Is Australia a new Greece? Commodities plunge hints it might become one

A couple of days ago commodity editor at The Telegraph Andrew Critchlow wrote a quite controversial article on what may happen to Australia in case of a further commodities crash. The reaction of Australian analysts was stormy.

Critchlow brought an example of Gina Rinehart, Australia's richest woman and a matriarch of Perth’s Hancock mining dynasty, who lost a bigger part of her fortune which has dropped to around $11bn from around $30bn just three years ago.

This collapse in wealth is a sign of a wider economic problem Australia is facing, as for years it has been lucky due to its predominance in commodities, in particular iron ore, coal and gold.

Gina Rinehart

"During the boom years of the so-called commodities “super cycle” when China couldn’t buy enough of everything that Australia dug out of the ground, the country’s economy resembled oil-rich Saudi Arabia," Critchlow says.

A crash in iron ore and coal prices came in line with large international mining companies trimming investment - which has exposed Australia’s true fragility. Similar to Saudi Arabia, which is now burning its foreign reserves to cover falling oil prices, Australia faces a collapse in export revenue.

The editor sheds light on other important economic indicators.

Recently revised figures for April signal that the country’s trade

deficit with the rest of the world jumped to a record A$4.14bn. That gap between the value of exports and imports is expected to

increase as the value of Australia’s most important resources touches fresh multi-year trough.

Iron ore is now trading at around $50 per tonne,

compared with a peak of around $180 per tonne achieved in 2011. Prices for thermal coal have also been damaged, now trading at around $60 per tonne

compared with around $150 per tonne four years ago.

"Could a prolonged period of depressed commodity prices even turn Australia into Asia’s version of Greece, with China being its banker of last resort instead of the European Union," says Critchlow.

Moreover, a drop in foreign currency earnings has seen Australia forced to borrow more in order to maintain government spending.

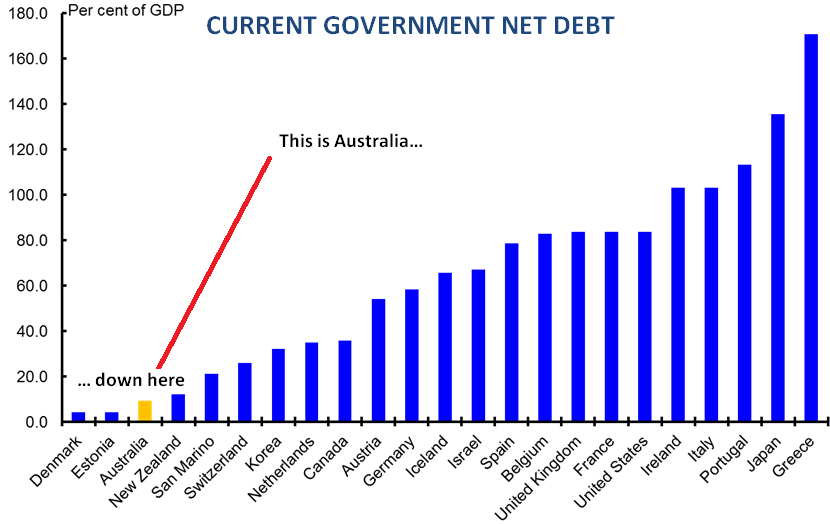

Respected Australian economist Stephen Koukoulas has suggested that by the end of the first quarter this year, Australia’s net foreign debt had climbed to a record $955bn - equal to almost 60pc of gross domestic product. Although this is far behind the likes of Greece, which boasts an unenviable ratio of over 175pc, it is nevertheless unsustainable, especially if it is allowed to widen further.

Source: Independent Australia, 2013

While Australia's authorities and the central bank have pointed out that depreciation in the local currency is quite needed in order to offset the decline in its overbearing mining industry. However, that hasn’t happened to the extent they would have wished.

After many years of efforts to diversify, the country is looking ever more "like a petrodollar economy of the Middle East, but without the vast horde of foreign currency reserves to fall back on when commodity prices fall."

Instead, Australians must borrow to maintain the standards of living that the country has become accustomed to, which even some Greeks will admit is unsustainable, Critchlow finishes.

"Absolute garbage!"

The reaction form Australian media has been stormy. According to the country's economists, the comparisons with Greece are “ridiculous” and “absolute garbage”.

Shane Oliver, chief economist at AMP Capital, says Critchlow is “over egging things significantly”. The drop in commodity prices is a problem for Australia but the country has dealt with it multiple times over the last century.

Then, Greece has a “massive level of public debt” which hit 103% of gross

domestic product before the global financial crisis and is currently

at 180%. In comparison, Australia has “very little public debt”, currently at around 25% of the GDP - a miniscule in relation to what's going on in Greece.

“Although the ongoing deficit is bad news, our starting point level of debt is a fraction," Oliver says.

He notes it is also a problem for Greece that it is part of the euro.

“When bad news hits a country their currency goes down and it helps them trade out of the problem,” he says. But Greece can’t do this as it is part of the euro. This is one of the reason the government decided to weaken the Aussie further.

Critchlow should be aware the mining boom has been over for four years, with iron ore prices peaking in 2011, the analyst points out.

However, with the end of the boom, segments of Australia’s economy that were suppressed by the mining boom have been able to bounce back again.

Alan Oster, chief economist at NAB, agrees with Oliver saying that Critchlow’s argument is “absolute garbage”. Australia’s debt to GDP ratio cannot be compared to the one Greece has.

“Their economy has shrunk by 25% in the last three years, ours has grown,” he says.

“And this is coming out of London? Well, no comment.”