Turkey's lira plunges to all-time low; stocks drop as ruling party loses majority in election

Turkey’s lira hit an all-time low and stocks dropped as Turkey's ruling AK Party failed to win a majority government for the first time since 2002.

According to preliminary results from the state-run news agency, the governing Justice and Development Party, or AK Party, won 40.9 percent of the vote, giving it 258 seats in parliament. 276 were needed to form a single-party government.

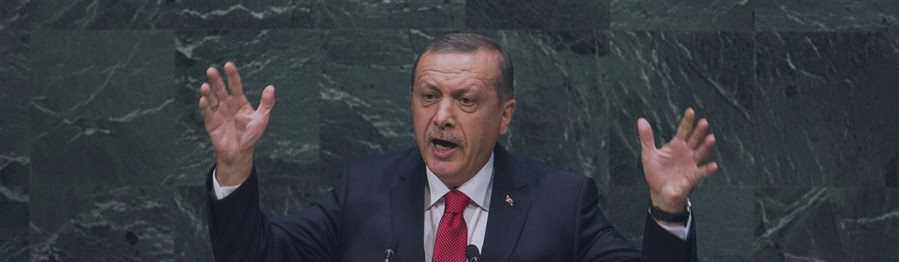

Meanwhile, the pro-Kurdish Peoples’ Democracy Party, or HDP, passed the 10 percent threshold of the national vote needed to win seats in parliament, raising a prospect for the two parties to create a coalition and also a possibility of conflict with President Recep Tayyip Erdogan. The results also mean the party won’t be able to deliver its key campaign pledge of formally shifting the nation’s center of executive power from parliament to the president.

Elections may be held again if a new government is not confirmed within 45 days.

“The current hung parliament will probably be viewed by the market as the worst outcome of the June 7 elections, and probably hit lira assets for some time to come,” Sertan Kargin, the chief economist at Eczacibasi Securities in Istanbul, said in an e-mailed note.

“The election results ruled out one of the most feared scenarios - the executive presidency - but it didn’t rule out early elections. Nobody can rule out central bank intervention and possibly a rate hike if this trend continues,” Gulsen Ayaz, the director of institutional sales at Deniz Yatirim in Istanbul, said to Bloomberg by email.

The lira dropped the most since October 2008 on a closing basis to

2.8096 per dollar before trading at 2.7650 at 11:28 a.m. in Istanbul.

The Borsa Istanbul 100 Index traded 6 percent lower after sinking 8.2 percent at the open of trading. The yield on the 10-year government bond jumped 44 basis points to 9.76 percent, the highest since October 2014 on a closing basis.

Turkey’s five-year credit default swaps rose 15 basis points to 234, the biggest increase since December.

This year, lira has weakened more than 15 percent against the greenback, the most among 24 emerging market currencies tracked by Bloomberg. The Turkish currency also dropped 4 percent to a record 2.9259 against an equally weighted basket of dollars and euros.

The country's annual economic growth, which averaged 5 percent under the AK Party’s rule, fell to almost half that rate last year and is set to increase to 3.2 percent in 2015. Unemployment is near a six-year high and inflation has stayed above the central bank’s target since 2011.

“Many investors were still hoping for a single-party government,”

Ozgur Altug, the chief economist at BGC Partners in Istanbul, said by

e-mail on Sunday. Markets will remain weak until investors see more clarity, he said, noting that coalition talks or early election bets will determine the dynamic in financial markets.