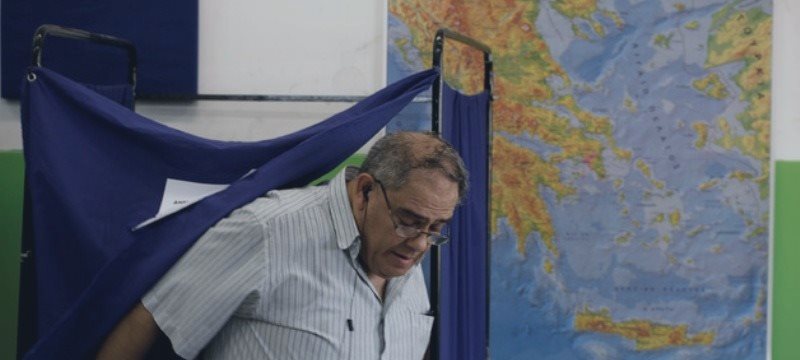

Greeks were voting Sunday on their economic future amid concern the country's banks are almost out of funds and that rejection of further austerity could push it out of the euro area.

Prime Minister Alexis Tsipras continued to urge his compatriots to vote “no,” arguing Greece could stay in the euro under better terms despite the result. Most European leaders characterized the referendum as a de facto vote on euro membership and a “yes” as an easier path out of economic misery.

“Many can ignore the will of a government, no one can ignore that of a people that take life in their own hands,” Tsipras told reporters after casting his vote. “We’re sending a message not only to stay, but to live with dignity in Europe.”

Voting on whether to accept spending cuts and tax hikes in exchange for a new European bailout is taking place in the most difficult circumstances faced by Greece since the country joined the euro. Banks have been shuttered for a week due to capital controls imposed to stem outflows of cash, commerce has slowed to a crawl and pension payments are being rationed.

“My logic and fear tell me to vote ‘yes’. But I’m voting ‘no’ because I think that even a small rupture is worth the risk for a better future,” said Ourania, 32, a consultant for small businesses who was voting in northern Athens. She didn’t want her last name published because the vote has caused family disputes. “I went to the ‘yes’ rally with my husband who is voting ‘yes’. There is a lot of tension within families right now,” she said.

Polls opened at 7 a.m. Athens time and will shut at 7 p.m., with a result expected by midnight.

ECB Lifeline

Either outcome brings complications. It’s unclear how and if the European Central Bank could extend a further lifeline to Greek lenders, whose cash reserves are nearly exhausted, after a “no” result. Such an outcome would also make it harder for Greece to reach a new aid deal with creditors.

A “yes” could force the ouster of the Tsipras government and fresh elections, a possibility to which Finance Minister Yanis Varoufakis alluded on Thursday. And a result so close that it’s inconclusive may only extend the current stalemate, which began when Tsipras called the surprise plebiscite on June 27.

Casting his own ballot in Athens, the prime minister said he was “very optimistic” for a “no” win. “Our people’s determination is beating, from what it looks like, the propaganda of fear,” he said in televised comments.

Polls in the run-up to the vote showed it was likely to be close, though voices in favor of “no” were getting louder by Sunday. A poll commissioned by Bloomberg and published on July 3 showed 43 percent of voters intend to reject the creditor proposals, while 42.5 percent will accept the conditions. The survey of 1,042 people conducted by the University of Macedonia had a margin of error of 3 percentage points.

Testing Vote

Some Greeks are despairing of their country’s situation. “This vote is a test of our collective IQ,” said Hara Nikolou, a retired biochemist who lives on the island of Serifos, before casting her “yes” vote. “If our society opts to turn this country into Balkan wasteland, I don’t want to continue living here.”

European leaders will have to spring into action as soon as a result is known, after a week in which negotiations with Greece were largely put on hold.

The ECB plans to meet on Monday to discuss extending further liquidity to Greek banks. ATMs will begin to run dry within hours of the referendum, National Bank of Greece chairman Louka Katseli said on Friday. Lines at ATMs are continuing as citizens wait to withdraw 60 euros each, the daily maximum currently permitted by the government.

“Political talks” on Greece’s future in the euro zone will also be resumed immediately after the vote, French economy minister Emmanuel Macron said at a conference in Aix-en-Provence, southern France.

Tsipras on Friday said that the only way for Greece’s debt to become sustainable is for a so-called haircut of 30 percent on obligations and a 20-year grace period, a position rejected by Germany and other creditors. The International Monetary Fund said in a report on Thursday the country needs 36 billion euros ($40 billion) from its European partners and better terms to stand on its own feet.

Financial markets suggest the so-called firewalls built since 2010 to insulate the rest of Europe from turmoil in Greece will hold. Since dropping on Monday after Tsipras first imposed capital controls, the benchmark Euro Stoxx 50 Index has gained, as have 10-year bonds in Italy, Portugal and Spain.

seemore signals https://www.mql5.com/en/signals/111434