China Just Killed the World's Biggest Stock-Index Futures Market

10 September 2015, 19:11

0

141

Include the world's greatest stock-record prospects business sector to the rundown of losses from China's interventionist battle to stop a $5 trillion value defeat.

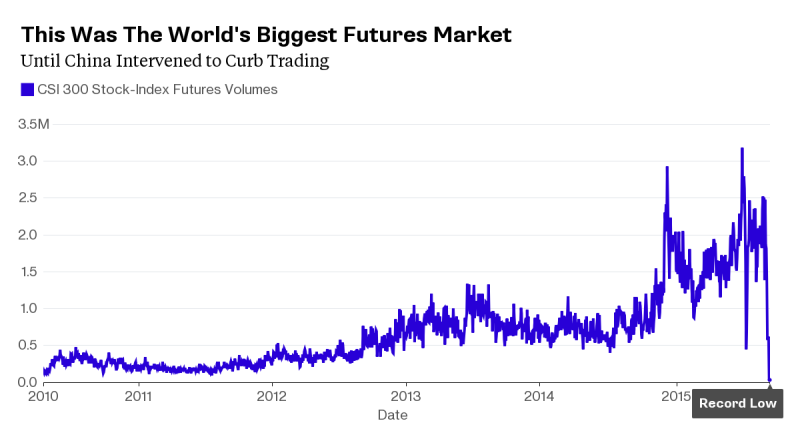

Volumes in the nation's CSI 300 Index and CSI 500 Index prospects sank to record lows on Wednesday in the wake of falling 99 percent from their June highs. Positioned by the World Federation of Exchanges as the most dynamic business sector for record fates as of late as July, liquidity in China has gone away as powers raised edge necessities, fixed position confines and began a police test into bearish wagers.

While exchanging Chinese values has likewise drooped in the midst of checks on short deals and an examination concerning PC driven requests, the tumble in prospects volumes may bring about considerably more prominent harm in light of their focal part in the venture procedures of residential mutual funds and other institutional cash administrators. An inability to restore the business sector would undermine the administration's own particular endeavors to draw in expert speculators to neighborhood stock trades, where people still record for more than 80 percent of exchanges.

"It is additional proof that the Chinese powers are not yet prepared to focus on openly exchanging markets," said Tony Hann, a London-based cash supervisor at Blackfriars Asset Management, which regulates about $350 million. "Completely working created money related markets in China will take numerous years."

Famous Tool

Chinese arrangement producers, plan on completion a selloff that has disintegrated trust in their administration of the economy, are focusing on the fates market on the grounds that offering the agreement is one of the most straightforward routes for financial specialists to make extensive wagers against stocks. It's additionally a favored item for transient examiners in light of the fact that the trade permits members to purchase and offer the same contract in a solitary day. In the money values market, there's a restriction on same-day exchanging.

Yet fates are additionally a prevalent device among refined financial specialists with longer-term skylines. For flexible investments, they give a simple approach to conform presentation to market swings. What's more, substantial establishments use them to roll out financially savvy resource allotment improvements. As an illustration, offering record fates may be less expensive than emptying a substantial square of shares - a request that could put descending weight on costs.

A supported droop in liquidity may goad some institutional financial specialists to "surrender supporting in fates, loosen up fates positions and decrease their stock positions," said Dai Shenshen, a merchant at SWS Futures Co. in Shanghai.

China, which has been researching confirmation of "malevolent" short offering subsequent to July, ventured up controls in the fates markets on Monday. The China Financial Futures Exchange now names a position of more than 10 agreement on a solitary file future as "strange exchanging." While the bourse said the limitation won't have any significant bearing to fates utilized for supporting purposes, it didn't detail how it will recognize such exchanges. Before a month ago, financial specialists could have upwards of 600 agreement.

The bourse likewise raised expenses for settling positions opened around the same time to 0.23 percent from 0.0115 percent. Edge prerequisites on stock-list fates contracts were lifted to 40 percent from 30 percent. For those with supporting request, the levels moved to 20 percent from 10 percent. Trade authorities didn't react to messaged inquiries from Bloomberg News on Tuesday.

Prospects exchanging on the CSI 300 Index, a country's gage greatest organizations, shrank to only 27,899 agreement on Wednesday. That is down from 3.2 million toward the end of June and contrasts and the 30-day normal of 1.7 million. For the CSI 500 Index of little top shares, volumes have dropped to 11,820 from around 144,000 a month prior.

The CSI 300 climbed 2 percent on Wednesday, while the benchmark Shanghai Composite Index expanded 2.3 percent.

Change Agenda

While Bocom International Holdings Co's. Hao Hong says the prospects checks will be particularly difficult for local flexible investments, he doesn't think Chinese powers are surrendering their long haul objective of giving markets a more prominent influence in the economy. At this moment, Hong says, strategy creators are principally centered around guaranteeing strength in the country's money related framework.

"Change is still a critical motivation, however it is additionally a more extended term one," said Hong, the China strategist at Bocom in Hong Kong.

For Yoyo Shi, a Shenzhen-based dealer at Citic Futures Co., it's misty to what extent the most recent measures will last. What she does know is that they're terrible for the securities business as volumes dissipate.

"It's an extreme time for every one of us," said Shi, whose firm is a unit of China's greatest business. "Every one of the measures the powers acquainted with assist the with marketting turn out to be more solid in the course of recent months should be interim. Be that as it may, as should be obvious, there are more measures coming in."https://www.mql5.com/en/signals/111434