.

To perceive how oil dealers are benefitting from the longest-enduring excess in three decades, take a gander at the minor Caribbean island of St. Lucia.

Glencore Plc employed tanks at the island's just oil terminal to stow unrefined, joining Vitol Group, individuals acquainted with the matter said a week ago. They're reacting to the market's developing contango, a circumstance where costs today are lower than those in future months, permitting dealers with access to capacity to secure a benefit. From St. Lucia to South Africa to Rotterdam, they're grabbing the open door.

"Contango opportunities are developing," Ian Taylor, CEO of Vitol, the world's biggest autonomous oil dealer, said in a meeting not long ago.

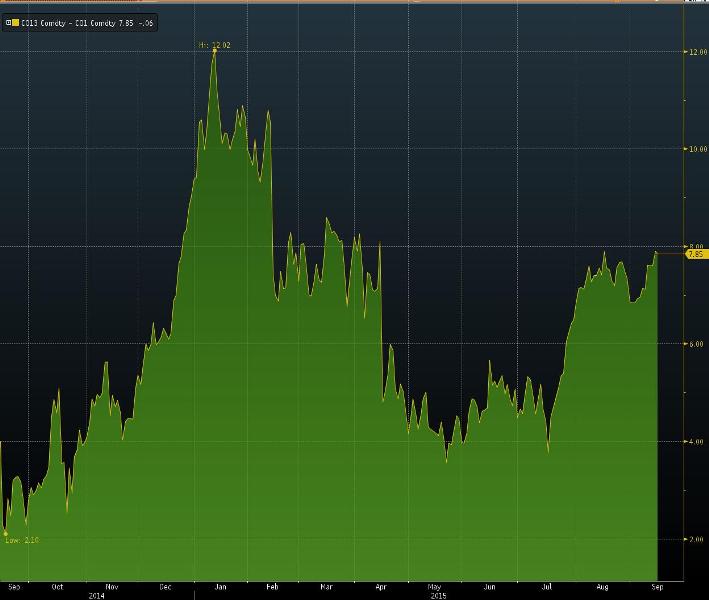

While the oil business sector has been in contango since August 2014, in the most recent month costs have moved in a heading that makes the exchange more productive. The value distinction between a Brent oil contract for quick conveyance, the worldwide benchmark, and one-year forward remained at short $7.82 a barrel on Tuesday, more than twofold its level in mid-July.

The distinction between Brent rough for quick conveyance and the value a year later on has more dramatically multiplied subsequent to July

The spread has enlarged as refiners go into their support season before the northern side of the equator's winter, decreasing raw petroleum admission. In the meantime, supplies in the Atlantic bowl from makers in the North Sea and West Africa have ascended to the most elevated in three years, constraining dealers to locate a home for a huge number of barrels.

Comprehensively, Goldman Sachs Group Inc. gauges unrefined petroleum supply is overwhelming interest by all the more right around 2 million barrels a day, putting expanding weight on the world's capacity limit.

Tanker Tracking

Glencore sent the medium-size Everglades tanker loaded with North Sea rough to St Lucia on Sept. 9, as per boat following information incorporated by Bloomberg. Its opponent Vitol sent supertanker Front Ariake, weighed down with Nigerian rough, to an inland storeroom in Saldanha Bay in South Africa on Aug. 25.

At today's value levels, dealers can store rough coastal, at terminals like St. Lucia and Saldanha Bay and profit. The contango isn't sufficiently solid yet to permit the utilization of oil tankers as gliding storerooms, brokers said.

In any case, signs coasting stockpiling could get to be monetary. Paddy Rodgers, CEO of Euronav, one of the world's biggest proprietors of oil supertankers said that oil is prone to be put away adrift throughout the following four to five months.

"On the off chance that it doesn't happen this fall, then it's going to happen next spring unless something gives on supply-request," Seth Kleinman, head of vitality technique at Citigroup Inc. in London, said by telephone.

Oman Crude

E.A. Gibson Shipbrokers Ltd. gauges that contango levels are motivating closer to permitting coasting stockpiling for some Middle East oil, for example, Oman unrefined. The 3-month contango on Oman unrefined close $3 per barrel is sufficient to cover the $3.10 a barrel it gauges would cost to contract a tanker for skimming stockpiling.

The primary snag to contango exchanges is the expense of capacity, both inland and seaward. In 2008 and 2009, the last time the oil business sector was as oversupplied as today, the stockpiling organizations and delivery firms were moderate to build rates, permitting the merchants who utilized their tanks to take a bizarrely huge cut of the contango benefit. This time, the split between tank proprietors and dealers is all the more even.

The interest for capacity is a help for the world's biggest tanking organizations, including Vopak NV, Kinder Morgan Inc., Oil tanking GmbH and Magellan Midstream Partners LP.

Indeed, even along these lines, the more grounded contango signals a blast for oil dealers if history is any aide.

Vitol had record pay of $2.28 billion in 2009, amid the last huge contango, up from $1.36 billion in 2008, as indicated by the organization's records. BP Plc, which has an expansive exchanging division, said it made an additional $350 million in oil exchanging amid the first quarter, to some degree on account of an in number contango.https://www.mql5.com/en/signals/111434#!tab=history