An indicator to love!

The dream of every trader is to have a tool that accurately shows the input and output of an operation.

The Sajuka indicator has a large percentage of successful entries, but as everyone knows, there is no tool with 100% accuracy in such a volatile and unstable market.

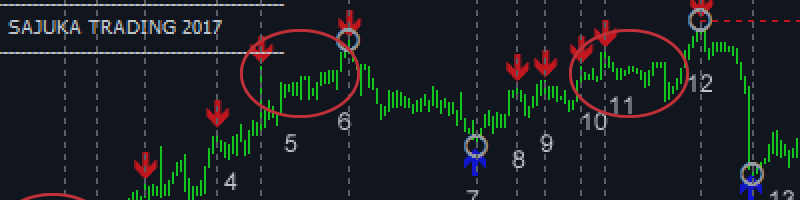

In the image below we review these entries and these funds, come on, look at the image below, the blue arrows indicate the possibility of purchase, and the red arrows sales possibilities.

The Sajuka doing efficiently their work, as it was designed, if you look, each arrow somehow there was a reversal of trend, but survive in the market requires knowing the right inputs, to get the most points, to get cover the costs of spreads and commissions.

Now, let's look at this other picture, the arrows are numbered:

Related entries, would be our best traders, and what we all want.

The Buy Entries in points:

28 - (211 points);

27 - (194 points);

There are approximately 2800 points in 4 hours trading, can you imagine having 100% of points in a single day, 100% is a dream we all want to achieve one day, and we're working on it, we know it is a difficult goal, but be trader and so much study and dedication to have a strategy of efficient war.

And logical, who has the best weapons, has great chances to win the war.

Then we go to the strategy, note the image below:

In the image below I did some circles, to understand the accumulation areas:

Every accumulation area will be our point of waiting if the arrow is selling, we expect the disruption of these accumulation areas, these areas are small candles with the same radius of High and Low, as seen in the picture, but if you look good, are small areas of accumulation where the price has found some strength to reverse the trend it is, so we need to analyze.

Use the strategy, if the arrow for sale, enter an order to Sell stop below the last found accumulation, if the arrow for sale, open a Buy stop order above the last accumulation.

Sajuka - An indicator to love !!!!!

https://www.mql5.com/pt/market/product/13455