Kazakhstan took off his control over the exchange rate of its currency within the last signal from emerging nations (developing countries new rose) who stopped defending its currency after China aggravate global market with devalued yuan. Central Asian State, which makes Russia and China as its main trading partner, said it took off its currency, the tenge, the free float, shrank to 23% to 257,21 per dollar. Meanwhile, Russia ruble plummeted to the lowest level since May be 67,44 per dollar.

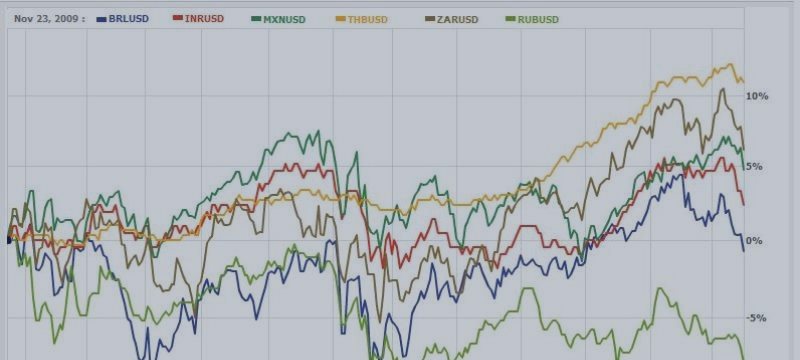

After a deep devaluation of the yuan last week, some 20 developing country exchange rate exchange rate closing most downturns ever since 2000, and the loss continues this week because devalued Viet Nam dong, and multiple currencies ranging from Russia to Turkey go down at least 3%.

"The appearance of China that make the weak exchange rate of its currency in order to encourage the growth of more and make the need for policy makers everywhere to do what it can to enlarge export earnings," said Koon Chow, strategist at Union Bancaire Privee in London. "Just maybe not small things because of Russia and China, Kazakhstan's largest trading partners as well," he said.

Kazakhstan is the largest crude oil exporter in Central Asia and the raw material manufacturer country losers since Russia stopped the control over the ruble last November. In addition to the fall in the price of oil up to 55% in the last year, yuan was further depressed the country's benchmark associated with forced various countries are dependent on Russia and China in trade in order to find a way to remain competitive.

Kazakhstan will try their monetary policy with inflation target, said PRIME MINISTER Karim Massimov in the Government at a meeting in Astana. The Central Bank doesn't target a particular level for the currency, Kairat Kelimbetov said the Governor, who added that the intervention would only be done if stability is threatened.

The ruble plummeted 46% in the last 12 months, against 7.6% attenuation for tenge before the changes Thursday. Kazakhstan Business Association, Atameken, and their local units of ArcelorMittal'S CEO among business leaders who complained that the price difference has reduced the competition of products made from steel to local grain and coal.

The Big Loss

"The step was taken after it suffered huge losses, as Russia's main trading partners make the ruble depreciates significantly with the plum commodity prices," said Tom Levinson, Chief foreign exchange strategist and the interest rates on the savings bank CIB in Moscow. The depreciation of the yuan "could be an additional factor," he said.

Tenge continued to slump because of the possibility it could still not be able to pursue the ruble, said Citigroup Inc. BMI Research Wednesday said, Tajikistan and Kyrgyzstan was the most vulnerable to a weakening of the currency of Kazakhstan after the country let tenge down 4.5%. That currency can go down to 364 tenge per dollar, said Citi Economist Ivan Tchakarov, while Levinson of the savings estimates could reach 275.

Kazakhstan, the largest oil producer of the 18th in the world, has to adjust to life with a crude oil price of $ 30 to $ 40 per barrel, said President Nursultan Nazarbayev in a meeting with State officials Wednesday. Brent oil was down to 59% from its highest price of the year 2014 and is now traded $ 46,91 per barrel in London.

"Kazakhstan, as well as other emerging countries, trying to stay competitive when the dollar strengthens," said Gary Dugan, head of investment for private banking at the National Bank of Abu Dhabi PJSC.

Meanwhile, Russia's currency, the ruble, shrank due to weakening oil prices become more 75 against the euro for the first time in six months, until more aggravating Yixin lately. The ruble also fell against the dollar to 67,44, approaching the level of the most weak against the dollar since February. Russia's currency down more than 20% against the dollar in the last two months, to trigger concerns enlarging the instability after a period of relatively experienced a recovery.https://www.mql5.com/en/signals/120434