Pimco, Fidelity Stung by Collapse of Petrobras' 100-Year Bond.

15 September 2015, 06:52

0

177

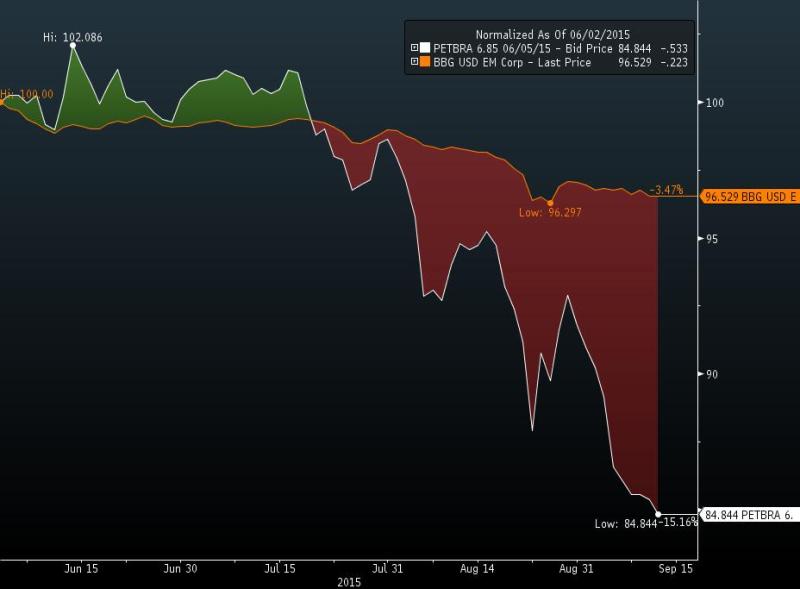

- One-hundred-year bonds have dove 15% since June issue.

- S&P brought down Petrobras' FICO score to garbage a week ago.

At the point when Petroleo Brasileiro SA sold 100-year bonds in June, the move was generally seen as a sign the defilement spoiled oil maker had put the most exceedingly bad of its issues behind it.

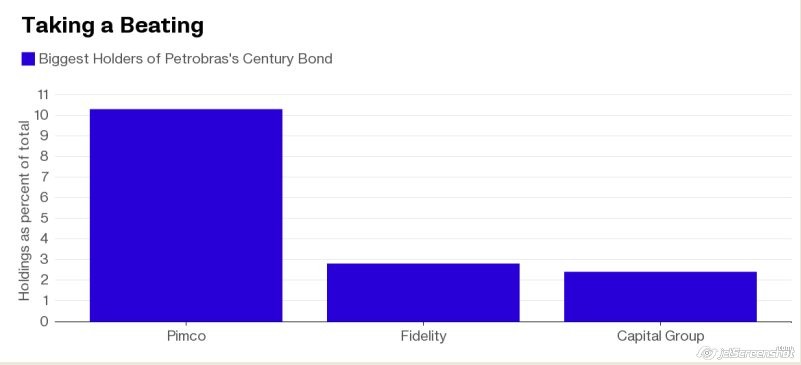

For speculators like Pacific Investment Management Co., Fidelity Management & Research Co. what's more, Capital Group Inc. - the three greatest holders of the securities - that ended up being an immoderate erroneous conclusion. Since the $2.5 billion offering, the bonds have tumbled 15 percent. That is four times the normal misfortune for developing business sector organization obligation.

The dive extended a week ago, when the securities sank to a record-low 69.5 pennies on the dollar after Petrobras, as the Brazilian organization is known, had its FICO score sliced to garbage by Standard & Poor's. The world's most-obligated real oil maker was stripped of its venture grade by Moody's Investors Service seven months prior as an extending test into claimed influences paid to previous administrators at the state-controlled oil organization made it defer reporting profit.

"Everything was valued for flawlessness, and unfortunately, with the exception of soccer players, Brazil sometimes accomplishes flawlessness," Russ Dallen, the head broker at Caracas Capital Markets, said from Miami.

Pimco didn't react to messaged solicitations for input. Constancy and Capital Group declined to remark. Petrobras didn't react to an email looking for input on the execution of its bonds. The organization has effectively sufficiently obtained to back its activities for the medium term, it said in an announcement Sept. 10.

Yields on Petrobras' 6.85 percent securities, which develop in 2115, have taken off 1.5 rate focuses to a record 9.86 percent since they were issued on June 2, as indicated by information incorporated by Bloomberg.

Rio de Janeiro-based Petrobras sold the purported century bonds - the first by a creating country organization since 1997 - in the wake of closure a five-month delay in distributed income in April.

Yet since the deal, Petrobras' battles have just exacerbated as oil costs dove further. UBS AG cut its 2015 income gauges for Petrobras by 80 percent this month on lower oil costs and sudden expense charges.

Brazil's own hardships have additionally extended, with the economy now set out toward its longest retreat subsequent to the Great Depression. S&P, which brought down Petrobras' evaluating one day after its minimization of Brazil, flagged more cuts for the organization by keeping its standpoint negative.

To trim obligation, Petrobras is hoping to slice $12 billion in costs through 2019 and has begun looking into contracts for its armada of seaward boring apparatuses. Still, the 50 percent fall in oil costs in the previous year will make it harder for the organization to raise money by offering resources, Bank of America Corp. said in a Sept. 11 note to customers.

"Petrobras and Brazil are going to need to get used to paying more," Caracas Capital Markets' Dallen said.https://www.mql5.com/en/signals/111434#!tab=history