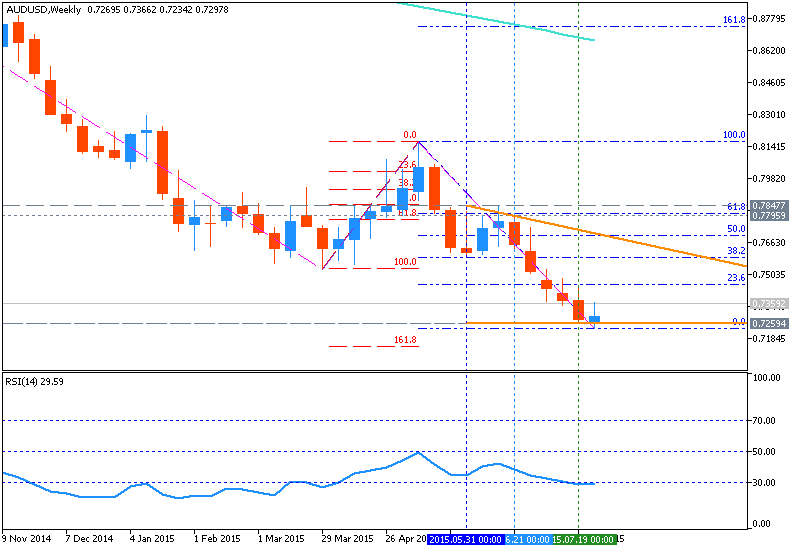

AUDUSD Weekly Outlook - descending triangle pattern to be broken for bearish breakdown

W1 price is located below 200 period SMA and 100 period SMA for the primary bullish between 23.6% Fibo resistance level at 0.7453 and Fibo support level at 0.7233:

- Fibo support level at 0.7233 is going to be crossed by the price from above to below for the bearish condition to be continuing;

- descending triangle pattern is crossing the price to below at 0.7259;

- “A slope confluence pinpointed the May high, which keeps the broader trend pointed lower. A long term level to be aware of in AUDUSD is the line that connects the 2001 and 2008 lows, which is near .7100;”

- “The immediate picture is bearish. Range expansion objectives yield .7143 and .6902;”

- RSI indicator is estimating the downtrend to be continuing.

If the price will break Fibo support level at 0.7233 so the bearish market condition will be continuing.

If the price will break 23.6% Fibo resistance level at 0.7453 from below to above so secondary market rally as a local uptrend within the primary bearish will be started.

If not so the price will be ranging between between the levels.

Trend: