Fundamental Weekly Forecasts for US Dollar, EURUSD, GBPUSD, USDJPY, AUDUSD and GOLD

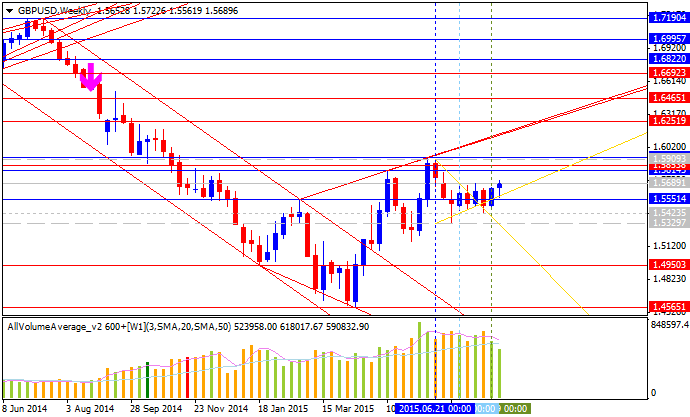

US Dollar - "Though it isn’t necessarily dependent on sentiment leveling out, a retrenchment in rate expectations would do better to pull speculative funds back to the Dollar if there isn’t a broad flight from all carry. Despite stumbles in data and a gradual turn in markets, the Fed and many of its key voters have notably kept their conviction on a return to tightening. Bullard this past Friday was just the most recent. A commitment to hike despite a market tumble would likely further feed a risk selloff and leverage the Dollar’s haven appeal."

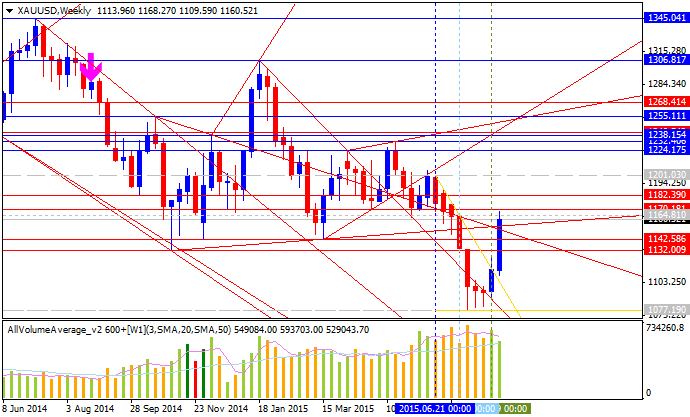

EURUSD - "Events to watch will include upcoming German Ifo Business Climate survey results and a handful of speeches from European Central Bank officials. Event risk is relatively limited, but it will be far more important to keep an eye on how financial markets open the week on Sunday night and trade into Monday. A continuation of recent sell-offs could push the EURUSD to fresh highs."

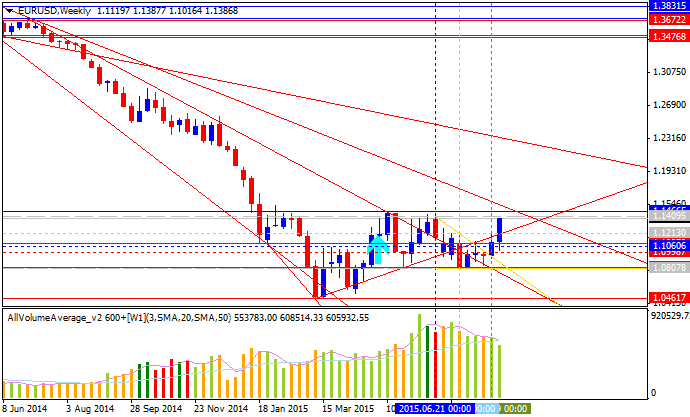

GBPUSD - "As a result, the fresh rhetoric coming out of the BoE/Fed may largely dictate price action in the week ahead as market participants continue to weigh the outlook for monetary policy. With that said, the recent price developments point to a further advance in GBP/USD as it breaks out of the tight range carried over from July, and the pair may continue to retrace the decline from back in June as it retains the bullish trend carried over from June."

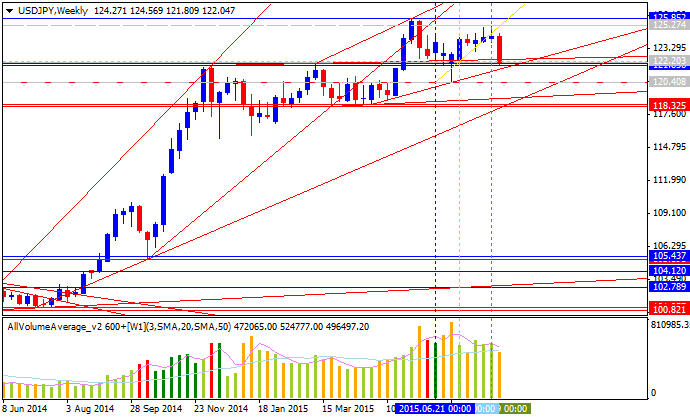

USDJPY - "The lone high-impact announcement coming out of Japan next week speaks to inflation, with CPI set to be delivered on Thursday night at 7:30 PM EDT: But perhaps more relevant is the situation in China, as it appears that weakness in the Chinese economy is beginning to spread around-the-globe. And with no clear sign of any future support coming out of the Bank of Japan, the Yen has become an easy currency to pick on as the results from ‘Abe-nomics’ continue to raise the question as to whether 2% inflation in Japan is actually attainable with current policy."

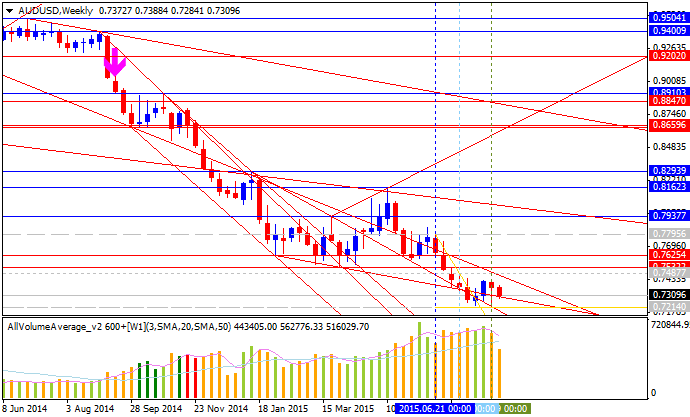

AUDUSD - "The markets have interpreted recent risk aversion as likely to delay tightening, with the priced-in outlook for the year-end standing of the Fed Funds rate falling alongside the S&P 500. This hints that while a stronger US economy amounts to broadly good news for global output, the possibility that upbeat data encourages the Fed to begin withdrawing stimulus in an otherwise difficult environment may be seen as decidedly risk-negative. This suggests that the Aussie may suffer if upbeat US data prints on the strong side. With that said, the possibility that firmer figures are on-boarded as supportive for sentiment and thereby lift the Aussie ought not be fully discounted."

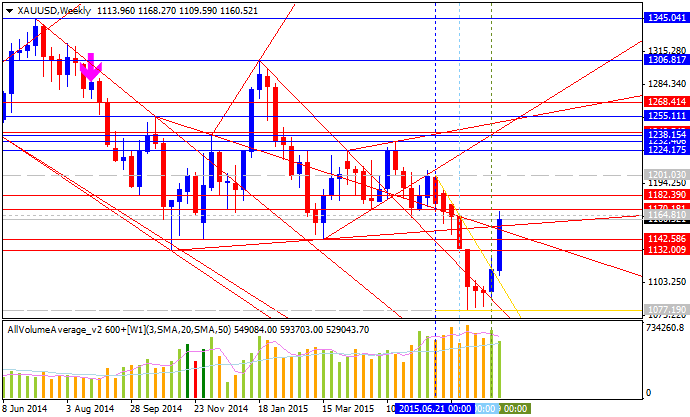

GOLD - "From a technical standpoint, gold has now rallied nearly 8% off the lows with the advance eyeing a resistance confluence just higher at 1170 where the 61.8% retracement of the May decline converges on the upper median-line parallel extending off the 2014 high. A breach above this region targets resistance objectives at the yearly open at 1182 backed closely by the 200-day moving average at 1188 with subsequent targets eyed at the 52-week moving average at 1196."