USDCHF Next Week Outlook - 200-day MA resistance at 0.9520 to break for reversal

12 July 2015, 21:11

1

967

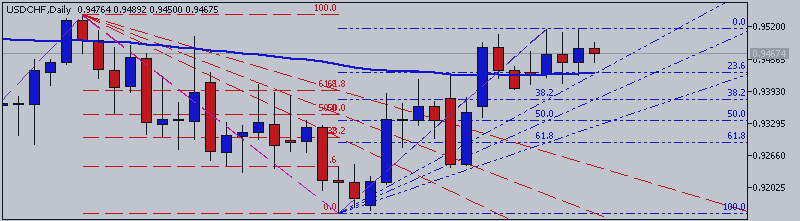

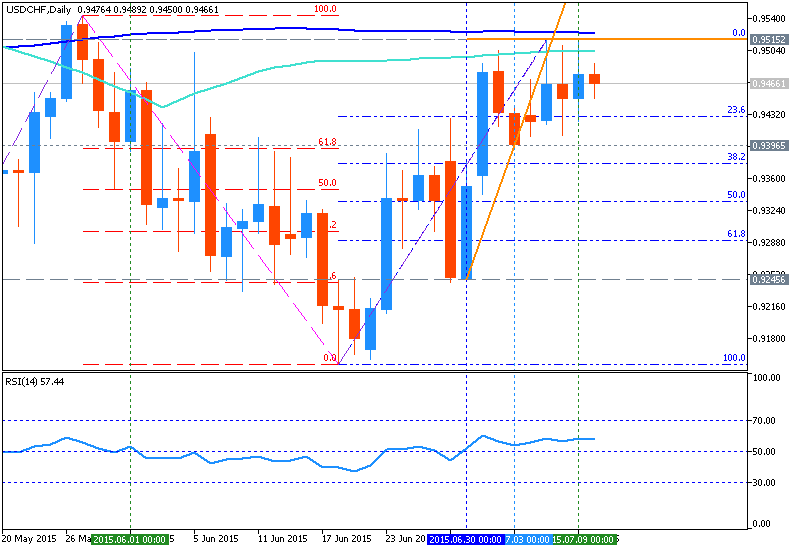

D1 price is located below 200-day MA and below 100-day MA for the primary bearish market condition with secondary market rally as local uptrend:

- 23.6% Fibo level at 0.9429 was broken by price from below to above with next levels on 100-day MA at 0.9500 and 200-day MA at 0.9520.

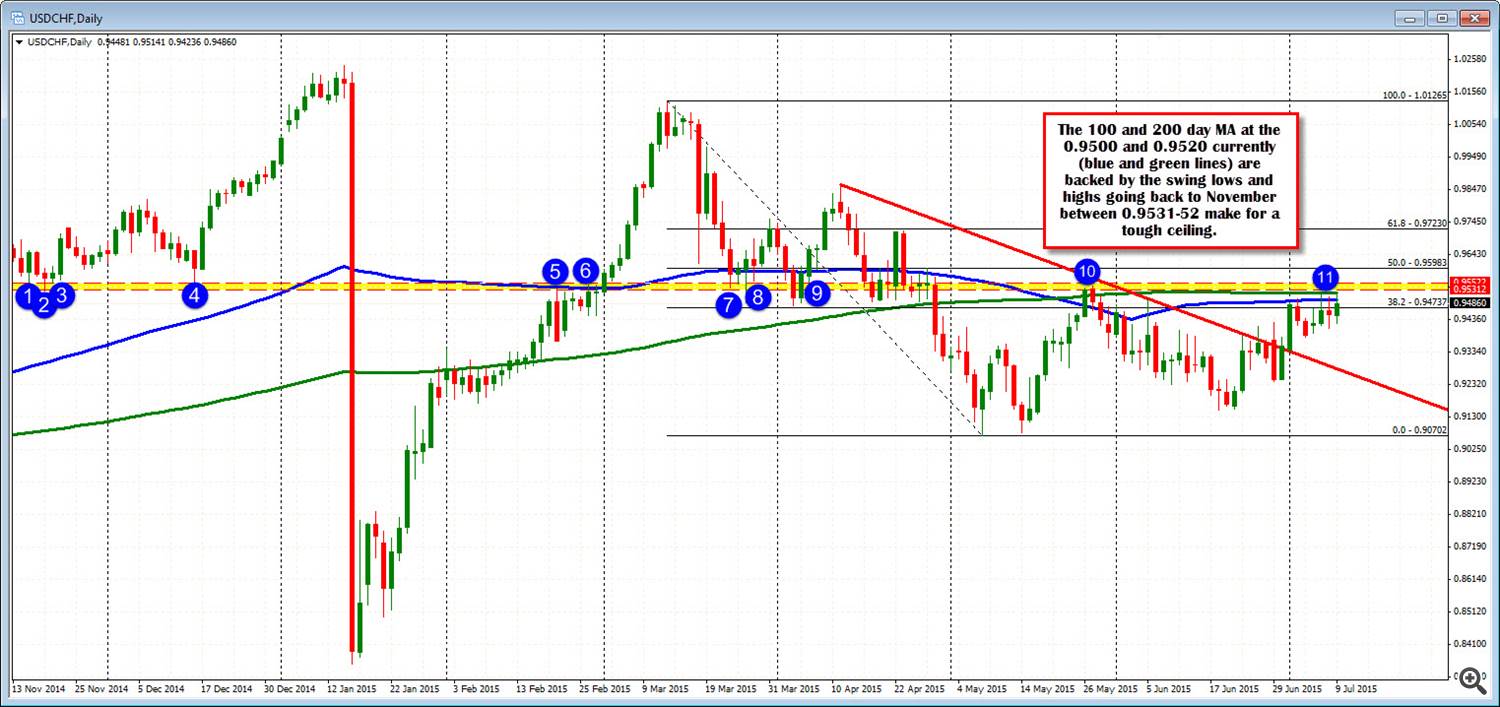

- "The USDCHF has been banging against 100 and 200 day MA over the last few trading days. Those two moving averages currently come in at 0.9500 and 0.9520."

- "The current price is moving back toward that level with the recent semi dollar buying (the baby might be awakening). The price has not traded above the 200 day moving average since May 27. Although a break above those 2 moving averages would be something new and would be something bullish,there is additional resistance in the 0.9531 to. 0.9552 area. Looking at the daily chart, there have been a number swing lows and swing highs going on way back to November in this area."

If the price will break 200-day MA resistance at 0.9520 from below to above so we may see the reversal of the price movement to the primary bullish market condition.

If not so the price will be ranging between between support level at 0.9245 and resistance level at 0.9520.

Trend: