Puerto Rico to Make Debt Restructuring Proposal in a Few Weeks.

10 September 2015, 21:21

0

165

- Republic confronts a $500 million trade deficiency out June 2016.

- Ban on vital installments is being sought after by island.

Puerto Rico arrangements to present an obligation rebuilding offer in a couple of weeks to address an anticipated $13 billion setback in bond installments due throughout the following five years that the republic says it can no more bear to pay.

"We'll be prepared with a first proposition in the matter of how to make the $18 billion value of contractual obligation administration fit to the accessible assets we have under this arrangement," Jim Millstein, the island's boss rebuilding guide, said in San Juan, after Governor Alejandro Garcia Padilla's organization discharged what they're calling a monetary and financial development arrangement. Puerto Rico said it just has $5 billion accessible for the installments.

Costs of a federation's portion bonds, which have been exchanging at troubled levels, fell after Puerto Rico made it clear in the recommendation that it would look to compel misfortunes on most obligation financial specialists. It likewise seek after a ban on vital installments for quite a long while, as per Melba Acosta, the island's principle obligation official.

The proposition paints a critical picture of Puerto Rico's accounts and the outcomes to the island's 3.5 million occupants. The anticipated deficiency is after expected reserve funds from the solidification of 135 government funded schools, diminishments in human services spending, extra endowment cuts and decreases in finance costs. The appraisal rejects the island's electric and water utilities.

"We're far from recognizing what the finished result will be on some of these credits," Matt Dalton, CEO of Rye Brook, New York-based Belle Haven Investments, said before authorities presenting the arrangement to the senator on Tuesday. The firm oversees more than $3 billion of civil securities, including Puerto Rico obligation.

Puerto Rico's Growing Debt Burden

Puerto Rico is confronting a more quick liquidity crunch. Authorities appraise the island will have a $500 million shortage before the end of June. The province owes $805 million on July 1 to general-commitment bondholders, as indicated by information aggregated by Bloomberg. Authorities expect an aggregate income deficiency of $28 billion in the following five years that may be diminished by about half by cutting consumptions and boosting income accumulations.

The arrangement showed that the district may experience difficulty paying off its general commitment bonds and has approved its consultants to start dealing with an intentional trade offer. "Accessible assets may be inadequate to administration all main and enthusiasm on obligation that has a sacred need," the report said.

That may pit holders of general-commitment obligation, which Puerto Rico's constitution says must be paid first before different costs, against speculators of offers assessment bonds, which have a committed income stream.

"These cases really contend with one another," Millstein said. "Accommodating the contending cases of the loan bosses will be one of the troublesome undertakings here."

General-commitment bonds with a 8 percent coupon and developing July 2035 exchanged at a normal cost of 73.2 pennies on the dollar, down from 75.5 pennies on Tuesday. That is up from a record-low 66.6 pennies on June 30, after Garcia Padilla said the island would look to postpone installments, as per information incorporated by Bloomberg. The normal yield spoke the truth 11.5 percent.

Irritable's Investors Service said it may downsize the province underneath its present rating of Caa3 relying upon the result of bondholder transactions.

The senator will choose a five-part control board from chosen people put together by loan bosses, outside partners and perhaps the national government, authorities said before the arrangement's arrival to the general population. That board will have the ability to authorize budgetary cuts. A few examiners have called for government control of any oversight board.

Puerto Rico and its organizations have racked up what they say is an unsustainable obligation load in the wake of getting to round spending plan deficits and push out installments. Different organizations swung to shortage getting with the desire that an enhancing economy would end the practice. Rather, the island's economy has contracted consistently yet one since 2006 and is anticipated to decrease another 1.2 percent in the financial year finishing June 30, 2016.

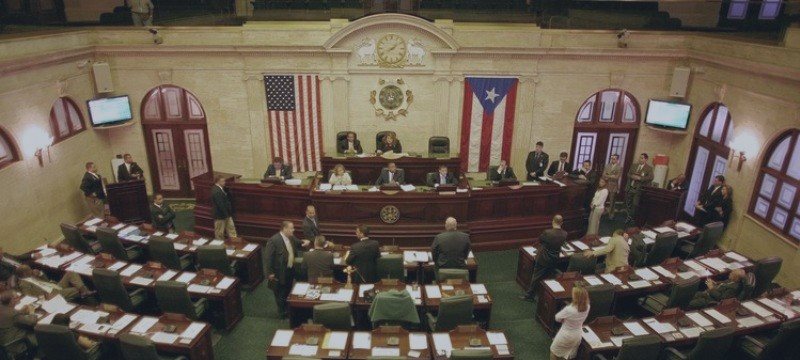

A Puerto Rico rebuilding would be the biggest ever in the $3.6 trillion civil security business sector, surpassing Detroit's record insolvency documenting in July 2013, which included about $8 billion of fortified obligation. Puerto Rico substances are not able to get to Chapter 9. An arrangement's portion proposed changes, for example, welfare change, changes to work laws and dispensing with corporate-charge provisos, will oblige endorsement from Puerto Rico's council.

A federation office, the Public Finance Corp. defaulted on a $58 million obligation administration installment on Aug. 3, a first for a Puerto Rico element, in light of the fact that officials neglected to distributed trusts in a financial plan crunch. The organization additionally avoided a Sept. 1 interest installment.

The obligation change proposition takes after a Sept. 1 speculative assention between Puerto Rico's fundamental electric utility and some of its bondholders that would offer financial specialists 85 percent of the securities' estimation they hold through an obligation trade. The force supplier has $8.3 billion of obligation and is looking to modernize plants that depend on oil to deliver power.https://www.mql5.com/en/signals/111434