EUR/USD Tech Review: 'correcting to 1.11' by Nomura; 'it isn’t very clear' by Goldman Sachs

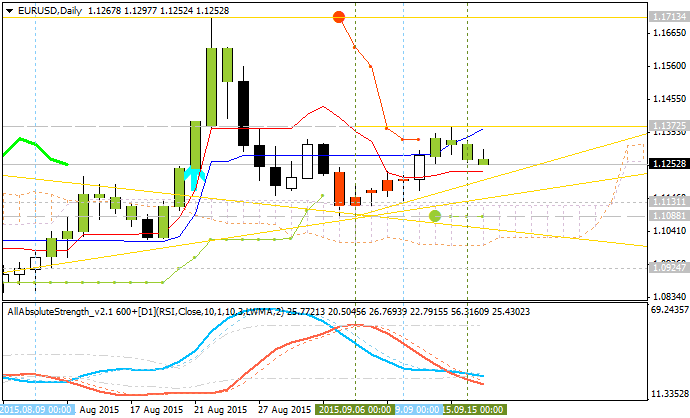

Nomura made a forecast for EUR/USD stated about correction for this pair to 1.11 :

-

"It is complex correction that is expected to complete

via 2 a-b-c rallies, currently the latter stages of the second a-b-c

are unfolding. A rally from near 1.13 to 1.14 can complete the larger

wave-B."

- "S/t, support via old pivots and an uptrend line is between 1.1300/1288, more critical support below is 1.1254. Resistance is 1.1340 and then the recent pivot high at 1.1374."

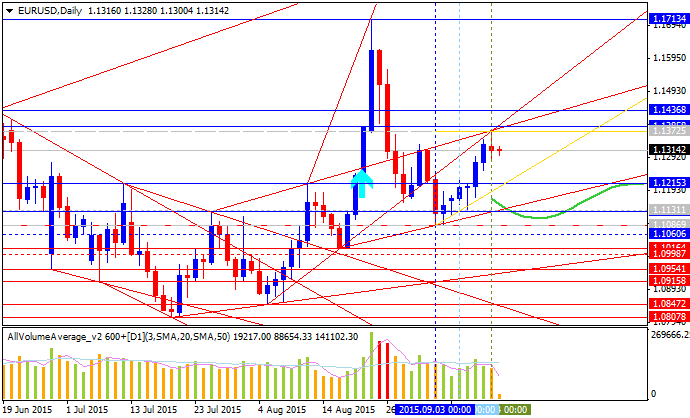

By the way, Goldman Sachs noted that the setup in EUR/USD isn’t very clear:

-

"A complete correction should retrace within wave 4 territory and near

38.2% of the preceding trend. In this case the high at 1.1713 is near

enough to 38.2% at 1.18 and actually exceeds the 4 th wave

(1.1533-1.1099). Moreover, an ABC extension from the March low targets

1.1818 (again, near enough?)."

- "At this point it seems reasonable to take a neutral stance until further signal develops."

Anyway, as we see from daily chart - the price is located near above 200 day SMA with 1.1372 resistance level to be ready for two scenarios to be implemented:

- bullish trend will be continuing by breaking 1.1372 resistance with 1.1713 as the next bullish target, or

- the price will be reversed to the bearish trend by breaking 1.11/1.10 support levels.