Such a great amount for September.

Dealers preparing for the Federal Reserve to raise premium rates one month from now turned around course Wednesday after minutes from the national bank's July meeting demonstrated strategy producers were all the while waffling on whether the economy is sufficiently solid to warrant higher acquiring expenses.

That is far shy of the certainty they anticipated that would see from a national bank as far as anyone knows weeks from what might be the first increment in very nearly 10 years.

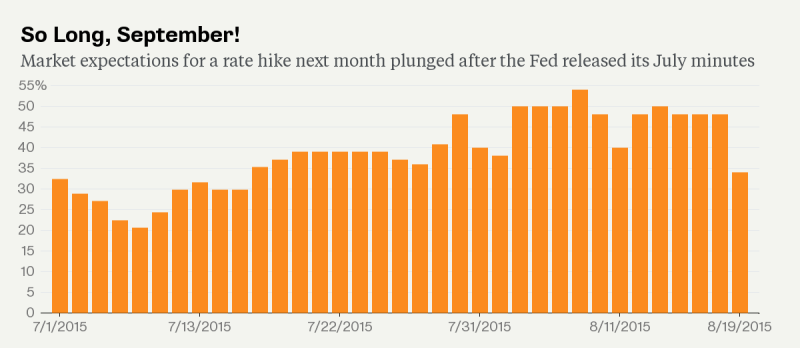

The likelihood that prospects brokers dole out to a rate help one month from now slid to 36 percent, the least since July, from around 50 percent prior in the day. The levels expect that the Fed's objective will normal 0.375 percent after the first move. The possibility of an increment at or before the Fed's December meeting dropped too, to 65 percent from 73 percent Tuesday.

Declining vitality costs and a reinforcing dollar have weighed on security market expansion gauges. So the news that authorities had talked about relentlessly low swelling drove dealers to leave wagers that the national bank was situated to begin raising premium rates. Before Wednesday, financial specialists were wagering that long haul Treasuries, which are delicate to swelling, would beat shorter developments, which are more powerless against changes in Fed approach.

"Their position on swelling has changed," said George Goncalves, head of interest-rate procedure in New York at Nomura Holdings Inc., one of 22 essential merchants that exchange with the Fed. "It's beginning to feel like they're not going to go in September."

No Guarantee

With the inversion of those wagers, the premium that financial specialists interest to possess 30-year Treasuries rather than two-year notes swelled to the vastest since Aug. 12.

"Those minutes did not ensure a September rate trek, and a few individuals were trusting that it would," said Charles Comiskey, head of Treasury exchanging New York at Bank of Nova Scotia, another essential merchant.

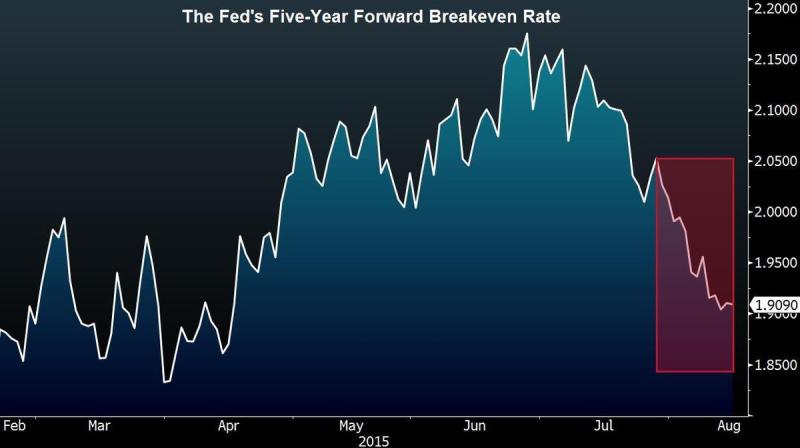

Brokers aren't totally precluding a September increment. In any case, Neil Bouhan, a premium rate strategist with BMO Capital Markets, said it's striking that the meeting happened before China's downgrading of its coin this month and the developing droop in unrefined costs, both of which have discouraged swelling desires. The Fed's favored business swelling measure has dropped to 1.91 percent from 2.05 percent between July 29 and the arrival of the minutes.

The minutes "appear to recommend that if the meeting were today, the FOMC would be uncomfortable with the present conditions, which is the way the business sector took this," Bouhan, who's situated in Chicago, said in a report. https://www.mql5.com/en/signals/120434#!tab=history

Dealers preparing for the Federal Reserve to raise premium rates one month from now turned around course Wednesday after minutes from the national bank's July meeting demonstrated strategy producers were all the while waffling on whether the economy is sufficiently solid to warrant higher acquiring expenses.

That is far shy of the certainty they anticipated that would see from a national bank as far as anyone knows weeks from what might be the first increment in very nearly 10 years.

The likelihood that prospects brokers dole out to a rate help one month from now slid to 36 percent, the least since July, from around 50 percent prior in the day. The levels expect that the Fed's objective will normal 0.375 percent after the first move. The possibility of an increment at or before the Fed's December meeting dropped too, to 65 percent from 73 percent Tuesday.

Declining vitality costs and a reinforcing dollar have weighed on security market expansion gauges. So the news that authorities had talked about relentlessly low swelling drove dealers to leave wagers that the national bank was situated to begin raising premium rates. Before Wednesday, financial specialists were wagering that long haul Treasuries, which are delicate to swelling, would beat shorter developments, which are more powerless against changes in Fed approach.

"Their position on swelling has changed," said George Goncalves, head of interest-rate procedure in New York at Nomura Holdings Inc., one of 22 essential merchants that exchange with the Fed. "It's beginning to feel like they're not going to go in September."

No Guarantee

With the inversion of those wagers, the premium that financial specialists interest to possess 30-year Treasuries rather than two-year notes swelled to the vastest since Aug. 12.

"Those minutes did not ensure a September rate trek, and a few individuals were trusting that it would," said Charles Comiskey, head of Treasury exchanging New York at Bank of Nova Scotia, another essential merchant.

Brokers aren't totally precluding a September increment. In any case, Neil Bouhan, a premium rate strategist with BMO Capital Markets, said it's striking that the meeting happened before China's downgrading of its coin this month and the developing droop in unrefined costs, both of which have discouraged swelling desires. The Fed's favored business swelling measure has dropped to 1.91 percent from 2.05 percent between July 29 and the arrival of the minutes.

The minutes "appear to recommend that if the meeting were today, the FOMC would be uncomfortable with the present conditions, which is the way the business sector took this," Bouhan, who's situated in Chicago, said in a report. https://www.mql5.com/en/signals/120434#!tab=history