RBS: Non-Farm Employment Change and basic trading scenarios

The Royal Bank of Scotland evaluated some scenarios concerning NFP for today (September 4 at 13:30 GMT).

- "250k to 300k: Long USD/CHF."

- "200k to 250k (Base-Case): Short EUR/USD."

- "150k to 200k: Short USD/CAD."

-

"150k or below: Short USD/JPY."

As we know - Non-Farm Payrolls is the most high impacted news event which can move the price for the pairs and estimate the direction of the trend for the next week for example.

Just to remind about this news event:

==========

2015-09-03 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

- past data is 215K

- forecast data is 215K

- actual data is n/a according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

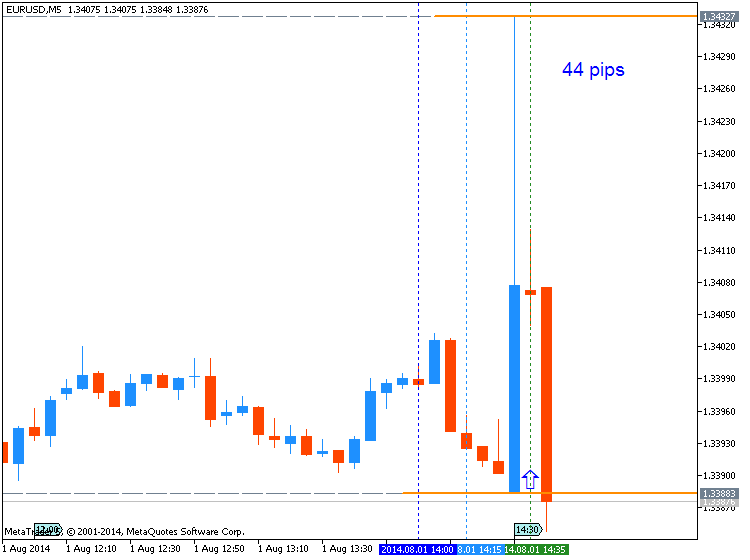

EURUSD M5 : 44 pips price movement by USD - Non-Farm Payrolls news event: