Where are you in the graphs? 401(k) arrangements put on the weight

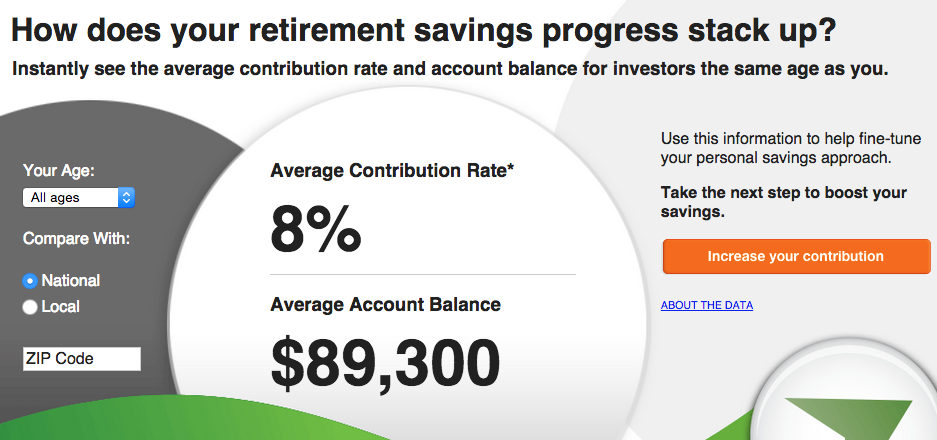

Suppose it is possible that individuals in your age and levels of pay put a normal of 8 percent of their pay rates into their 401(k) arrangements, and the main 10 percent squirreled away 15 percent—and you could see it all on your arrangement's site.

Furthermore, suppose it is possible that you put just 6 percent of your compensation away—and, with a tick or two, you could help your commitment.

OK:

A. Consider what amount those 15 percenters are making?

B. Chip away at your pitch for a raise?

C. Say "Yippee for them" and continue sparing 6 percent?

D. Knock up your funds rate?

Numerous workers pick D, as companion correlations push under savers to get a move on, some extensive 401(k) arrangement directors say.

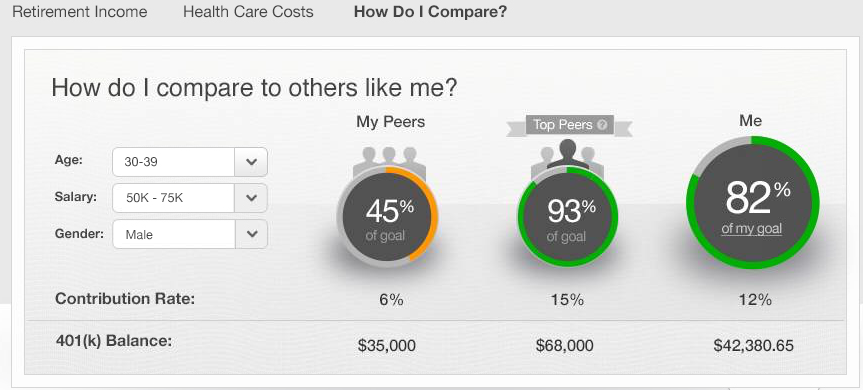

One major defender of the methodology is Empower Retirement, which controls arrangements covering 7.5 million workers. (Engage consolidated the 401(k) organizations of Putnam Investments, Great-West Financial, and J.P. Morgan Retirement Plan Services and manages Bloomberg LP's own particular arrangement.) The apparatus it utilizes, How Do I Compare?, propelled a year ago at Putnam—around 350,000 individuals have admittance to it today—and Empower is revealing an improved rendition for every one of its members.

With Empower's instrument, retirement savers can contrast their commitment rate and parity and the normal for individuals of their sexual orientation and their age and wage ranges. They can likewise perceive how they stack up against the main 10 percent of their companions, which Empower says is the genuine purpose of the activity.

In an example of 30,000 savers Empower followed, 5,000 changed their funds rate while utilizing the instrument, knocking up their commitment, all things considered, from a beginning stage of 7.3 percent of compensation to coordinate the top savers' normal rate of 9.1 percent, for a 25 percent expansion.

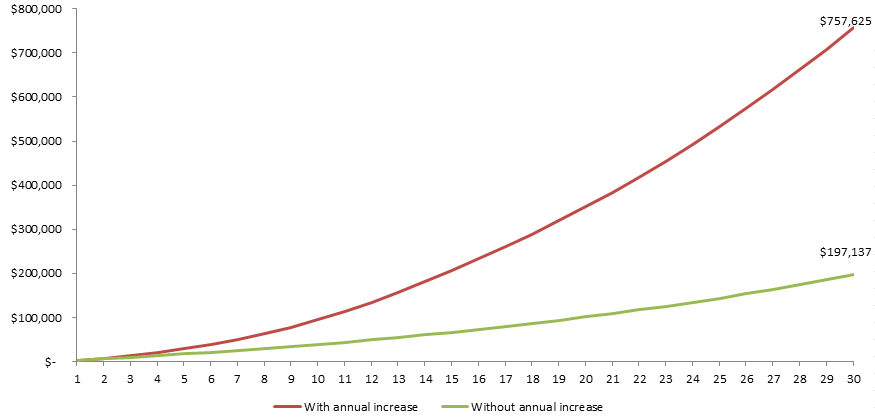

One thing's without a doubt: Americans don't sufficiently spare for retirement, and sparing more can have a major effect to your retirement store. Take a gander at this situation, which uses numbers from Vanguard to demonstrate the effect of expanding 401(k) commitments by 1 rate point every year more than 30 years. It's taking into account conceding 3 percent of a $100,000 salary1:

Also, what's useful for the goose is useful for everyone. The representative spares more for retirement. The boss does right by its laborers. The arrangement supplier serves its customer well—and picks up monetarily on any included reserve funds the worker puts resources into its own items.

There's a threat to welcoming such correlations, says Rob Austin, chief of retirement exploration at Aon Hewitt, which doesn't utilize a companion examination device. "In case you're in the upper a large portion of the companion examination, you may say, 'Hey, I'm showing improvement over most,' and be somewhat more careless," he says, however you still may not be almost an ideal investment funds level.

Vanguard doesn't have such a device, either, however it may make one, says representative Emily White. You should be extremely watchful with associate informing, says Rebecca Katz, Vanguard's head of member system and advancement. One of her specialists knows of an arrangement in which the normal reserve funds rate was 6 percent; after a message went out taking note of that normal, some higher savers cut their rate, she says. Enable said it hasn't seen indications of this.

Members in 401(k) arrangements oversaw by Fidelity can contrast themselves and normal Fidelity account holders by age, Zip code, state, or district, and with other age bunches. A study Fidelity did of individuals who utilized the apparatus' application on their cell phone indicated they were 17 percent likelier to raise their commitment than the individuals who didn't utilize the device. This is what Fidelity's NetBenefits apparatus looks like on a desktop (its arrangement members can likewise utilize the NetBenefits application, and Empower has an application also):

On a moderate summer Friday, it can likewise be diverting. Look here: People between ages 40 and 49 who live in 90210 commonly have an investment funds rate of 11 percent and a normal offset of $111,700. In the White House's Zip code, it's 9 percent and $112,000. Out in Palo Alto, Calif., it's 15 percent and $156,700. Great fun.

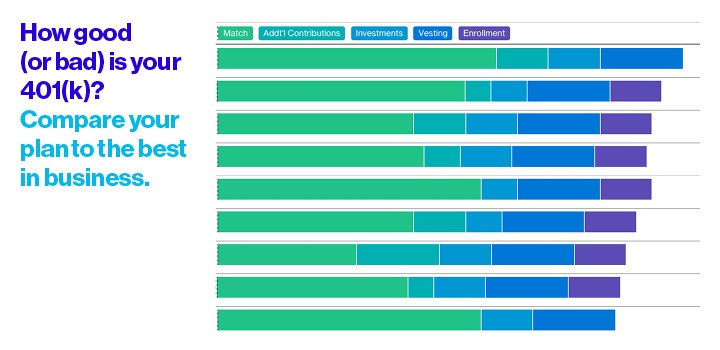

For a more extensive picture, this Bloomberg Business intelligent realistic, which gives you a chance to think about you're 401(k) with top-positioned arrangements, is really enlivening (and lighting up), as well:

Companion themed messages that Vanguard sent in tests done in 2013 and 2014 prodded a few savers between ages 30 and 50 who put under 8 percent of their compensation in a 401(k) to build investment funds. Around 5.4 percent of those getting the message raised their investment funds rate, contrasted and a control bunch's 4.7 percent. Reaction from individuals under 30 was littler; the 50 or more group didn't react.

Peer examinations are one of numerous ways arrangements attempt to start sparing. Others incorporate email pushes, for example, this message in emojis2 that Vanguard sent to more youthful specialists, and online number crunchers indicating what your present reserve funds could deliver in retirement wage.

"A few individuals wouldn't be persuaded by social correlation, and for others it drives all that they do," says Edmund Murphy, Empower's leader. "A definitive objective is to come to the heart of the matter where, in retirement, they can supplant the wage they made while working". https://www.mql5.com/en/signals/111434#!tab=history