Inside These Hedge Funds, Special Money Managers for the Boss.

16 September 2015, 18:40

0

1 326

- Ackman's own ventures incorporate innovation new businesses.

- Jones put resources into geothermal organization and African eco-tourism.

Venture inside Table Management, a dark speculation firm in New York, and something abnormal happens: you're transported to the tenuous domain of Bill Ackman, the tycoon multifaceted investments director.

Table, it turns out, is kind of a mystery wrapped in riddle. From the same Manhattan high rise as Ackman's Pershing Square Capital Management, Table handles the individual accounts of one customer: the supervisor.

Ackman's setup may appear to be abnormal in the support investments business, where chiefs stake their fortunes on the stores they regulate for customers.

Be that as it may, a developing number of noticeable fence funders are additionally discreetly cordoning off private enclaves for themselves, frequently inside of their enormous name firms. Eric Mindich, Dan Och and others have made what are known as single family workplaces - and not everybody is upbeat about it. Pundits say administrators ought to concentrate on their multifaceted investments and, in actuality, eat their own particular cooking.

"I anticipate that support investments supervisors will be 100 percent put resources into their speculative stock investments," said Karl Scheer, boss venture officer of the $1.2 billion enrichment at the University of Cincinnati. "I lean toward that they're independently engaged with a specific end goal to accomplish the best results."

Foggy Lines

In a few ways the chiefs are simply taking after a fundamental principle of contributing: differentiate. Yet, customers and controllers stress these one-part clubs could raise potential clashes, going from who spreads costs for what, to how speculations may cover or impact.

In any event, the lines can get foggy. Table, for occasion, put resources into Sprout Pharmaceuticals, creator of the first pill to help ladies' sex drive. No sooner was the medication affirmed in August than Sprout was obtained by Valeant Pharmaceuticals International Inc., a firm that Ackman, from his roost at Pershing, had championed amid an antagonistic takeover standoff.

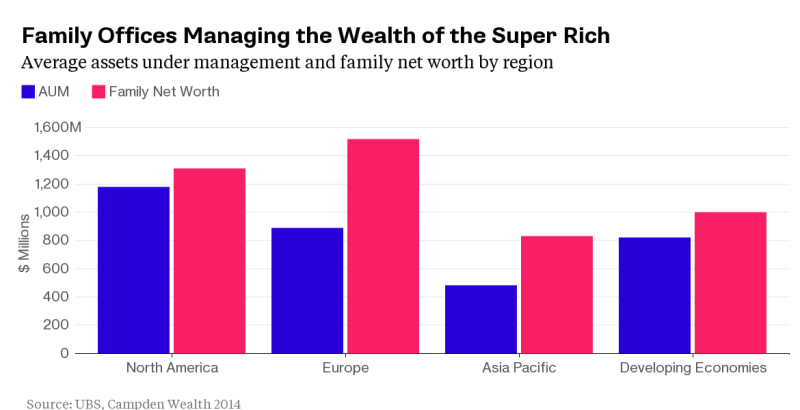

Family workplaces have been around since the times of John D. Rockefeller. Be that as it may, the business has blasted in a period of hyper-riches on Wall Street, in Silicon Valley and past. Private value titans, for example, Leon Black and David Bonderman have set them up, as well. The organizations handle a wide range of issues, from duties to magnanimity to looking after homes.

"This is conceivably another time of family workplaces," said Jamie McLaughlin, a Darien, Connecticut-based guide to riches administration firms.

Ackman began Table four years back so he could concentrate on overseeing Pershing, a man with information of his reasoning said. The family firm developed out of speculations Ackman did with his dad and now has a group of around five, including CIO Greg Lyss, who worked for Ackman at his first reserve; and President Andrea Markezin, who beforehand worked at the family office of the Sulzberger family, which controls the New York Times Co.

Notwithstanding Sprout, Ackman has put resources into new companies including Relationship Science, an online expert systems administration firm; PlaySight Interactive, a tennis investigation organization; and Nitrous, a distributed computing firm. Be that as it may, a large portion of Table's speculations are in land, including a $91.5 million penthouse in Manhattan.

Mindich, Och

Mindich, originator of Eton Park Capital Management, made Everblue Management last October. To run it, he procured Kerrie Juras Ferrentino, who already worked with the family office of the Dolans, the New York tribe behind Cablevision. It's vague if Everblue has made any ventures.

Och, who runs Och-Ziff Capital Management Group LLC, set up his Willoughby Capital Management in 2009. It's controlled by Morgan Rutman, a previous speculative stock investments supervisor. The CIO, Mira Muhtadie, already worked in private value and manages speculations including funding and workmanship.

Paul Tudor Jones has been enhancing past his Tudor Investment Corp. since the late 1980s. His Jones Family Office, with areas in Greenwich, Connecticut, and Palm Beach, Florida, is controlled by Mikael Andren, who beforehand worked in private value. The association's ventures incorporate Singita, an eco-tourism organization in Africa; Reykjavik Geothermal, an Icelandic clean-vitality organization; and exchanging firms Castleton Commodities and Engineers Gate.

Approximately Regulated

Single family workplaces are much more inexactly managed than mutual funds, and there are couple of necessities about what they must reveal openly. Some stress that these parallel operations could make clashes.

Suppose it is possible that a chief's family firm puts resources into a little organization that develops into one in which the support stock investments needs to contribute. In-house family workplaces, which share office space and conveniences, are especially irritating. Who pays costs for exploration and bolster staff? Like Tudor, some of Jones' family-office endeavors exchange products and utilization PC driven methods.

Mindich's Everblue and the family office of Ray Dalio, who runs Bridgewater Associates, are housed in the same structures as their stores. Like Ackman, Mindich and Dalio spread the expenses of running their family firms, individuals with learning of the matter said.

By complexity, Och has put some separation - actually - between his New York trust and family office, which is based 30 miles north of the city in White Plains.

SEC's View

Representatives for Eton Park, Och-Ziff and Tudor declined to remark on the potential for clashes between the two sides.

Controllers are observing. The U.S. Securities and Exchange Commission is attempting to evaluate dangers connected with the development of family workplaces.

"Expanding from the trust is not an issue, but rather we need to verify that if there's a cover of speculations, it's uncovered in an opportune way to financial specialists," said Jennifer Duggins, who co-runs the SEC's private stores unit.

Over at Pershing, Ackman revealed his holding in Sprout on Aug. 26, six days after Valeant said it was purchasing the organization. In a report to customers, Ackman said the holding stamped just the second time he'd put resources into a private firm that was in this manner purchased by an organization in which Pershing has a stake. (Pershing wouldn't have put resources into Sprout in light of the fact that it just takes stakes in traded on an open market securities.)

Ackman's Rules

Ackman additionally said in the report that his support stock investments has strict arrangements overseeing potential clashes. Representatives aren't permitted to put resources into traded on an open market value or obligation securities other than U.S. Treasuries, currency markets and civil securities. Almost all workers have a large portion of their fluid total assets tied up in Pershing trusts, however they aren't urged to put 100 percent in, Ackman said.

"Representatives that are "overinvested" in the trusts may lose the impartial monetary sanity that is key for sound speculation judgment, especially in times of business sector stress," Ackman composed.

A representative for Ackman declined to remark for this story.

At Fortress Investment Group LLC, four administrators have family workplaces based inside of the New York-based firm. One of them, Red Lion, handles the issues of Michael Novogratz and another central. Their staffs got to be representatives of Fortress three years prior, as indicated by a recording.

The officials repay Fortress for remuneration, advantages and different costs, representative Gordon Runte said. They are banished from putting resources into the same ranges as their stores, unless they can demonstrate that their stakes have no effect on the trusts, he said.

At last, then again, such steps may not be sufficient to dispense with all contentions, genuine or saw. Most speculators trust their cash chiefs and don't beware of potential clashes, said Daniel Celeghin, an accomplice at Casey Quirk & Associates, a Darien, Connecticut-based counsel to resource administrators.

"Chiefs self-police, so it to a great extent comes down to trust," he said.https://www.mql5.com/en/signals/111434#!tab=history