JP Morgan - The 'No' Vote: 'there is no change to the year-end EUR/USD forecast of 1.05'

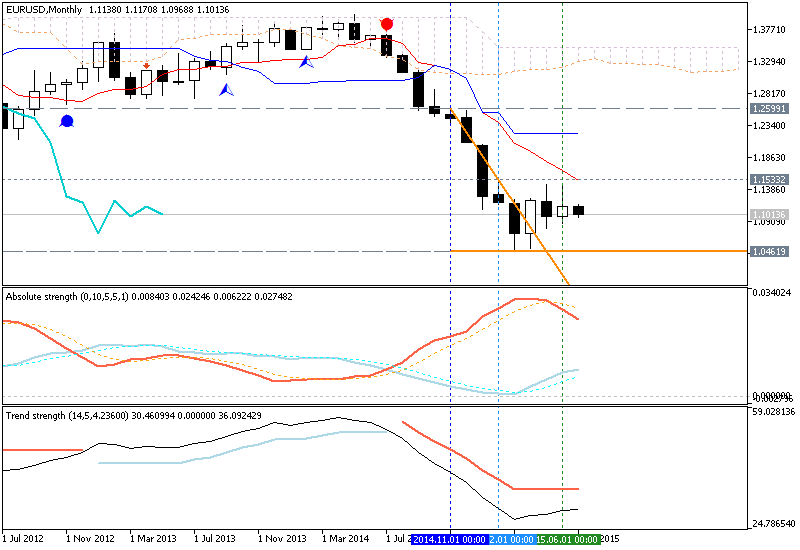

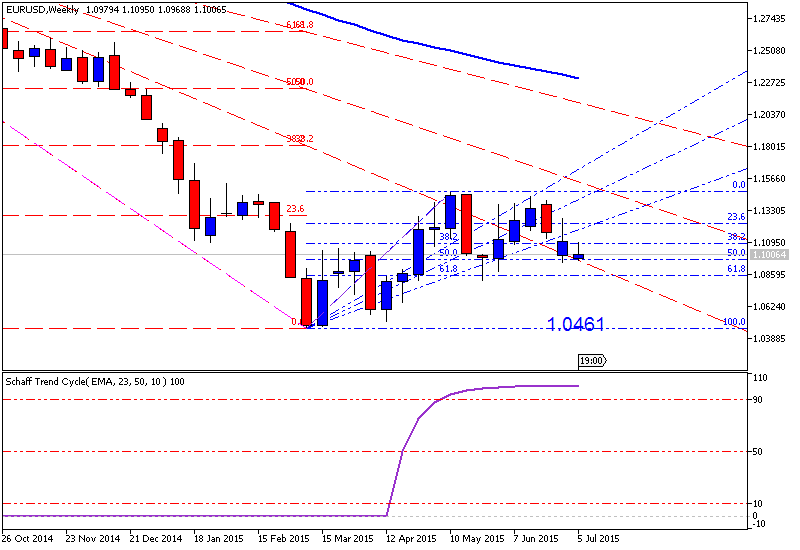

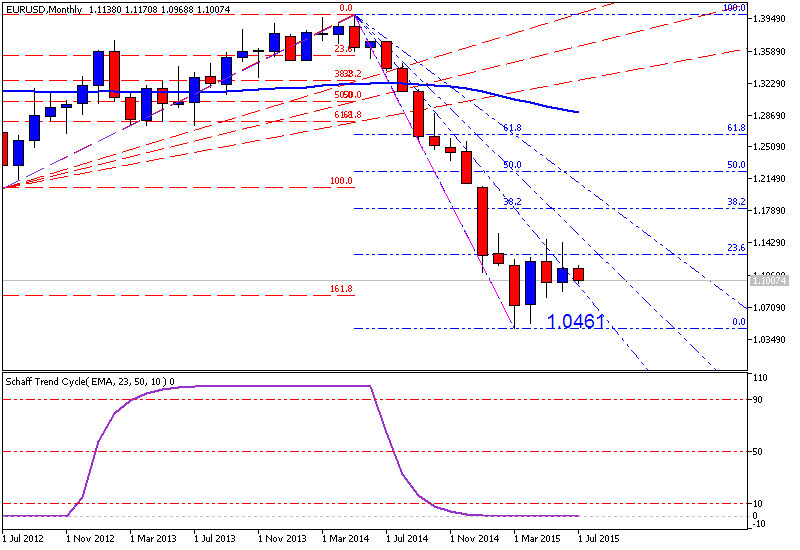

JP Morgan provided the strategy and forecasts for EUR after 'No' vote estimating the target to the end of this year as 1.05 for EUR/USD. My view on this situation is the following: EURUSD may drop to 1.0461 by the end of this year (as we see from the chart below):

By the way - this 1.0461 is the key support level for monthly and weekly timaframe as well. Besides, 1.0461 support is acting as a Fibo level (se images below). Thus, 1.0461 is the real target this may achieve EUR/USD by the end of the year for example.

- "Greek EMU exit could be worth 5 to 10 cents of maximum downside on EUR/USD during this crisis, but only if contagion requires the ECB to upsize its balance sheet materially

- Fair value on EUR/USD 1-yr implied vol would be about 13% versus Friday’s closing level of 10.8%, if Europe experiences a brief recession due to the sentiment shock from Greek exit.

- There is no change to the year-end EUR/USD forecast of 1.05. To us, Fed policy will be more enduring than sovereign stress, and we doubt the stress will require such a large ECB commitment to deliver the extreme downside targets outlined above. Hence, no change the forecast decline to 1.05 this year (based on the Fed) and a bottom in Q2 2016 (based on ECB tapering).

- For strategy, we’ve avoided positioning around the Greek referendum because the risk-reward seemed poor unless three conditions were met: Greece said No, contagion to the rest of Europe would be significant and the ECB needed to increase its balance sheet materially beyond current QE-related targets to contain the stress. The first condition for euro downside has been met today, but the second and third may not be, despite the landslide referendum vote. So we remain neutral EUR/USD except for a 1-mo long volatility position in the Derivatives portfolio."