Wall Street is always find new ideas to trade and invest. But some surprisingly simple and weird investments can give impressive results.

In article by Bloomberg Markets Magazine, Devin Banerjee says about some of the strange but highest-performing investments in the past couple of years. If you'll invest in them (from the wine to lean hogs) they can give you real good profit - up to 465% in a year.

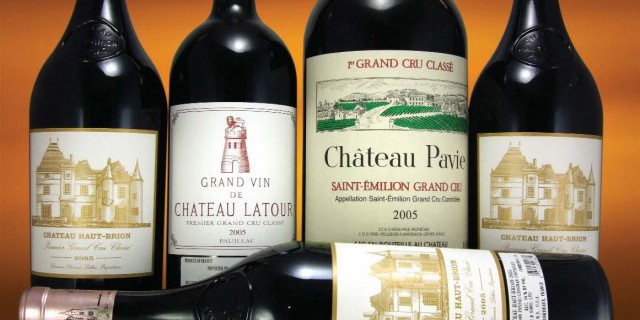

Chateau Pavie WineAlthough wine has seen dismal returns over the past three years, at an annualized return of -9.6%, one vintage wine is doing exceptionally well.

Chateau Pavie, from the Bordeaux region of France, has seen high returns, especially on its 2004, 2001, 1999, and 1998 bottles. A 2004 Chateau Pavie bottle had a one-year return of 14.3% and a three-year annualized return of 24.1%.

Another high performer from Bordeaux was the 1982 Chateau Latour, with an annualized return of 10.1%.

A Grand Prix Race Car

Classic cars were a huge earner for investors, with a three-year annualized return of 21.0% and a one-year return of 40.7%.

The 1954 Mercedes Benz W196 Grand Prix race car fetched a record $29.5 million at a British auction to an unidentified private buyer. The car was used by Formula One driver Juan Manuel Fangio.

In the same category of classic cars, Ferraris from the 1950s and '60s saw high returns.

A 1967 Ferrari GTB NART Spyder went for $27.5 million, and several more went for prices between $10 million and $20 million.

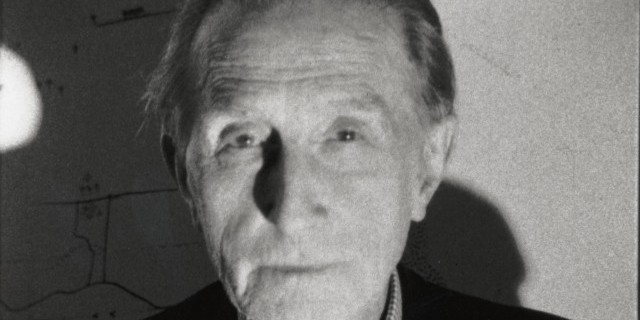

Marcel Duchamp

Contemporary art was another lackluster investment opportunity — but with some exceptional outliers.Among those was work from the French-American artist Marcel Duchamp. His artwork had a whopping one-year return of 465% and a three-year annualized return of 93.8%.

The second-best performer in contemporary art was Indian painter Vasudeo Gaitonde. Gaitonde paintings had an annualized return of 198.1% over one year and an 83% return over three.

One 1979 painting sold for $3.8 million at an auction in Mumbai. His paintings have been espeically popular in the Indian art market.

One Jackson Pollock painting sold last year for a record $58.3 million. The American painter, who was known for his signature drip painting style, had his work earn a 320% one-year return and an annualized three-year return of 57.5%.

You can make your own Jackson Pollock painting here. (Although your returns might not be quite as high.)

David Hall, cofounder of Professional Coin Grading Service, with some of 1,427 Gold Rush-era U.S. gold coins, at his office in Santa Ana, California, on Feb. 25.

On average, rare coins have experienced gains of 13.2% in three years and 10.1% in one year.

One 1559 British coin had a one-year return of 27.3% and three-year annualized return of 26%. Other coins from the 1500s and 1600s saw similar three-year gains of over 20%.

Lean hogs, a major source of pork in the U.S., were the winning investment in agriculture commodities.

Hogs had a gain of 56.3% in one year and 11.5% annualized over three.

Soybean meal

If you missed out on the hogs, soybean meal was the next best thing for agriculture.

The ground flour had a one-year return of 18.5%, and it outperformed cattle, rice, and lumber.

Self-storage units were very successful in real estate investment trusts, with a three-year annualized return of 21.2% and a one-year return of 16%.

Some of the best-performing companies include Space Storage Inc., with 36.7% gain in three years; Sovran Self Storage, with 27.2%; and CubeSmart with 21.3%.

Stamps generally produced gains of 2.6% over one year and 5.4% over three. However, if you were fortunate enough to have invested in some rare 1800s stamps, your return could have quadrupled.

One 1867 9d pale straw stamp had a three-year annualized return of 26%. Another, from 1830, had a three-year return of 23.7%.