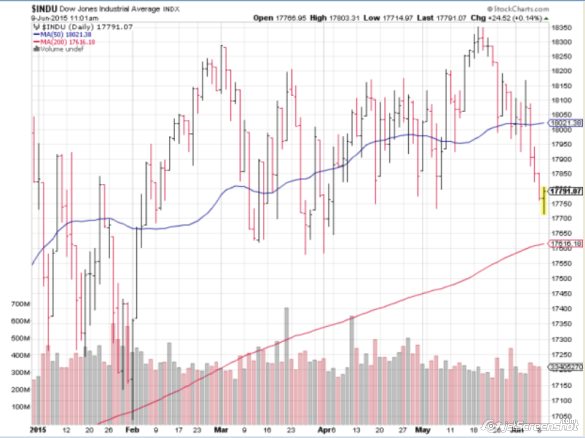

Speculators have needed to learn persistence this year. Following two great years of profits in 2013 and 2014, 2015 so far has been dull most definitely. The Dow Jones Mechanical Normal has turned negative for the year to date as we have seen generally range bound exchanging stocks.

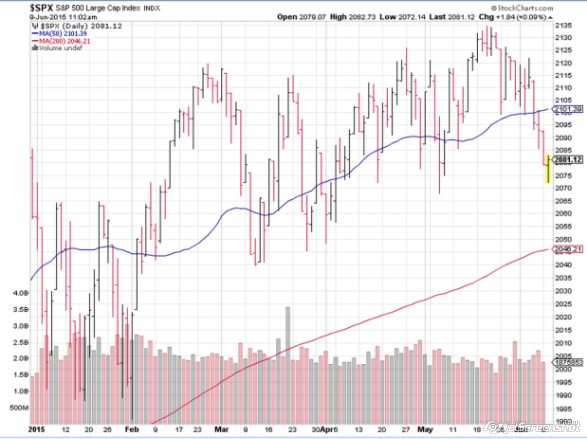

The S+P 500 has encountered various pullbacks of around 4% and the new highs are getting to be shallower.

The increment in yields puts drawback weight available cost of securities, so as we see the total security record has additionally turned negative year to date.

This blend has made it hard to discover returns in this environment. These are the times when our behavioral propensities have a tendency to cause us harm. We start to scrutinize our benefit allotment, feel slanted to desert our arrangement and search for the best performing speculations and hop into those. However this is quite often a terrible choice.

It's critical to dependably keep these occasions and value activity into point of view of your objectives. Case in point, in the event that somebody has the objective of financing their retirement and a period skyline of 10+ years, then you realize that your new buys will be at lower costs if the business sector does pullback and right, which implies higher profit yields and higher future expected returns. Thinking in those terms may help you refocus on your objectives.

The vital thing is to focus an advantage distribution arrange for that you feel great with. A consultant can surely assist you with that with helping you stay concentrated on your objectives. https://www.mql5.com/en/signals/120434#!tab=history