EUR/USD to 1.05 in 3 months, 0.98 in 12 months – 4 reasons – Credit Suisse

Greece has submitted its proposal, which is one that the creditors will find hard to reject. Nevertheless, there are good reasons to see the euro falling.

Here are 4 reasons from the team at Credit Suisse:

Here is their view, courtesy of eFXnews:

While Greece has so far not proven a powerful negative for the EUR, a number of other factors are now aligning to push EUR lower especially vs the USD and JPY, argues Credit Suisse in its weekly note to clients this week.

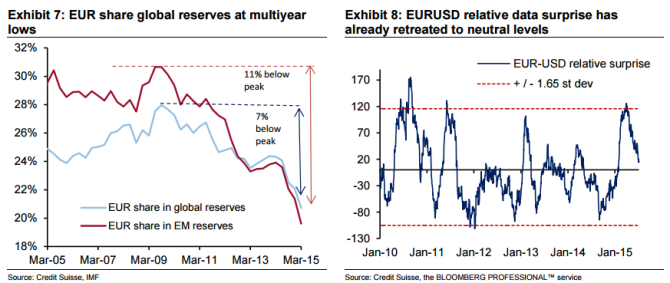

1) Relative data surprise is clearly moving against the EUR and in the USD’s favor.

“This is in line with our economists’ view of rebounding US growth momentum. EURJPY relative data surprise is already at stretched negative levels,” CS notes.

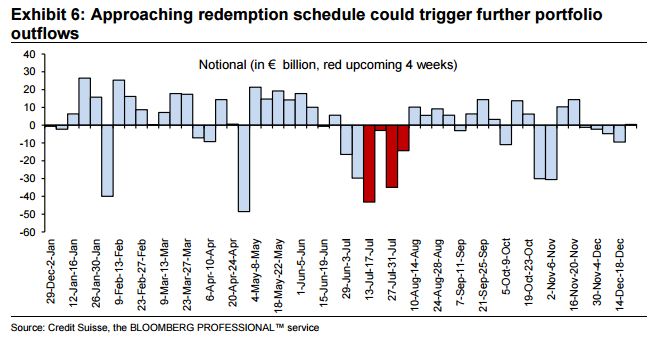

2- EUR portfolio flows may now also suffer as we approach the heavier summer government bond redemption schedule.

“We see a risk that a portion of the market may only choose to rebalance holdings away from the low-yielding EUR only once existing holdings expire,” CS clarifies.

3) EM weakness has in the past coincided with EUR downside.

“In particular, any pressure on EM reserves, which we consider quite likely in this environment, would result in EUR selling to replenish USD reserve allocations. This would exaggerate the impact from the downward pressure on EUR allocations evident in the COFER data,” CS adds

4) Finally, the fast oil price decline is likely to pose new risks to the inflation outlook, as the ECB’s inflation projections appear too optimistic in any case.

“This is likely to impact more markets than just the EUR, yet the low starting point combined with the Greek risk overlay for growth and consumer/business sentiment may make it more powerful for the European currencies,” CS argues.

CS maintains its EUR/USD forecasts at 1.05 in 3-month and 0.98 in 12-month.