Although Dow Theory was written over 100 years ago most of its points

are still relevant today. Dow focused on stock indexes in his writings

but the basic principles are relevant to any market.

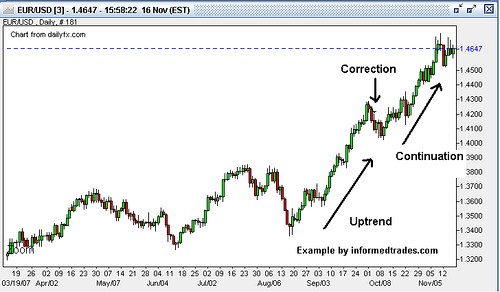

Dow Theory is broken down into 6 basic tenets. In this lesson we are going to take a look at the first 3. The first tenet of Dow Theory is that The Markets Have 3 Trends.

• Up Trends which are defined as a time when successive

rallies in a security price close at levels higher than those achieved

in previous rallies and when lows occur at levels higher than previous

lows.

• Down Trends which are defined as when the market makes successive lower lows and lower highs.

• Corrections which are defined as a move after the

market makes a move sharply in one direction where the market recedes in

the opposite direction before continuing in its original direction.

The second tenet of Dow Theory is that Trends Have 3 Phases:

• The accumulation phase which is when the “expert”

traders are actively taking positions which are against the majority of

people in the market. Price does not change much during this phase as

the “experts” are in the minority so they are not a large enough group

to move the market.

• The public participation phase which is when the

public at large catches on to what the “experts” know and begin to trade

in the same direction. Rapid price change can occur during this phase

as everyone piles onto one side of a trade.

• The Excess Phase where rampant speculation occurs and the “smart money” starts to exit their positions.

The third tenet of Dow Theory is that The Markets Discount All News,

meaning that once news is released it is quickly reflected in the price

of an asset. On this point Dow Theory is in line with the efficient

market hypothesis which states that:

“the efficient market hypothesis (EMH) asserts that financial markets

are "informationally efficient", or that prices on traded assets, e.g.,

stocks, bonds, or property, already reflect all known information and

therefore are unbiased in the sense that they reflect the collective

beliefs of all investors about future prospects.”