Oleg Papkov / 个人资料

- 信息

|

7+ 年

经验

|

11

产品

|

228

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

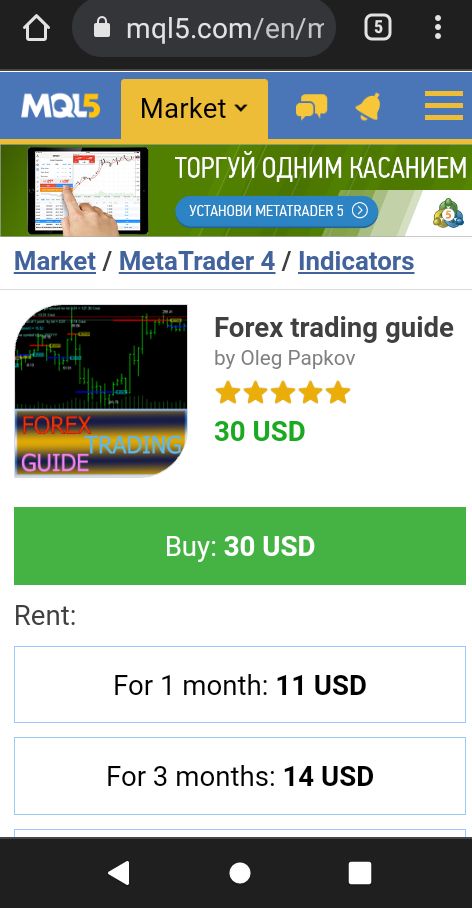

The Forex Trading Guide indicator works based on the standard RSI indicator with an adjustable period. Crossing the internal level calculated mathematically, the indicator gives a signal for opening a trade in a certain direction, showing it on the price chart with the corresponding line (blue - deal up, red - deal down) and the price label of the corresponding color. In other words, if the previous directive was to deal down (the line and the price label in red), then the next directive will be to reverse the deal, deal up (the line and the price label in blue). Appearance of a deal directive is preceded by the appearance of a white line with the price label, colored accordingly. That is, the appearance of a white price label indicates that the intersection of the signal levels has taken place in the indicator;s calculations, and it is necessary to reverse the deal.

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

The Forex Trading Guide indicator works based on the standard RSI indicator with an adjustable period. Crossing the internal level calculated mathematically, the indicator gives a signal for opening a trade in a certain direction, showing it on the price chart with the corresponding line (blue - deal up, red - deal down) and the price label of the corresponding color. In other words, if the previous directive was to deal down (the line and the price label in red), then the next directive will be to reverse the deal, deal up (the line and the price label in blue). Appearance of a deal directive is preceded by the appearance of a white line with the price label, colored accordingly. That is, the appearance of a white price label indicates that the intersection of the signal levels has taken place in the indicator;s calculations, and it is necessary to reverse the deal.

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

The Forex Trading Guide indicator works based on the standard RSI indicator with an adjustable period. Crossing the internal level calculated mathematically, the indicator gives a signal for opening a trade in a certain direction, showing it on the price chart with the corresponding line (blue - deal up, red - deal down) and the price label of the corresponding color. In other words, if the previous directive was to deal down (the line and the price label in red), then the next directive will be to reverse the deal, deal up (the line and the price label in blue). Appearance of a deal directive is preceded by the appearance of a white line with the price label, colored accordingly. That is, the appearance of a white price label indicates that the intersection of the signal levels has taken place in the indicator;s calculations, and it is necessary to reverse the deal.

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

https://www.mql5.com/ru/market/product/23038?source=Site+Profile+Seller

https://www.mql5.com/ru/users/novocel_ol/seller

The Grid stability plus semi automatic expert Advisor trades on the signals of the RSI indicator. Trades are made in different directions when the indicator reaches values of 30 or 70 . If the indicator is greater than 70 , the Short direction is selected for initial trades, and if the indicator is less than 30 , the Long direction is selected. Profitable trades are closed by take profit. Unprofitable ones are processed by the expert Advisor using the averaging method, a network of transactions

The EA uses the Stochastic indicator. Long and Short trades are opened each in their own range of indicator levels. The lot of transactions changes depending on the established risk level and the results of previous transactions. The EA has two modes of use. 1-without using the averaging network. 2 - using the averaging network. To choose from, according to your preferences. The settings for these modes are different. The default settings are optimized for EURGBP M15 in non-network averaging

游轮 船舶巡航专家顾问交易的RSI指标信号。 当指标达到30或70的值时,交易是在一个方向或另一个方向进行的。 盈利交易以获利收盘。 无利可图的交易被ea使用平均方法处理,交易网络建立在同一方向上,计算盈亏平衡水平,并且当价格达到此水平时,网络以获利关闭。 EA具有最低的指示,对于选择所选产品(货币对),账户和存款的初始参数进行优化是非常容易的。 在一个方向上的所有交易,短期或长期,在连接丢失的情况下受到保护,并具有相同的止损。 TPSL经理根据平均网络的状态和方向的交易数量改变总止损的位置。 设置选项。 部分"交易时间" Hours_to_GMT_Offset-来自代理服务器的已知GMT时间偏移时钟。 小时-开/关。 Begin_hour-小时开始; 结束时间_结束时间; 该节"初始设置" 优惠-立即优惠; MaximumRisk-影响开始很多的大小; LotStop-limiter了很多。 当达到LotStop值时,网络的初始交易将保留该lot值; DecreaseFactor-用于减少初始交易的参数 ; TP-止盈;