“In its most basic form,” said Haris Constantinou, markets analyst, “the MACD is a momentum indicator that is designed to follow existing trends and find new ones.” The MACD does this by showing the differences and relationships between a two-level combination of moving averages and price activity itself.

MACD Calculations

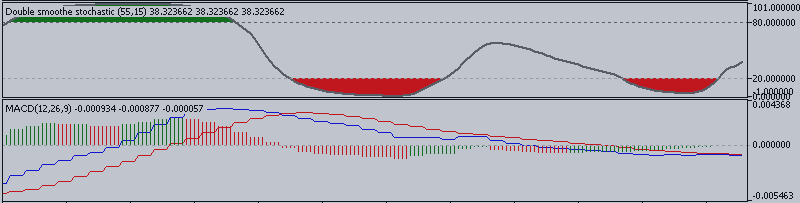

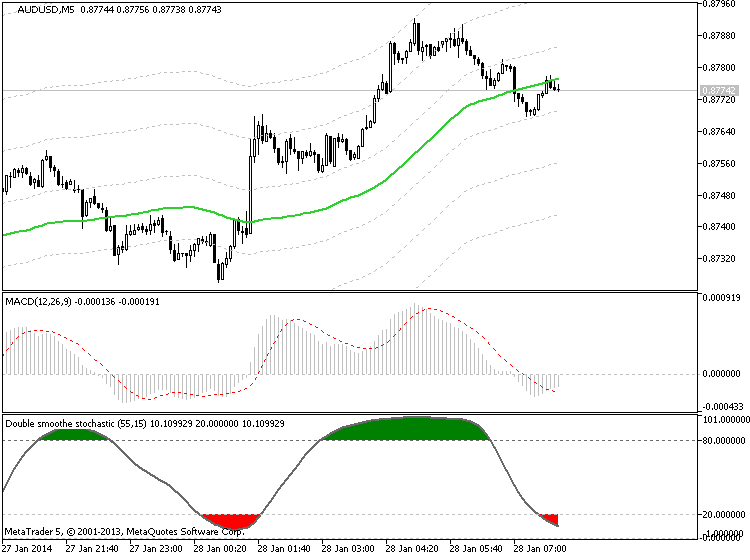

To determine and calculate the MACD, we must subtract a 26 period Exponential Moving Average (EMA) from a 12 period EMA. Then, a 9 period EMA of the MACD is plotted, and this becomes the Signal Line for the indicator. The Signal Line is plotted over the MACD and this will be used as the trigger reading for trading signals (both buy signals and sell signals). These elements form the basis of the MACD construction, and it is important to have a strong understanding of these elements if you plan on using the indicator in your daily trading.

Three Common Approaches to the MACD

Now that we understand the basics of how the MACD is calculated, it is a good idea to look at some of the common ways that the MACD is viewed by traders so that we can get a sense of how exactly the indicator is used to identify trading opportunities. There are a few different ways the indicator can be interpreted, and the three of the most common methods proven to be the most effective for traders include

- Crossovers,

- Divergences,

- and in identifying Overbought / Oversold conditions

Since the indicator has become a major part of the technical trading community, it is a good idea to look at some of these approaches in greater depth. But before you can do this, it is essential you understand the basics. Failure to do this is what leads to a large number of losses for many traders that are just getting started.