0

158

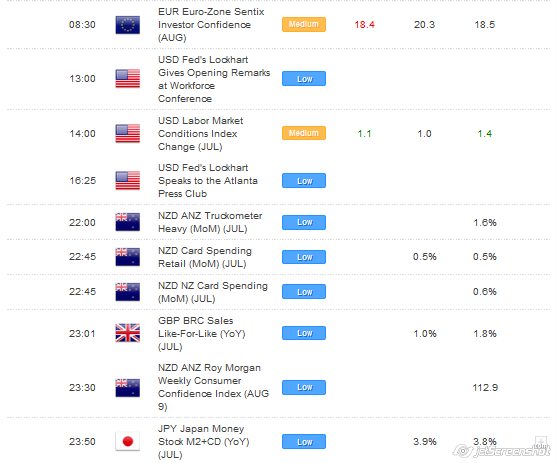

Center of the day:

"USD: Keeping September on the Table. Bullish.

We stick to our bullish USD view. Late remarks from Fed Governor Lockhart propose that September is still all that much in play, and as businesses bring the timing of the first climb forward, this ought to bolster USD. With a national bank that is information subordinate, we will be watching discharges intently in August and anticipate that USD will be additional information touchy.

EUR: Watching the Fed for the Path. Bearish.

The EUR has been hard to exchange as of late given that European stories, for example, Greece or the ECB have gone far from the market's core interest. Rather we anticipate that EURUSD will exchange lower on more confidence on the Fed. The US side of the story will command exchanging this pair. EURUSD keeps on exchanging contrarily with danger craving so we keep on monitorring the neighborhood value markets. We take note of that information from the fringe is beginning to pivot, specifically Spanish PMI beating desires.

JPY: Reflation Rebound. Nonpartisan.

We stay bullish on JPY for a couple reasons. To begin with, we keep on seeing indications of local reflation that could convey the BoJ closer to fixing. We expect solid compensation development in July on the grounds that rewards typically paid in June moved to July. This ought to offer backing to JPY. Second, with merchandise monetary standards falling, the danger environment may be influenced, which will likewise bolster JPY. The primary danger here would be a China boost which backings hazard and weighs on JPY.

GBP: BoE Votes 8-1. Impartial.

The swelling report was more dovish than the business sector was expecting, creating GBPUSD to move underneath 1.55. This has now broken a past triangular bolster territory and has given a bearish sign. For the way of GBPUSD over nearing weeks we put most accentuation on the USD side. With Lockhart putting a September rate trek solidly in the market's psyche now, as rate desires rise, this ought to bolster the USD side. We are still bullish on GBP on the crosses, particularly with product monetary standards.

AUD: Sell on Rallies. Bearish.

"USD: Keeping September on the Table. Bullish.

We stick to our bullish USD view. Late remarks from Fed Governor Lockhart propose that September is still all that much in play, and as businesses bring the timing of the first climb forward, this ought to bolster USD. With a national bank that is information subordinate, we will be watching discharges intently in August and anticipate that USD will be additional information touchy.

EUR: Watching the Fed for the Path. Bearish.

The EUR has been hard to exchange as of late given that European stories, for example, Greece or the ECB have gone far from the market's core interest. Rather we anticipate that EURUSD will exchange lower on more confidence on the Fed. The US side of the story will command exchanging this pair. EURUSD keeps on exchanging contrarily with danger craving so we keep on monitorring the neighborhood value markets. We take note of that information from the fringe is beginning to pivot, specifically Spanish PMI beating desires.

JPY: Reflation Rebound. Nonpartisan.

We stay bullish on JPY for a couple reasons. To begin with, we keep on seeing indications of local reflation that could convey the BoJ closer to fixing. We expect solid compensation development in July on the grounds that rewards typically paid in June moved to July. This ought to offer backing to JPY. Second, with merchandise monetary standards falling, the danger environment may be influenced, which will likewise bolster JPY. The primary danger here would be a China boost which backings hazard and weighs on JPY.

GBP: BoE Votes 8-1. Impartial.

The swelling report was more dovish than the business sector was expecting, creating GBPUSD to move underneath 1.55. This has now broken a past triangular bolster territory and has given a bearish sign. For the way of GBPUSD over nearing weeks we put most accentuation on the USD side. With Lockhart putting a September rate trek solidly in the market's psyche now, as rate desires rise, this ought to bolster the USD side. We are still bullish on GBP on the crosses, particularly with product monetary standards.

AUD: Sell on Rallies. Bearish.

Items are liable to weigh on AUD, and we hold our medium term bearish AUD view. Nonetheless, we see two conceivable legs of backing in the close term. In the first place, the RBA has increased current standards for cuts, and as the business sector processes this, the cash may advantage. Second, any development strong monetary boost in China would likely advantage AUD the most inside of the G10 space. We would hope to offer on energizes." https://www.mql5.com/en/signals/120434#!tab=history

Jpy will Be Trade Balance.https://www.mql5.com/en/signals/120434#!tab=history