Central banking is the primary focus for currency traders this month.

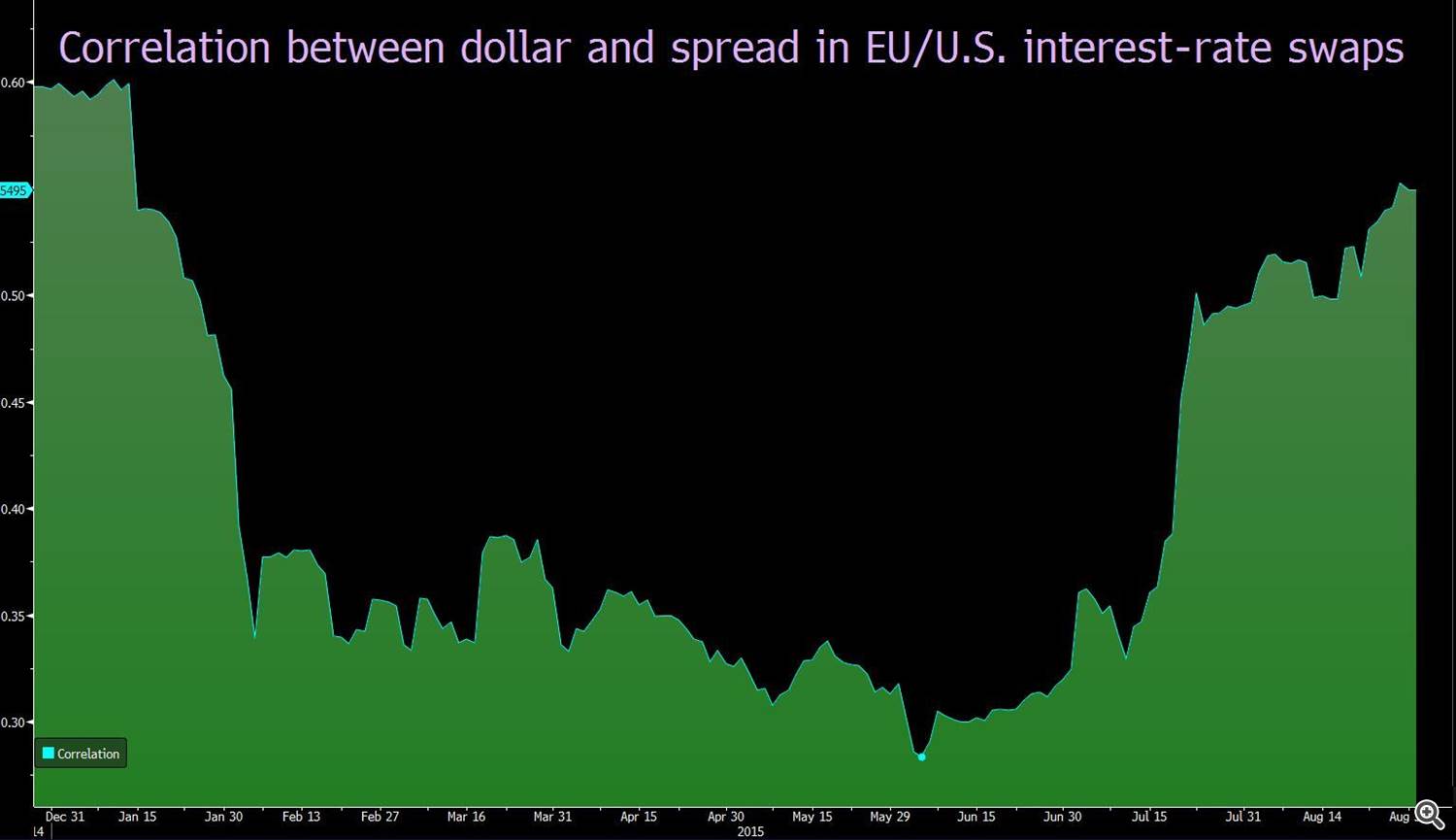

The dollar is increasingly moving together with the difference

between dollar- and euro-based interest rates. The 120-day correlation between euro-dollar and the gap between two-year swap rates touched the

most since January.

Source: Bloomberg

Interest-rate differences were implying a stronger greenback until about three weeks ago when China surprised the markets with the yuan devaluation, increasing speculation that the turmoil can make FOMC officials postpone hiking interest rates.

When

European Central Bank officials meet on Thursday, they’ll decide

whether quantitative-easing program needs to be scaled up as risks to

economic growth threaten their inflation goal.

On Friday, the U.S. Labor Department’s August payroll report will provide Fed policy makers with the most important numbers available to them before the September 16-17 meeting.

A more stimulative-minded ECB may lower yields in the area and undermine the appeal of the shared currency.

Omer Esiner, chief market analyst at currency brokerage Commonwealth

Foreign Exchange Inc, said that both of them are symptoms of the same thing.

"If we get continued intense global

market volatility, then investors will unwind that the Fed will raise

rates in September or even December. You will see that change reflected

in the yield spread and the dollar.”