MQL5 Cookbook: Handling BookEvent

Introduction

As is well known, the MetaTrader 5 trading terminal is a multi-market platform, that facilitates trading on Forex, stock markets, Futures and Contracts for Difference. According to the Freelance section stats, the number of traders trading not only on Forex market is growing.

In this article I would like to introduce novice MQL5 programmers to the BookEvent handling. This event is connected with Depth of Market—an instrument for trading stock assets and their derivatives. Forex traders, however, may find Depth of Market useful too. In ECN accounts, liquidity providers supply data on the orders, though only within their aggregator model. These accounts are becoming more popular.

1. BookEvent

According to the Documentation, this event is generated when Depth of Market status changes. Let us agree that BookEvent is a Depth of Market event.

Depth of Market is an array of orders, which differ in direction (sell and buy), price and volume. Prices in Depth of Market are close to the market ones and therefore are considered as the best.

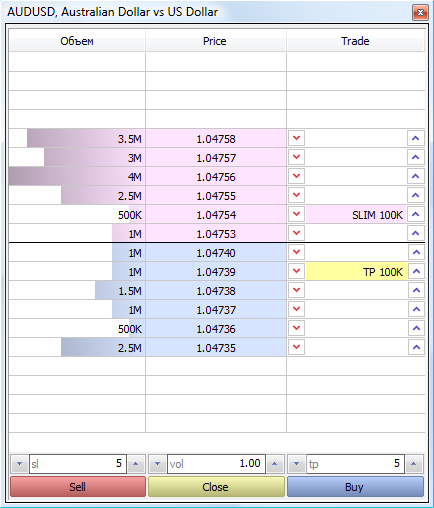

Fig.1 Depth of Market in MetaTrader 5

In MetaTrader 5 an "order book" is named as the "Depth of Market" (Fig.1). Detailed information about Depth of Market can be found in the User Guide to the Client Terminal.

The MqlBookInfo structure providing information on the Depth of Market should be mentioned separately.

struct MqlBookInfo { ENUM_BOOK_TYPE type; // order type from the ENUM_BOOK_TYPE enumeration double price; // price long volume; // volume };

It contains three fields. Data on the order type, price and volume can be obtained by processing the order structure.

2. Event Handler of BookEvent

The OnBookEvent() event handling function takes one constant as a parameter. It is a reference to a string parameter.

void OnBookEvent (const string& symbol)

The string parameter contains the name of the symbol, for which a Depth of Market event took place.

The event handler itself requires preliminary preparation. For the EA to handle a Depth of Market event, this event has to be subscribed for, using the built-in function MarketBookAdd(). Usually it is located in the block of EA's initialization. If a Depth of Market event has not been subscribed for, then the EA will ignore it.

Providing a possibility to unsubscribe from receiving events is considered to be a good programming practice. At deinitialization, it is necessary to unsubscribe from receiving that data by calling the MarketBookRelease() function.

The mechanisms of subscribing and unsubscribing from receiving data is similar to creating and processing a timer, which has to be activated before processing.

3. BookEvent Handling Template

We are going to create a simple template of EA, which calls the OnBookEvent() function, and name it BookEventProcessor1.mq5.

The template comprises a minimum set of handlers, which are handlers of initialization and deinitialization of the EA, as well as the Depth of Market event handler.

The Depth of Market event handler itself is very simple:

//+------------------------------------------------------------------+ //| BookEvent function | //+------------------------------------------------------------------+ void OnBookEvent(const string &symbol) { Print("Book event for: "+symbol); //--- select the symbol if(symbol==_Symbol) { //--- array of the DOM structures MqlBookInfo last_bookArray[]; //--- get the book if(MarketBookGet(_Symbol,last_bookArray)) { //--- process book data for(int idx=0;idx<ArraySize(last_bookArray);idx++) { MqlBookInfo curr_info=last_bookArray[idx]; //--- print PrintFormat("Type: %s",EnumToString(curr_info.type)); PrintFormat("Price: %0."+IntegerToString(_Digits)+"f",curr_info.price); PrintFormat("Volume: %d",curr_info.volume); } } } }

As this Depth of Market event is a broadcast one (after subscription it will appear for all symbols), a required instrument has to be specified.

It should be noted though that in the latest few builds, changes have been introduced in the work of Depth of Market. In the current version (build 975) I did not find any signs of broadcasting. The handler was called only for the assigned symbol. To prove this fact, I simply arranged entering information to the "Experts Log".

To do that, we are going to use the built-in function MarketBookGet(). It will return all the information about Depth of Market, namely the MqlBookInfo, array of structures, which contains Depth of Market records for the specified symbol. It should be noted, that this array will vary in size, depending on a broker.

The template allows displaying values of the array structures in the Log.

The EA was launched for the SBRF-12.14 futures in a debug mode. The sequence of records in the Experts log will be as follows:

EL 0 11:24:32.250 BookEventProcessor1 (SBRF-12.14,M1) Book event for: SBRF-12.14 MF 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL KP 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7708 LJ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 6 MP 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL HF 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7705 LP 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 6 MJ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL GL 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7704 ON 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 3 MD 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL FR 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7703 PD 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 2 MN 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL DH 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7701 QQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 10 GH 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL QM 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7700 OK 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 1011 ER 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL KS 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7698 EE 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 50 OM 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL KI 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7696 IO 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 21 QG 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL LO 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7695 MK 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 1 QQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL KE 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7694 QQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 5 QK 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL PK 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7691 LO 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 2 QE 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL HQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7688 OE 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 106 MO 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL RG 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7686 IP 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 18 GI 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL FL 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7684 QI 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 3 GS 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL IR 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7681 LG 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 4 GM 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL JH 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7680 RM 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 2 GG 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL DN 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7679 HH 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 19 IQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL ED 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7678 EQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 1 IK 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL OJ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7676 DO 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 2 IE 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_SELL RP 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7675 EE 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 1 QR 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY LF 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7671 LP 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 40 QD 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY KL 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7670 QJ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 21 QN 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY CR 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7669 RD 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 20 QP 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY DH 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7668 NN 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 17 QJ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY QN 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7667 RK 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 2 OL 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY DE 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7666 MQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 151 QF 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY OJ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7665 RO 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 2 OH 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY FQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7664 EF 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 49 OR 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY GG 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7663 OS 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 3 ED 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY JM 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7662 PI 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 4 CN 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY ES 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7661 LD 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 13 CP 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY FI 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7660 LM 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 2 IJ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY NO 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7659 II 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 12 IL 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY ME 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7658 IP 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 3 GF 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY NK 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7657 FM 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 15 GH 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY MQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7656 DD 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 6 MS 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY NG 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7655 KR 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 9 KE 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY OM 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7654 IK 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 14 KO 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY NS 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7653 DF 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 534 MQ 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Type: BOOK_TYPE_BUY OI 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Price: 7652 IO 0 11:24:33.812 BookEventProcessor1 (SBRF-12.14,M1) Volume: 25

It is what Depth of the Market looked like at a certain moment in time. The first element of the array of structures is an order to sell at the highest price (7708 Rub). The last element of the array is an order to buy at the lowest price (7652 Rub). So, the Depth of Market data is read to the array from top to bottom.

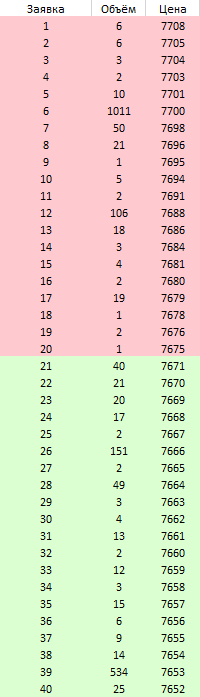

For convenience, I have gathered data in Table 1.

Table 1. Depth of Market for SBRF-12.14

The upper block highlighted in red contains sell orders (sell-limits). The lower block highlighted in green includes buy orders (buy-limits).

It is obvious that out of all sell orders, order #6 had the largest volume with the price of 7700 Rub and volume of 1011 lots. Order #39 had the largest volume out of all buy orders with the price of 7653 Rub and volume of 534 lots.

The source data in Depth of Market is the information that a trader analyses to work out a trading strategy. The simplest trading idea is that gathering and clustering orders with significant volumes at contiguous price levels create zones of support and resistance. In the following section, we shall create an indicator that will track changes in Depth of Market.

4. Depth of Market

There are a lot of various indicators working with Depth of Market data. You can find a few interesting ones in the MetaTrader 5 Market. I like IShift most of all. Yury Kulikov, the developer, succeeded in creating a compact and informative tool.

All programs, working with Depth of Market data, will have a form of either an Expert Advisor or an indicator, as only these MQL5 programs feature the BookEvent event handler.

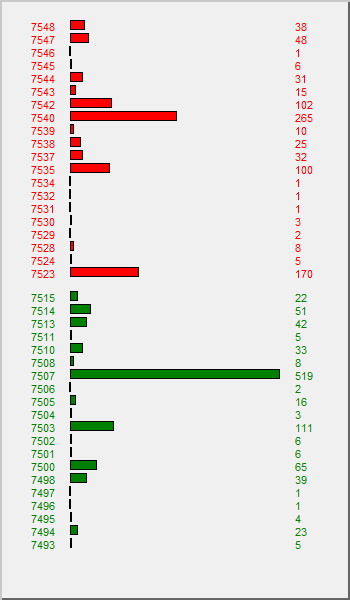

Let us create a short program that will be showing live Depth of Market data. At first we need to specify the data to be displayed. It will be a panel, with horizontal bars indicating the volume of the order. The size of the bars, however, will be of relative nature. Maximum volume of all current orders will be considered as 100%. Fig. 2 shows that the order at the price of 7507 Rub has the largest volume of 519 lots.

For correct panel initialization, the exact Depth of Market or the number of levels has to be specified (the "DOM depth" parameter). This number differs from broker to broker.

Fig. 2 Depth of Market Panel

The program code for the panel is written with Object-Oriented Programming approach. The class responsible for the panel operation is named as CBookBarsPanel.

//+------------------------------------------------------------------+ //| Book bars class | //+------------------------------------------------------------------+ class CBookBarsPanel { private: //--- Data members CArrayObj m_obj_arr; uint m_arr_size; //--- uint m_width; uint m_height; //--- Methods public: void CBookBarsPanel(const uint _arr_size); void ~CBookBarsPanel(void){}; //--- bool Init(const uint _width,const uint _height); void Deinit(void){this.m_obj_arr.Clear();}; void Refresh(const MqlBookInfo &_bookArray[]); };

This class contains four data members.

- The m_obj_arr attribute is a container for pointers to the objects of the CObject type. It is used for storing Depth of Market data. A separate class will be created for the latter.

- The m_arr_size attribute is responsible for the number of Depth of Market levels.

- The m_width and m_height attributes store the panel dimensions (width and height in pixels).

As far as the methods are concerned, their set besides standard constructor and destructor includes:

- method of initialization

- method of deinitialization

- method of updating

We shall create the separate CBookRecord class for each row of the panel (Depth of Market level) specifying the price, horizontal bar and volume.

It will comprise three pointers. One of them will be pointing to the object of the CChartObjectRectLabel type (rectangular label for working with a horizontal bar) and two pointers of the CChartObjectLabel type (text labels for the price and volume).

//+------------------------------------------------------------------+ //| Book record class | //+------------------------------------------------------------------+ class CBookRecord : public CObject { private: //--- Data members CChartObjectRectLabel *m_rect; CChartObjectLabel *m_price; CChartObjectLabel *m_vol; //--- color m_color; //--- Methods public: void CBookRecord(void); void ~CBookRecord(void); bool Create(const string _name,const color _color,const int _X, const int _Y,const int _X_size,const int _Y_size); //--- data bool DataSet(const long _vol,const double _pr,const uint _len); bool DataGet(long &_vol,double &_pr) const; private: string StringVolumeFormat(const long _vol); };

Among the methods are:

- method of a record creation;

- method of data setting;

- method of data receiving;

- method of big numbers formatting.

Then the handler of BookEvent for the EA and, essentially, the indicator, will look as follows:

//+------------------------------------------------------------------+ //| BookEvent function | //+------------------------------------------------------------------+ void OnBookEvent(const string &symbol) { //--- select the symbol if(symbol==_Symbol) { //--- array of the DOM structures MqlBookInfo last_bookArray[]; //--- get the book if(MarketBookGet(_Symbol,last_bookArray)) //--- refresh panel myPanel.Refresh(last_bookArray); } }

So, every time BookEvent is generated, the panel will update its data. We are going to name the updated version of the program as BookEventProcessor2.mq5.

In the video above you can see how the EA is working.

Conclusion

This article is dedicated to another event of the Terminal - the Depth of Market event. This event is often at the core of high frequency trading algorithms (HFT). This type of trading is gaining popularity among traders.

I hope that traders starting to program on MQL5 will find included examples of handling the Depth of Market event useful. The source files attached to this article are convenient to be put into the project folder. In my case it is \MQL5\Projects\BookEvent.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/1179

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Why Virtual Hosting On The MetaTrader 4 And MetaTrader 5 Is Better Than Usual VPS

Why Virtual Hosting On The MetaTrader 4 And MetaTrader 5 Is Better Than Usual VPS

How to Access the MySQL Database from MQL5 (MQL4)

How to Access the MySQL Database from MQL5 (MQL4)

MQL5 Programming Basics: Global Variables of the Terminal

MQL5 Programming Basics: Global Variables of the Terminal

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello Denis!

Quick question. Can we access all types of pending orders not only buy below market price but also sell below it and vice versa, buy above market price. In other words Im trying to map out all forms of liquidity orders in the book. Similar like Oanda broker used to have in the FX lab tools.

Thanks a lot

good day friend

i saw your block

I couldn't copy the file

I await your prompt response, thank you

good day friend

i saw your block

I couldn't copy the file

I await your prompt response, thank you

@Denis Kirichenko

Hello Sir,

Hope you are doing well, thanks a lot for your code about the DOM automated it is really useful for me so thanks a lot. :)

I have downloaded and installed the code fine, but I only see the sell orders. I think there was an update in the API Reference or something and your buy orders is not showing now.

As you can see in the screenshot, the Sell works fine, but no data for the Buy. I am in MT5 free, I don't have subscribed to any market data Level 2.

What do you think I need to check please ?

Thanks for your help Denis,

Kind regards,

Alexandre