Click here to read the full article

In this article I will provide my view on the AUD/JPY, EUR/USD and the EUR/NZD specific the long term strategy. These are the pairs that I am currently interested in or was interested in last week for trading with the Hybrid Grid strategy.

- All trades are based on specific rules according to the FxTaTrader Hybrid Grid strategy.

- All open positions can be viewed by clicking here.

- All closed positions can be viewed by clicking here.

The full aticle will provide:

- The weekly currency score for the major currencies.

- The weekly currency chart for the interesting pairs.

- The daily(timing) chart for the interesting pairs.

- Possible positions for the coming week and positions taken.

Every first Sunday of the month I will provide the long term strategy which has been added recently to the Hybrid Grid strategy. The strategy is under evaluation and positions have been placed on the evaluation account. The EUR/NZD is for this an interesting pair.

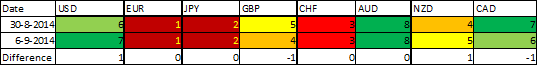

CURRENCY SCORE

See Currency score explained for more details |

- The USD, AUD and CAD are very strong. The EUR, JPY and CHF are the weakest currencies. The best pairs to look at are a combination of those pairs.

- The AUD remains in general stronger than the JPY. This combinations is interesting. Same for the USD compared to the EUR.

- The CHF has become weak just recently but is in general stronger than the EUR. So the preference for going short is the EUR.

- The CAD has become strong lately but offer less opportunities compared to the other stronger pairs.

- The EUR/USD and AUD/JPY remain the best pairs to trade. These are one of the interesting pair combinations according to the strategy rules for the FxTaTrader Hybrid Grid strategy, see FxTaTrader Hybrid Grid.

- Last week pending orders were placed for the EUR/USD and AUD/JPY.

___________________________________________

Open/pending positions of last week.

Ranking and rating list (Click to open the list)

Rank: 2

Rating: - - -

Open/pending positions of last month.

Although the explanation may seem simple and clear there is always risk involved. I added a disclaimer to my blog for this purpose. If you like to use this article then mention the source by providing the URL www.FxTaTrader.com or the direct link to this article http://fxtatrader.blogspot.nl/2014/09/review-hybrid-grid-weeks-3637.html.Open/pending positions of last week.

Since there was a lot of important news for the interesting currencies last week and the strategy avoids by preference to trade around important news the orders were placed with caution. Only on a significant pull back positions would have been opened in the direction of the main trend. The momentum was very high for both pairs and the pull backs were not significant.

The coming week may offer good opportunities in these pairs because the news for coming week is not anymore as heavy and as much.

AUD/JPY

The coming week may offer good opportunities in these pairs because the news for coming week is not anymore as heavy and as much.

AUD/JPY

___________________________________________

EUR/USD

Ranking and rating list (Click to open the list)

Rank: 2

Rating: - - -

Total outlook: Down

___________________________________________

Open/pending positions of last month.

This is the first article where we will look into the longer term strategies. The strategy does not differ much from the current strategy used on the daily chart. There are 3 important differences which are:

EUR/NZD

- The timing chart is the weekly instead of the daily and the decision chart is the monthly instead of the weekly. There is no context chart.

- There is also more emphasis on the taking carry trades because positions will be held longer.

- The profit target is 1/4 ATR of the monthly chart instead of the weekly.

EUR/NZD

The EUR/NZD is a very interesting pair for the longer term and is an interesting pair for the Hybrid Grid strategy. On the evaluation account positions have been taken and also closed with profit.

Ranking and rating list (Click to open the list)

Rank: 6

Rating: - - -

Ranking and rating list (Click to open the list)

Rank: 6

Rating: - - -

Total outlook: Down

___________________________________________