Let Data Mining do the FX trading. Alpari Virtual Reality Round 1 is over and the results are super interesting. After deep analysis and mining, the contest was guided by fully automated algorithmic trading with models feeding in variable periods of the competition.

Algorithmic Trading is a dynamic method of trading with several major benefits: consistency, speed of trading, no psychology and scientific confirmation. Algorithmic Trading is very popular in foreign exchange markets.

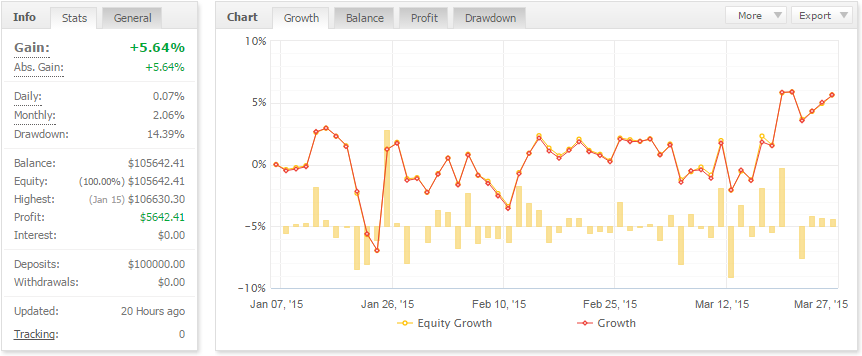

Hereby enclosed the results for the first round of the contest using autonomous trading with Data Mining principles.

General overview, +700 pips:

Growth:

Trading statistics:

Conclusion:

January was tough to trade after EURCHF spikes, but the trading models were good enough to generalize over the data set and not to trade too much. This is better than trading in such times. February and March were good to go with a lot of pips. As a result we can see that the field of Data Mining and Machine Learning algorithms are super useful in Algorithmic Trading strategies. We will proceed the exploration.