According to the American Petroleum Institute (API) data, which was published Tuesday night, US oil inventories rose 5.3 million barrels last week. The reserves of gasoline decreased by 5.8 million barrels, and the reserves of distillates decreased by 2.2 million barrels.

Investors drew attention to the growth of oil reserves, and its quotes decreased.

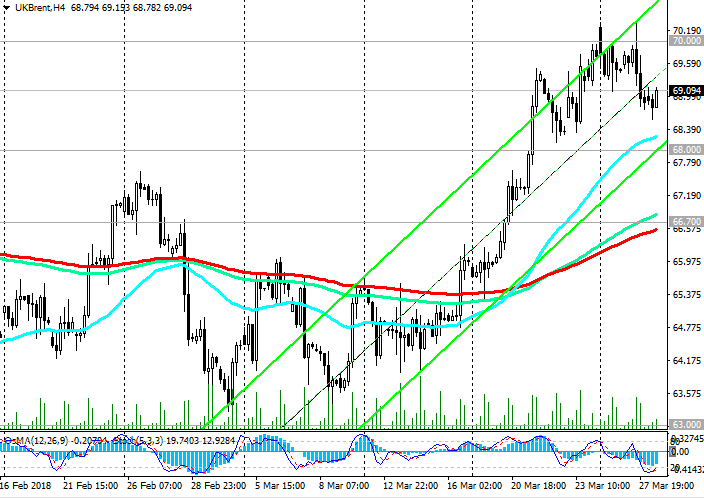

Today Brent crude oil is trading in a narrow range near the $ 69.00 per barrel mark, pending the publication at 14:30 (GMT) of official data from the US Department of Energy on oil and petroleum products in the US. Some analysts of the oil market expect an increase in commercial oil reserves in the US, by 1.4 million barrels in the week of March 17-23.

Other analysts expect the stock to decline by 0.287 million barrels. Given the data previously provided by the American Petroleum Institute (API), it is likely that stocks have grown.

While OPEC is making efforts to reduce oil production, the US successfully took advantage of the situation and increased oil production, including shale oil. As you know, the OPEC agreement on the reduction of oil production by about 1.8 million barrels per day was signed in 2016 and will continue until the end of 2018.

And now, as it became known from media reports last week, OPEC intends next year to continue joint efforts to reduce the supply of oil.

Another positive factor for oil prices and the argument for further price growth may be the prospect of the US withdrawing from the international agreement on the Iranian nuclear program concluded in 2015.

Iran is the largest supplier of oil, possessing about 10% of all the world's proven oil reserves. And if sanctions are imposed on Iran again, the country will not be able to supply oil to the world market, which inevitably entails a decrease in the world supply of oil and, consequently, a rise in prices for it.

Even despite the growth of oil production in the US, the world oil supply will not be able to cover the demand for it in this case.

As the UAE energy minister Suhail Al-Mazrui, who is the OPEC president at the present time, said last month that OPEC is "more concerned about the supply shortage than its surplus".

There is a high probability that the oil price rally may soon resume.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

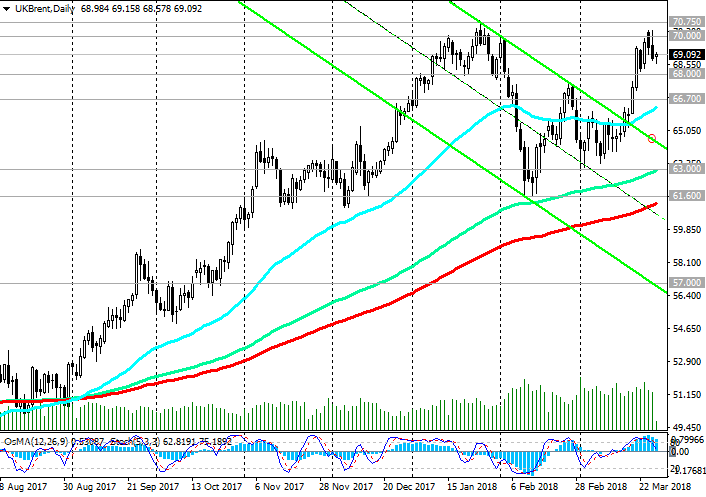

Support levels: 69.00, 68.00, 66.70, 63.00,

61.60, 60.00, 57.00

Resistance levels: 70.00, 70.75

Trading Scenarios

Sell Stop 68.50. Stop-Loss 69.60. Take-Profit 68.00, 66.70, 63.00, 61.60

Buy Stop 69.60. Stop-Loss 68.50. Take-Profit 70.00, 70.75, 76.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com