The Most Downloaded SSRN Paper Ever Is All About Market Timing

1 September 2015, 20:05

0

180

What's more, it proposes speculators ought to as of now be in real money

There are two great motivations to investigate this week at the most downloaded paper on the Social Science Research Network. For a begin, we're heading into Labor Day weekend, which means it's the ideal time for light shoreline perusing. Second, the paper is centered around a business timing method, and this specific business timing procedure current proposes financial specialists ought to continue with most extreme alert.

Here's Mebane Faber, the paper's creator and fellow benefactor of Cambria Investment Management, on Twitter on Tuesday:

As it were a portfolio in light of the paper's system would be completely put resources into money and securities a month ago—no stocks. As Faber noticed, that is to a great degree uncommon, happening under 7 percent of the time. The possibly most troubling bit is that the last time this happened was in the profundities of the money related emergency.

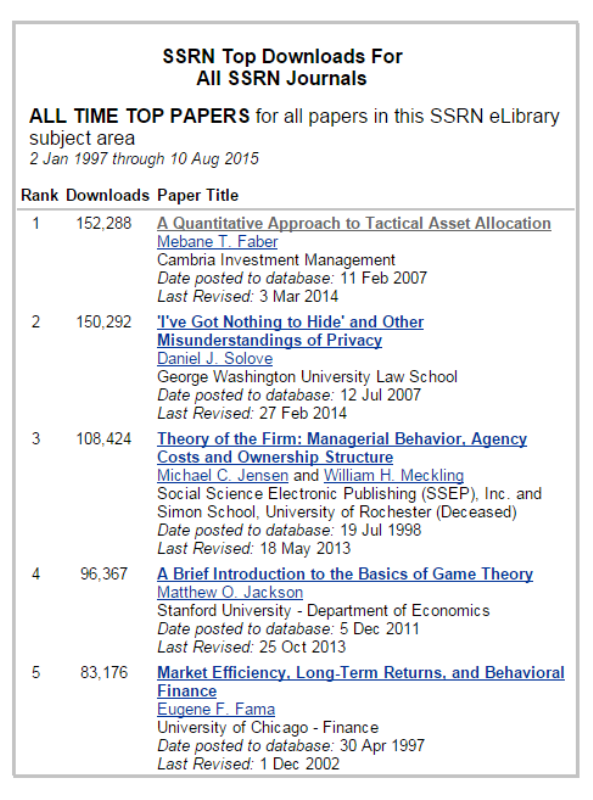

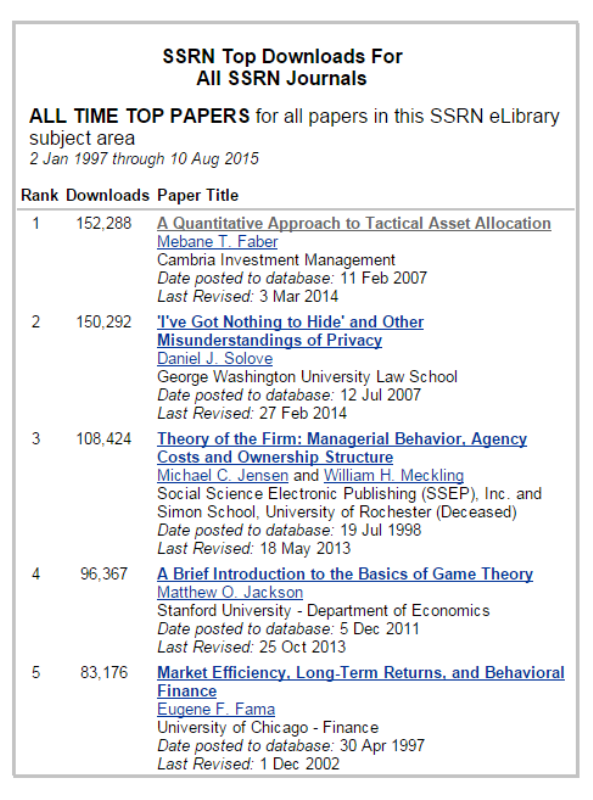

Established in the 1990s by two money related business analysts, the SSRN has rapidly turned into a go-to site for an expansive number of individuals in the fund business. The webpage's idea is really basic: It permits creators to transfer their scholarly papers specifically to the website with the expectation of complimentary downloading around the world, while distributers and foundations have the alternative of transferring papers and charging an expense for each download.

Initially distributed in 2006 and most as of late overhauled in 2013, his paper has been downloaded more than 150,000 times on SSRN. It concentrates on a business sector timing system to help financial specialists smooth unpredictability in their portfolios while staying in productive positions—and ensuring themselves ought to the air pocket burst.

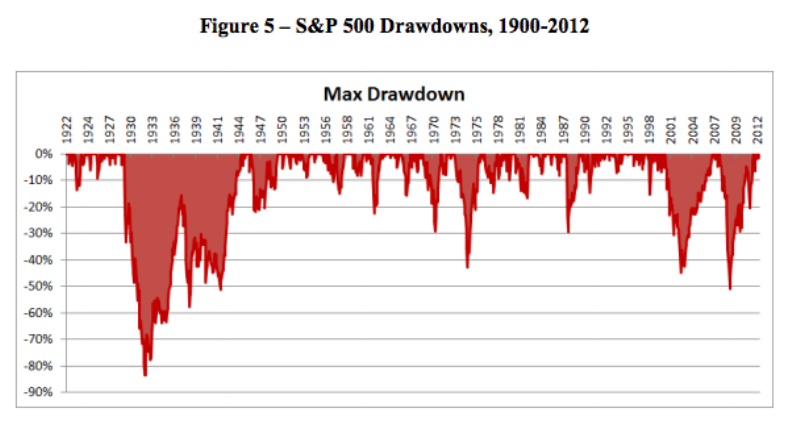

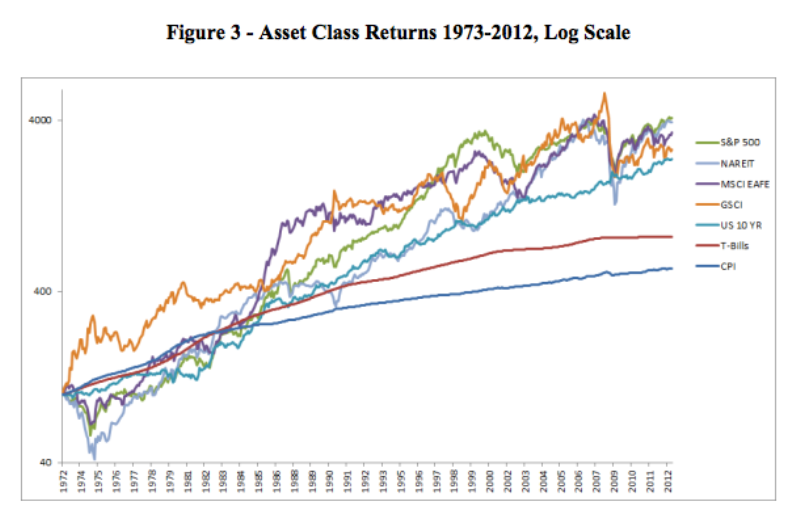

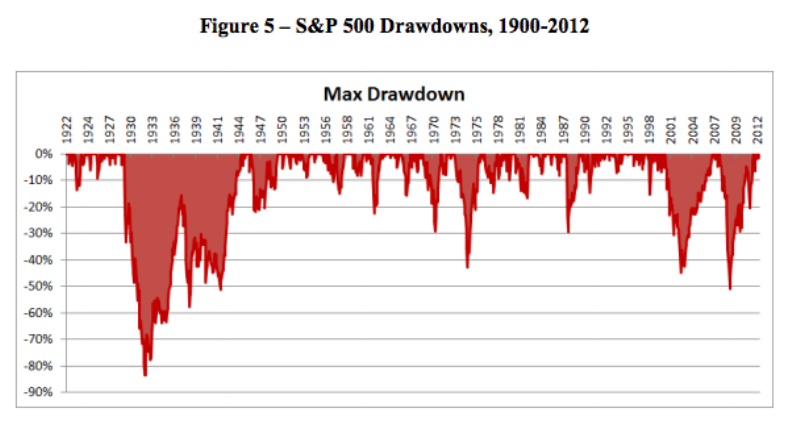

Here's a representation of the issue Faber is attempting to comprehend.

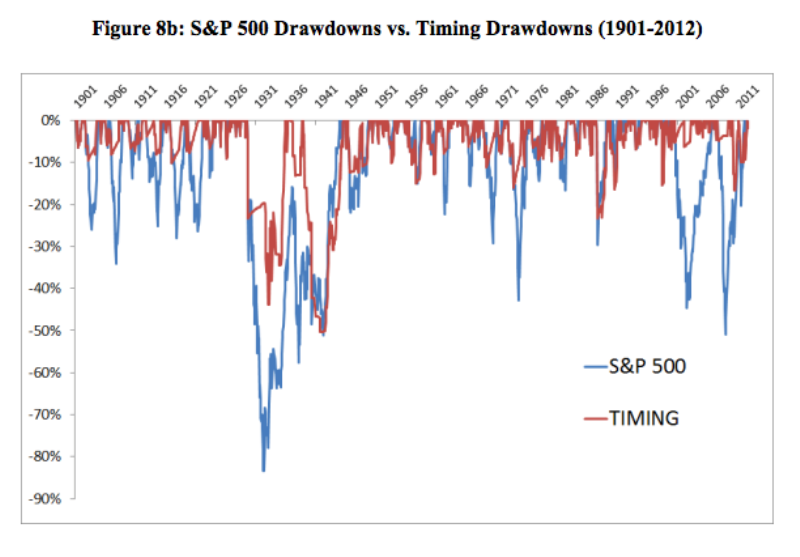

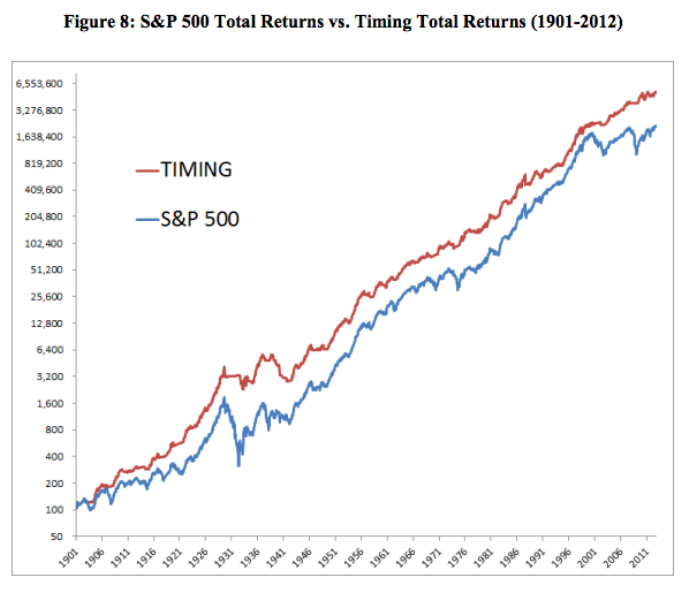

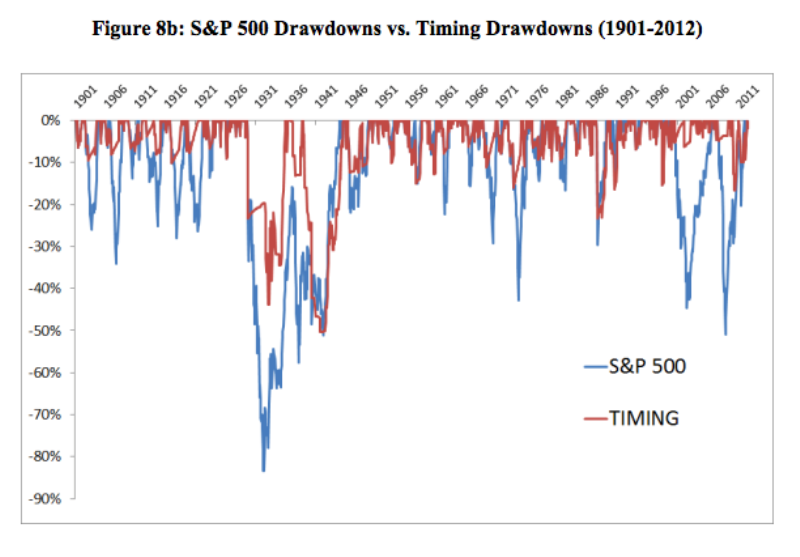

Faber proposes a business sector timing arrangement, or a "danger decrease method that flags when a financial specialist ought to leave a dangerous resource class for danger free ventures." One specific brand of business sector timing he recommends lives up to expectations along these lines: Investors ought to purchase when a security's month to month cost is higher than its 10-month straightforward moving normal and offer when the cost is not exactly the 10-month basic moving normal.

While the timing model improved and positively diminished instability, it merits remembering that Faber's methodology does not, for functional reasons, consider such things as duties and commissions.

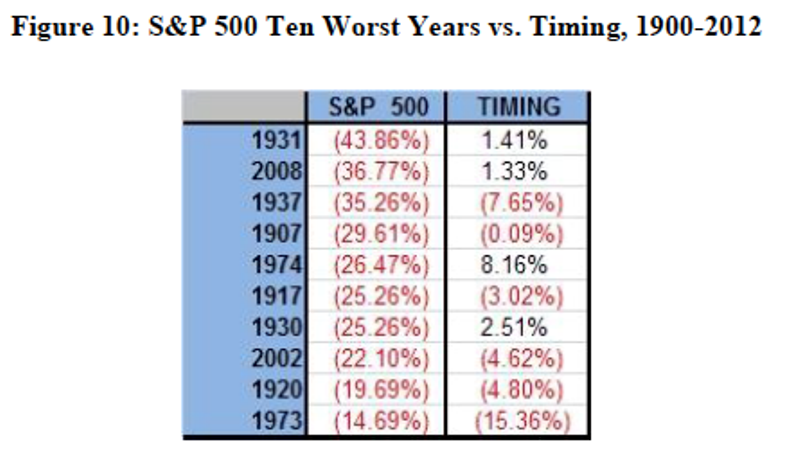

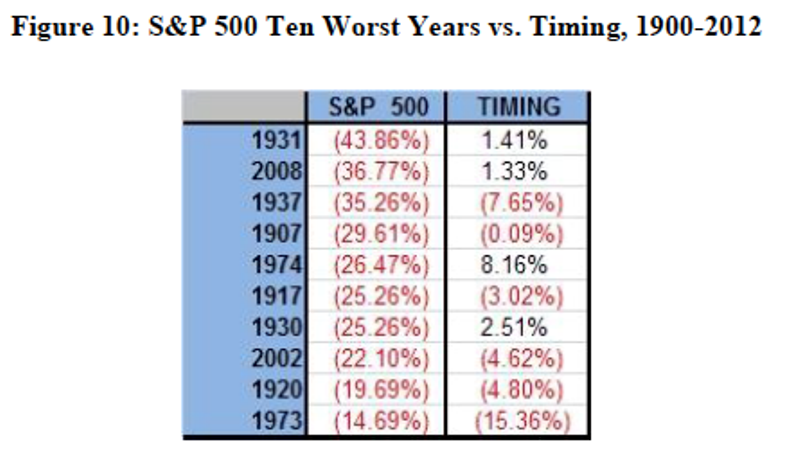

In awful years, on the other hand, his technique seems to have an immense effect:

Faber goes ahead to roll out various different improvements, including distinctive levels of broadening, and more forceful moves, for example, utilizing influence. He likewise utilizes his Global Tactical Asset Allocation system to envelop five worldwide resource classes with equivalent weightings: U.S. stocks, remote stocks, bonds, land, and wares. He took a gander at both a purchase and-hold system and a timing method by which the portfolio treats every advantage class freely and is either long the benefit class or in real money with its 20 percent allotment.

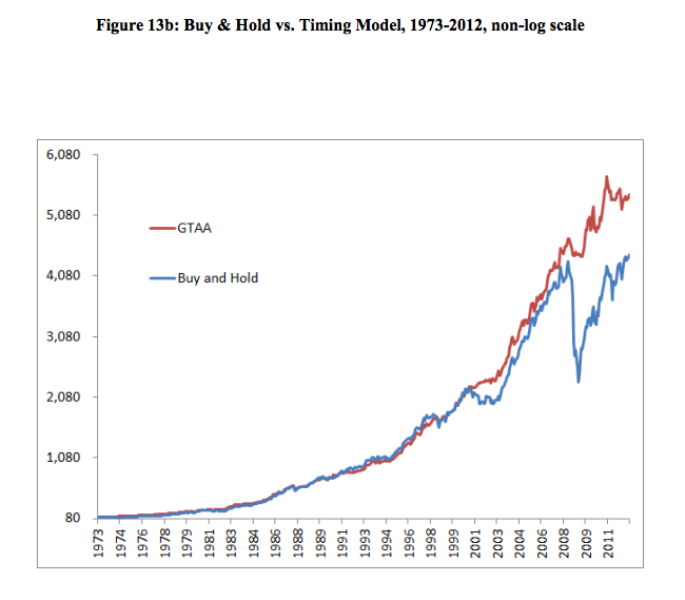

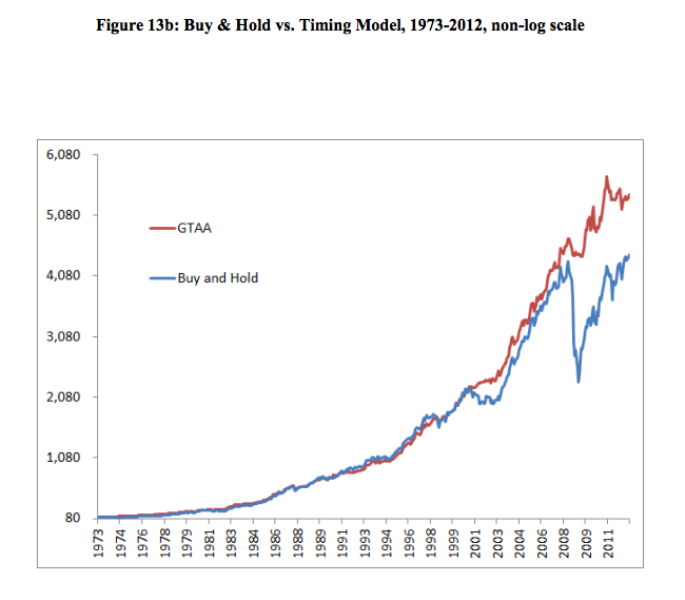

The diagram beneath demonstrates the execution of each, both respectable, yet the timing portfolio's outcomes demonstrate a lessening of unpredictability the distance down to single-digit levels, alongside a most extreme drawdown of single digits. Astoundingly, the speculator would have encountered stand out down year of not exactly - 1 percent since 1973, when the examination starts:

In the paper's decision, Faber says speculators would be best-served by utilizing his least difficult model—staying away from misfortunes by means of moving midpoints—or one of his more mind boggling (yet still really basic) model portfolios. By the by, a considerable measure relies on upon the amount of time speculators need to allot to customizing their portfolio, and in addition what phase of life they are in.

A non-optional, pattern taking after model goes about as a danger lessening strategy with no unfriendly effect on return. Using a month to month framework since 1973, a financial specialist would have possessed the capacity to build danger balanced returns by broadening portfolio resources and utilizing a business sector timing arrangement. What's more, the speculator would have likewise possessed the capacity to evade a large number of the extended bear markets in different resource classes. Keeping away from these huge misfortunes would have brought about value like comes back with bond-like instability and drawdown.https://www.mql5.com/en/signals/111434#!tab=history

There are two great motivations to investigate this week at the most downloaded paper on the Social Science Research Network. For a begin, we're heading into Labor Day weekend, which means it's the ideal time for light shoreline perusing. Second, the paper is centered around a business timing method, and this specific business timing procedure current proposes financial specialists ought to continue with most extreme alert.

Here's Mebane Faber, the paper's creator and fellow benefactor of Cambria Investment Management, on Twitter on Tuesday:

As it were a portfolio in light of the paper's system would be completely put resources into money and securities a month ago—no stocks. As Faber noticed, that is to a great degree uncommon, happening under 7 percent of the time. The possibly most troubling bit is that the last time this happened was in the profundities of the money related emergency.

Established in the 1990s by two money related business analysts, the SSRN has rapidly turned into a go-to site for an expansive number of individuals in the fund business. The webpage's idea is really basic: It permits creators to transfer their scholarly papers specifically to the website with the expectation of complimentary downloading around the world, while distributers and foundations have the alternative of transferring papers and charging an expense for each download.

Initially distributed in 2006 and most as of late overhauled in 2013, his paper has been downloaded more than 150,000 times on SSRN. It concentrates on a business sector timing system to help financial specialists smooth unpredictability in their portfolios while staying in productive positions—and ensuring themselves ought to the air pocket burst.

Here's a representation of the issue Faber is attempting to comprehend.

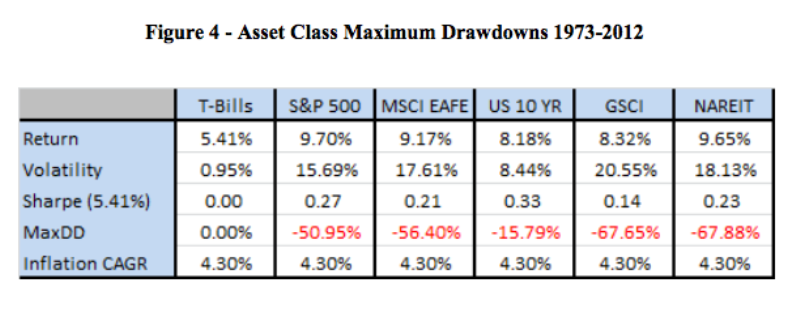

While putting resources into any of these advantages would have created returns for speculators for a long time, it would likewise subject them to the danger of huge intermittent "drawdowns" when costs drop all of a sudden from crests:

Faber proposes a business sector timing arrangement, or a "danger decrease method that flags when a financial specialist ought to leave a dangerous resource class for danger free ventures." One specific brand of business sector timing he recommends lives up to expectations along these lines: Investors ought to purchase when a security's month to month cost is higher than its 10-month straightforward moving normal and offer when the cost is not exactly the 10-month basic moving normal.

You can see a correlation of this procedure versus a purchase and-hold approach in the Standard & Poor's 500-stock file beneath:

While the timing model improved and positively diminished instability, it merits remembering that Faber's methodology does not, for functional reasons, consider such things as duties and commissions.

In awful years, on the other hand, his technique seems to have an immense effect:

Faber goes ahead to roll out various different improvements, including distinctive levels of broadening, and more forceful moves, for example, utilizing influence. He likewise utilizes his Global Tactical Asset Allocation system to envelop five worldwide resource classes with equivalent weightings: U.S. stocks, remote stocks, bonds, land, and wares. He took a gander at both a purchase and-hold system and a timing method by which the portfolio treats every advantage class freely and is either long the benefit class or in real money with its 20 percent allotment.

The diagram beneath demonstrates the execution of each, both respectable, yet the timing portfolio's outcomes demonstrate a lessening of unpredictability the distance down to single-digit levels, alongside a most extreme drawdown of single digits. Astoundingly, the speculator would have encountered stand out down year of not exactly - 1 percent since 1973, when the examination starts:

In the paper's decision, Faber says speculators would be best-served by utilizing his least difficult model—staying away from misfortunes by means of moving midpoints—or one of his more mind boggling (yet still really basic) model portfolios. By the by, a considerable measure relies on upon the amount of time speculators need to allot to customizing their portfolio, and in addition what phase of life they are in.

A non-optional, pattern taking after model goes about as a danger lessening strategy with no unfriendly effect on return. Using a month to month framework since 1973, a financial specialist would have possessed the capacity to build danger balanced returns by broadening portfolio resources and utilizing a business sector timing arrangement. What's more, the speculator would have likewise possessed the capacity to evade a large number of the extended bear markets in different resource classes. Keeping away from these huge misfortunes would have brought about value like comes back with bond-like instability and drawdown.https://www.mql5.com/en/signals/111434#!tab=history