Today traders vividly try to take advantage of a so-called “contango” structure in Brent

crude, market slang for when prices for future delivery exceed spot

prices, by keeping oil in storage and banking on an almost risk-free

profit when they sell it forward, or in the future. British periodical Financial Times suggests its own investigation.

Last week reports suggesting a Chinese buyer had chartered the world’s biggest crude tanker to store oil, made some market players really nervous. It is still unclear if the Chinese were striving for a contango play in the traditional sense, or if they were seeking the relatively low-priced oil for a better deal on crude that would ultimately wind its way into the country’s strategic reserves. In any ways, it witnesses to a larger context.

According to analysts at London-based consultancy Energy Aspects, about 50m barrels of crude is being held on tankers in Saldanha Bay in South Africa and Asia - the highest level since the supercontango of 2008-2009.

A well-supplied market fueled with weaker than expected demand has weighed on near-term prices of Brent, which have now fallen below $98 a barrel for the first time since April 2013.

Production has not been disrupted, though, despite geopolitical shocks from Libya to Syria and Iraq. At the same time, oil surplus in the Atlantic Basin, since European refineries cut runs because of poor profitability and seasonal maintenance, has deepened the effects of greater North American oil production. According to International Energy Agency data, in July global reserves of crude oil rose to 2.67bn barrels - the highest since September of last year.

“Brent and Brent-related crudes are in contango. Russian Urals, Middle Eastern crudes, west African crudes, all of these are a possibility right now for traders to store. There is money to be made, that’s clear,” says Michael Wittner, analyst at Société Générale.

However, oil contracts for later delivery have come up on concerns about future supplies. Violence in Iraq and banks holding back credit for Russian ventures have raised fears over medium-term oil output in these countries and others.

The strategy is simple for producers such as BP and Shell, trading houses, such as Mercuria and Vitol and other companies with easy access to physical oil - hold on to the stock until the price differential is bigger than the costs of storage and other capital investments, and then sell on.

Initially it is possible to use cheap onshore storage facilities, and when viable, more expensive storage on tankers, which are more flexible in terms of location and duration.

Some industry watchers see traces of the contango play in 2008-2009, when as many as 200m barrels of oil were put into storage when demand dropped during the global recession. But others are doubting the market is not witnessing a replay of five years ago.

“During 2008-2009 there was a dramatic collapse in underlying crude and product demand as a result of a global financial and economic crisis. This is something that is not visible now and the numbers are not comparable,” says Mr Wittner, adding that crude going into storage to take advantage of contango is an important market dynamic that needs to be watched.

Many traders and analysts say, however, that margins this time are a lot tighter and floating storage is not yet an option for a lot of market participants.

Source: Financial Times

“Looking at the forward curve the opportunity is here for another two or three months and then the contango narrows a bit,” says David Fyfe, global head of market research, at Swiss oil trader Gunvor, who is unsure how the long the weakness in the oil price will last.

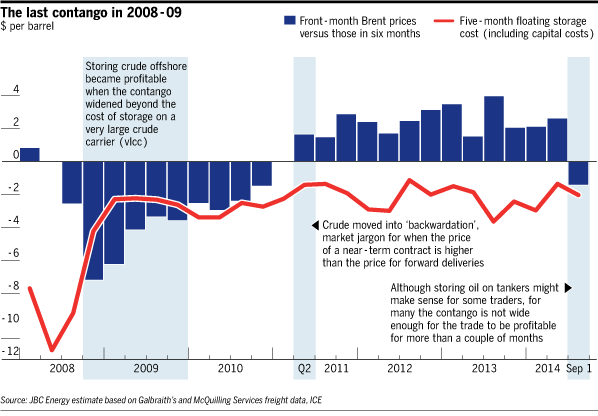

While

front-month Brent prices versus those in six months witness that

floating storage economics do not really make sense, according JBC Energy

data, other analysts suppose shorter time periods are being observed in the

current trade.

Many see little evidence of stronger demand in the upcoming months – as European refineries close for seasonal maintenance and growth remains weaker than expected in economies such as China and the US. They say international oil prices will continue to fall. But there are other threats to the storage trade, such as supply disruptions in still-volatile oil producing regions.

Moreover, industry watchers are keeping an eye

on Saudi Arabia – Opec’s largest producer – to see if the country makes

production cuts to keep global supply under control and support prices.

But, some analysts have said, its cuts to October selling prices for customers in Asia, Europe and the US, signal that it is hardly to diminish production even in the atmosphere of an excess of crude oil supply, fuelling suppositions that prices will decline further and the contango will only persist.