Vitor Gomes / 프로필

- 정보

|

9+ 년도

경험

|

0

제품

|

0

데몬 버전

|

|

0

작업

|

0

거래 신호

|

0

구독자

|

Trader

에

www.vgforextrader.com

Hello.

I'm Victor, I was born in 1965 and I live in Oporto, Portugal

My experience as a Trader started in 2008 when I became interested in developing trading systems for foreign exchange.

I have a mission to the advice from investors who want to enter the market through the broker, with my experience and knowledge to monitor the entire investment process with the best risk management / profitability always preserving client capital.

I'm Victor, I was born in 1965 and I live in Oporto, Portugal

My experience as a Trader started in 2008 when I became interested in developing trading systems for foreign exchange.

I have a mission to the advice from investors who want to enter the market through the broker, with my experience and knowledge to monitor the entire investment process with the best risk management / profitability always preserving client capital.

Vitor Gomes

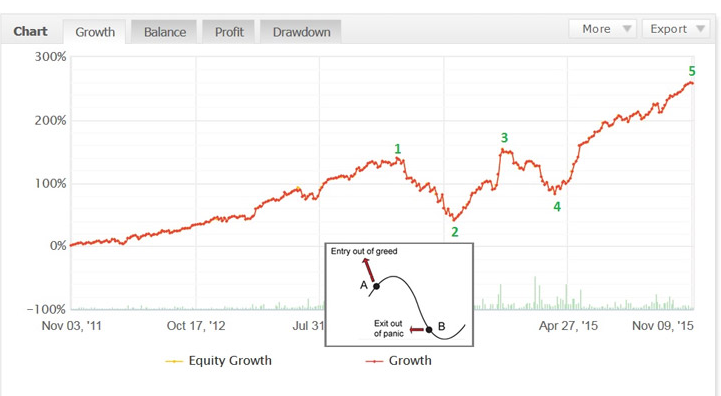

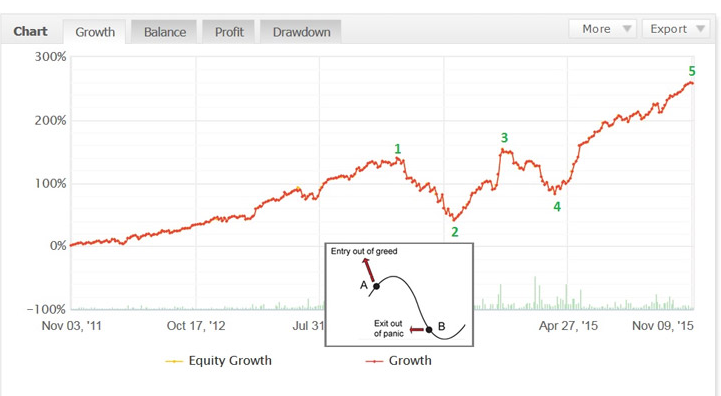

The “greed-panic” cycle in trading with EAs

One of the biggest enemies of the trader is the human nature. The so called “greed-panic” cycle is a psychological phenomenon which lies at the heart of most failures from the time markets and trading started to exist. It is interesting that this phenomenon is one of the reasons why many people fail to gain profit even when trading with a reliable trading system that is profitable in the long run.

One of the biggest advantages of trading with automated trading strategies (EAs) is that our mentality is involved to a limited extent. And yet it plays a certain role. Although we may be able to fight the urge to intervene in trades, it is even harder to resist the “greed-panic” phenomenon and here is why. Many traders start using an EA when it is at its peak performance and the equity curve is skyrocketing. Sadly, this is often the exact moment when a drawdown comes in. Even the greatest trading system has its bad periods and when these occur, many traders just throw the system aside, because they are not committed enough to resist the “greed-panic” cycle. On the equity curve, we can pinpoint several clearly defined points which correspond to “greed-panic” cycle points. Many of the system’s users started taking unreasonable risks in point 1 and then dumped the system in point 2 just to witness its quick recovery. As our example demonstrates, up to know, this cycle has occurred once more. Despite all that, the system recovers after each bad period and will keep recovering in the future, because it implements a solid trading logic and uses a proper risk management strategy.

So, what can we learn from that?

1. Do not get overly excited when your trading is showing fantastic results. Keep calm and maintain a reasonable risk level, because the “rocket” mode will not last forever.

2. Do not panic when your system falls into a bad series. If you have a good and reliable trading system, stick with it - it will recover sooner or later and you will be rewarded for your patience and self-control.

3. Remember! Risk management is the key to successful trading. Wise risk management is what keeps you in the game!

WF

http://goo.gl/7ZRTyp

One of the biggest enemies of the trader is the human nature. The so called “greed-panic” cycle is a psychological phenomenon which lies at the heart of most failures from the time markets and trading started to exist. It is interesting that this phenomenon is one of the reasons why many people fail to gain profit even when trading with a reliable trading system that is profitable in the long run.

One of the biggest advantages of trading with automated trading strategies (EAs) is that our mentality is involved to a limited extent. And yet it plays a certain role. Although we may be able to fight the urge to intervene in trades, it is even harder to resist the “greed-panic” phenomenon and here is why. Many traders start using an EA when it is at its peak performance and the equity curve is skyrocketing. Sadly, this is often the exact moment when a drawdown comes in. Even the greatest trading system has its bad periods and when these occur, many traders just throw the system aside, because they are not committed enough to resist the “greed-panic” cycle. On the equity curve, we can pinpoint several clearly defined points which correspond to “greed-panic” cycle points. Many of the system’s users started taking unreasonable risks in point 1 and then dumped the system in point 2 just to witness its quick recovery. As our example demonstrates, up to know, this cycle has occurred once more. Despite all that, the system recovers after each bad period and will keep recovering in the future, because it implements a solid trading logic and uses a proper risk management strategy.

So, what can we learn from that?

1. Do not get overly excited when your trading is showing fantastic results. Keep calm and maintain a reasonable risk level, because the “rocket” mode will not last forever.

2. Do not panic when your system falls into a bad series. If you have a good and reliable trading system, stick with it - it will recover sooner or later and you will be rewarded for your patience and self-control.

3. Remember! Risk management is the key to successful trading. Wise risk management is what keeps you in the game!

WF

http://goo.gl/7ZRTyp

소셜 네트워크에 공유 · 6

Vitor Gomes

1. How to choose a forex trading system wisely. Many traders don't spend enough time researching the EAs market. Sadly, the EAs market is flooded with SCAMS - 90% of EAs are sold by marketers instead of traders and developers...

소셜 네트워크에 공유 · 2

132

Vitor Gomes

PART 2: The importance of the Risk Management:

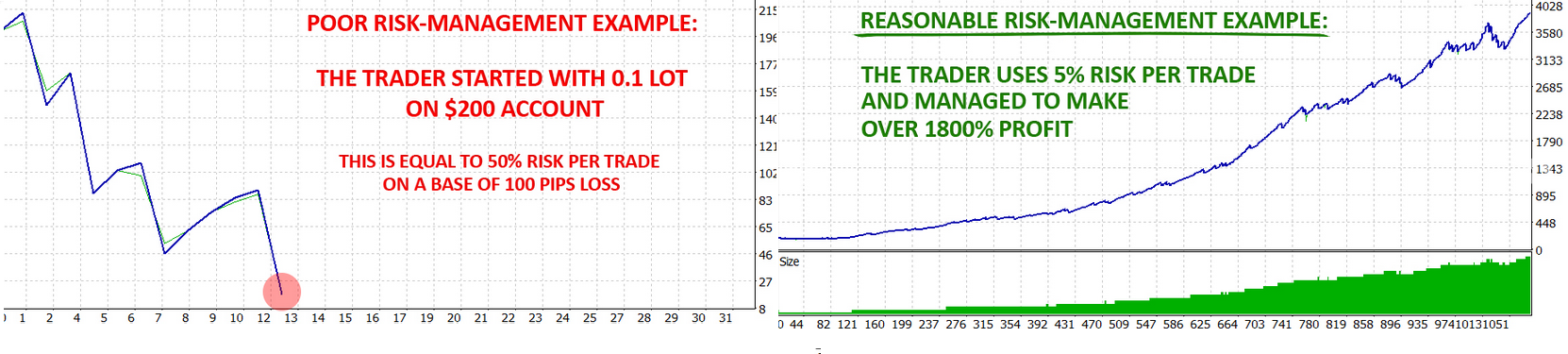

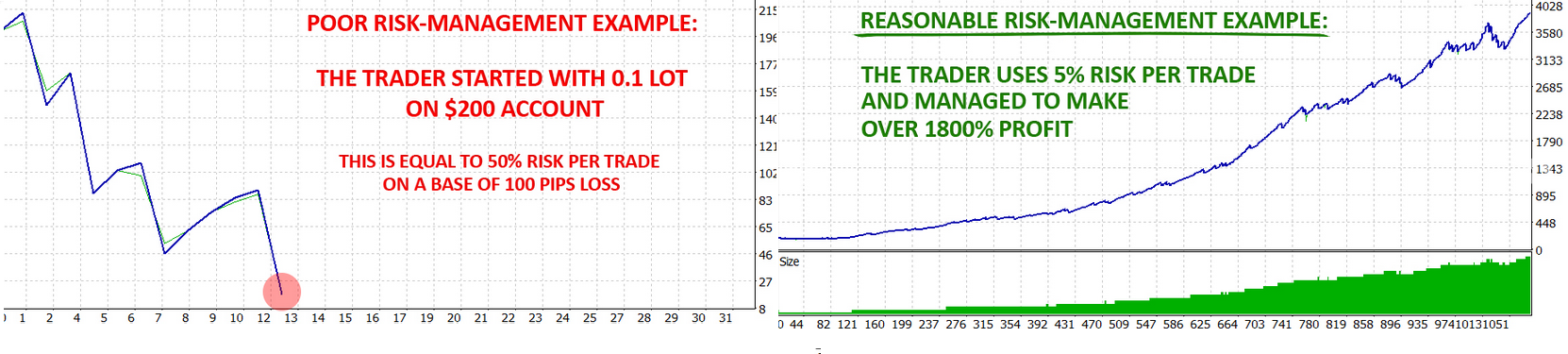

The risk management is maybe the major aspect of the trading. Poor risk management could make a profitable trading system a disastrous one, as a proper risk management could transform a poor trading system in a profitable one. Many people start using default 0.1 standard lot on $200 even $100 accounts. Some experienced traders do this with a purpose, but most of the inexperienced traders just don’t realize the level of risk they take. Such level of risk is equal to account loss in more than 50% of the cases, even with a great trading system.

So, how to wisely manage the risk? – Generally speaking, if you are looking for long-term success you shouldn't risk more than 5% from the account balance in a single trade, 10% on a daily basis and 20% on a weekly basis. If the trading system opens multiple trades you should consider this carefully and reduce the risk per trade accordingly. It is very useful if you are able to perform backtests and check the historical drawdown of the trading strategy you use. Let’s say that the historical drawdown on a backtest is 500 pips, then double this number and prepare yourself for a 1000 pips drawdown and calculate the risk level so you wouldn't lose more than 30-40% of your account in such case. In the best case you will have a system with 3 or even more years real money account verified performance with thousands trades track record. In this case you can get all stats you need and calculate the risk you take very objectively. As a major rule, for an optimal risk/reward, we recommend 5% risk per trade for one-trade-at-a-time systems and 0.5-1% risk per trade for multiple-trade systems.

Remember – the risk level is a relative concept! There is no an absolutely best universal number for the risk you take. If 5% risk per trade sounds very reasonable for the retail traders, for the institutional trader this level of risk sounds insane. So the risk level you take should be considered very carefully on a base of the importance of the capital you manage. If the amount of money you manage is from significant importance for you and/or for other people, you are obliged to reduce the risk you take accordingly.

At the end:

Always get familiar with the system operation, before you risk significant for you amount of money! Never risk money that you cannot afford to lose!

Use the leverage that the broker provides you very wisely! The leverage is more your enemy then your friend. The high leveraged trading is the major reason for most of the bankruptcies.

WF

The risk management is maybe the major aspect of the trading. Poor risk management could make a profitable trading system a disastrous one, as a proper risk management could transform a poor trading system in a profitable one. Many people start using default 0.1 standard lot on $200 even $100 accounts. Some experienced traders do this with a purpose, but most of the inexperienced traders just don’t realize the level of risk they take. Such level of risk is equal to account loss in more than 50% of the cases, even with a great trading system.

So, how to wisely manage the risk? – Generally speaking, if you are looking for long-term success you shouldn't risk more than 5% from the account balance in a single trade, 10% on a daily basis and 20% on a weekly basis. If the trading system opens multiple trades you should consider this carefully and reduce the risk per trade accordingly. It is very useful if you are able to perform backtests and check the historical drawdown of the trading strategy you use. Let’s say that the historical drawdown on a backtest is 500 pips, then double this number and prepare yourself for a 1000 pips drawdown and calculate the risk level so you wouldn't lose more than 30-40% of your account in such case. In the best case you will have a system with 3 or even more years real money account verified performance with thousands trades track record. In this case you can get all stats you need and calculate the risk you take very objectively. As a major rule, for an optimal risk/reward, we recommend 5% risk per trade for one-trade-at-a-time systems and 0.5-1% risk per trade for multiple-trade systems.

Remember – the risk level is a relative concept! There is no an absolutely best universal number for the risk you take. If 5% risk per trade sounds very reasonable for the retail traders, for the institutional trader this level of risk sounds insane. So the risk level you take should be considered very carefully on a base of the importance of the capital you manage. If the amount of money you manage is from significant importance for you and/or for other people, you are obliged to reduce the risk you take accordingly.

At the end:

Always get familiar with the system operation, before you risk significant for you amount of money! Never risk money that you cannot afford to lose!

Use the leverage that the broker provides you very wisely! The leverage is more your enemy then your friend. The high leveraged trading is the major reason for most of the bankruptcies.

WF

소셜 네트워크에 공유 · 2

Vitor Gomes

Vitor Gomes

How to be a successful forex trader using Forex Expert Advisors - PART 1

1. How to choose a forex trading system wisely.

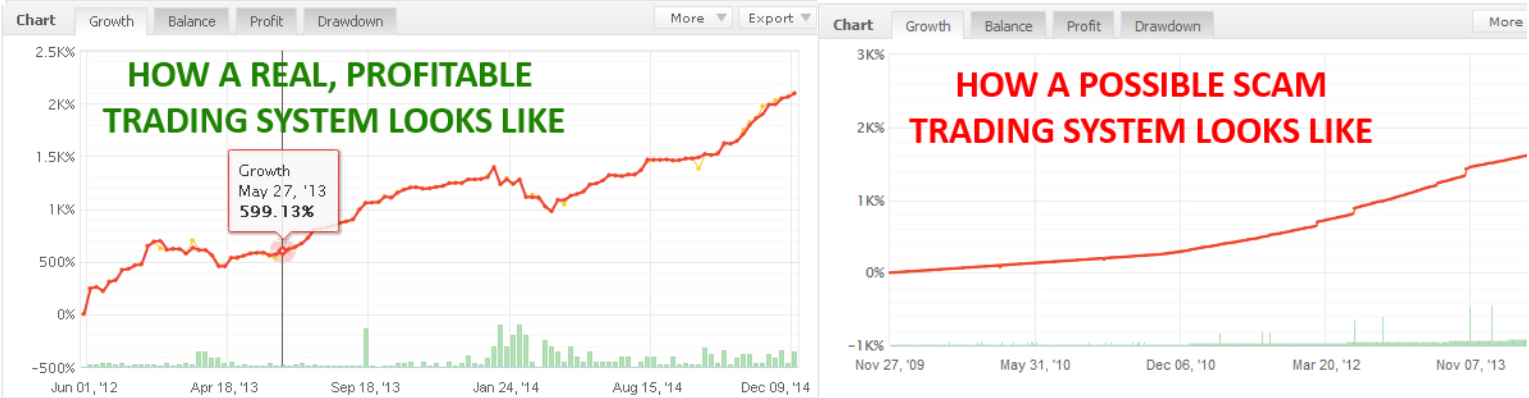

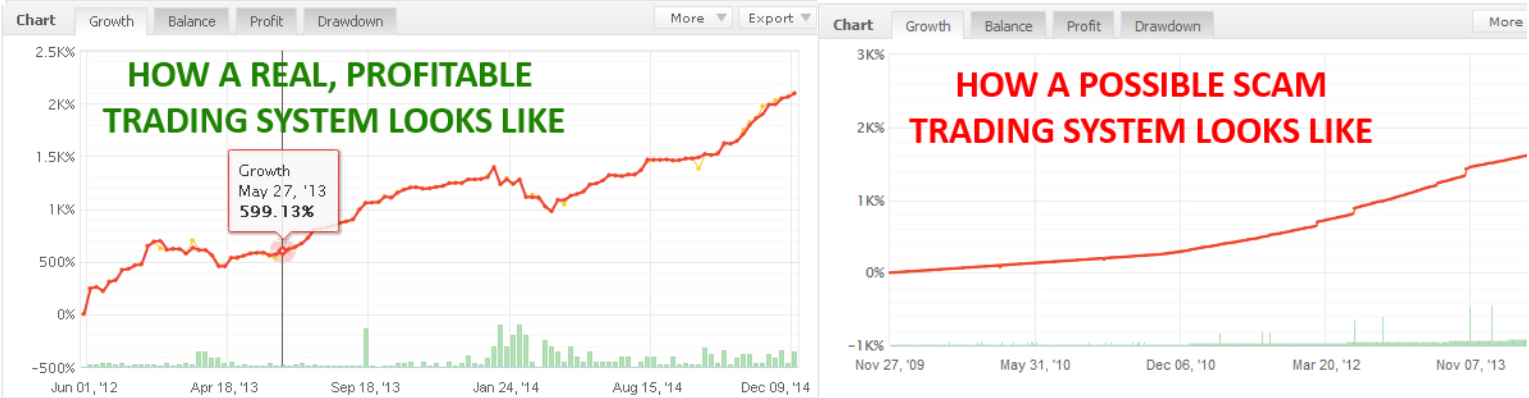

Many traders don't spend enough time researching the EAs market. Sadly, the EAs market is flooded with SCAMS - 90% of EAs are sold by marketers instead of traders and developers. Because marketers know how to attract your attention with big words and promises, many people fall into this trap.

What should you do?

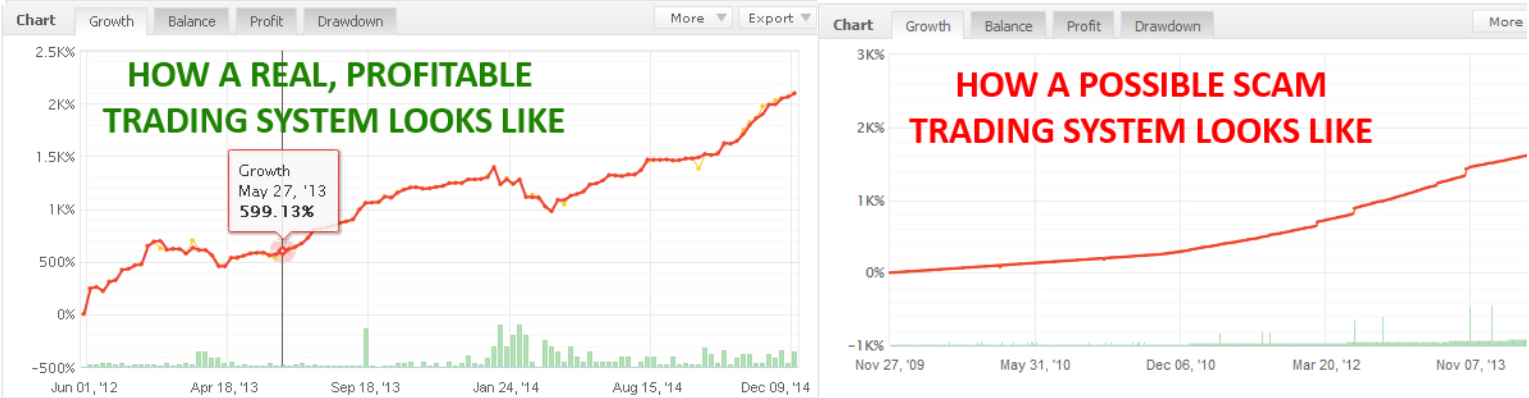

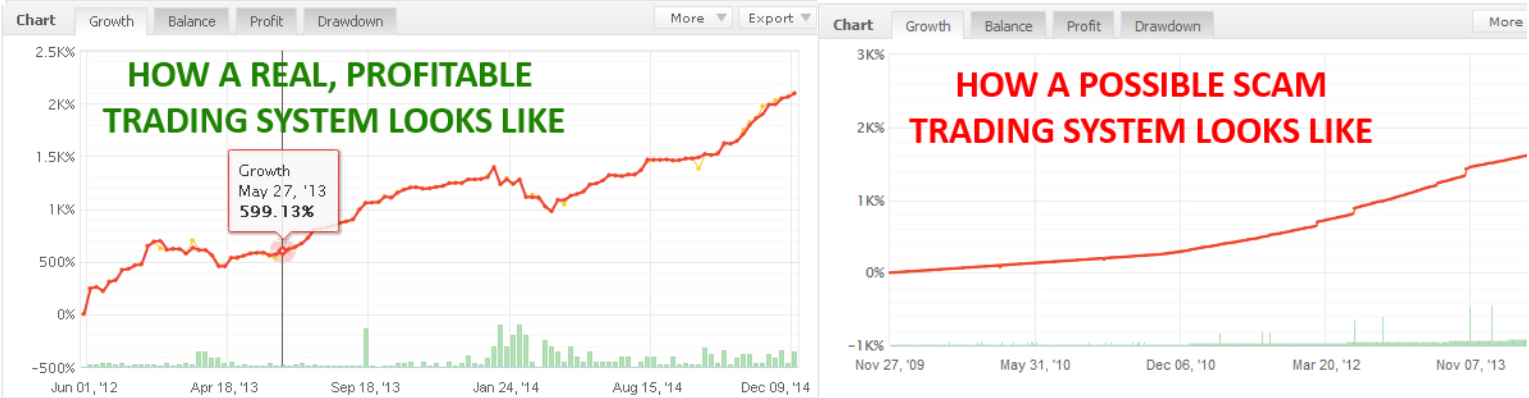

Look at the results, do not listen to words only. Backtests are good, but live results are the only thing that matters. Look for third party verified results - myfxbook.com is great for this purpose. Look for a long enough performance record - at least six months or more. Pay attention to the balance curve - if it is completely flat, STAY AWAY – it means that this is a "no-stop-loss" system, "martingale", or just another reckless system!

A healthy EA equity curve looks like a nice market trend - it goes up, but has some corrections/drawdown periods as well. Look at the number of trades - less than 100 trades is not representative enough. As a final step, look around in forums to check up on the reputation of a vendor and its products.

WSF

1. How to choose a forex trading system wisely.

Many traders don't spend enough time researching the EAs market. Sadly, the EAs market is flooded with SCAMS - 90% of EAs are sold by marketers instead of traders and developers. Because marketers know how to attract your attention with big words and promises, many people fall into this trap.

What should you do?

Look at the results, do not listen to words only. Backtests are good, but live results are the only thing that matters. Look for third party verified results - myfxbook.com is great for this purpose. Look for a long enough performance record - at least six months or more. Pay attention to the balance curve - if it is completely flat, STAY AWAY – it means that this is a "no-stop-loss" system, "martingale", or just another reckless system!

A healthy EA equity curve looks like a nice market trend - it goes up, but has some corrections/drawdown periods as well. Look at the number of trades - less than 100 trades is not representative enough. As a final step, look around in forums to check up on the reputation of a vendor and its products.

WSF

1

Vitor Gomes

How to be a successful forex trader using Forex Expert Advisors - PART 1

1. How to choose a forex trading system wisely.

Many traders don't spend enough time researching the EAs market. Sadly, the EAs market is flooded with SCAMS - 90% of EAs are sold by marketers instead of traders and developers. Because marketers know how to attract your attention with big words and promises, many people fall into this trap.

What should you do?

Look at the results, do not listen to words only. Backtests are good, but live results are the only thing that matters. Look for third party verified results - myfxbook.com is great for this purpose. Look for a long enough performance record - at least six months or more. Pay attention to the balance curve - if it is completely flat, STAY AWAY – it means that this is a "no-stop-loss" system, "martingale", or just another reckless system!

A healthy EA equity curve looks like a nice market trend - it goes up, but has some corrections/drawdown periods as well. Look at the number of trades - less than 100 trades is not representative enough. As a final step, look around in forums to check up on the reputation of a vendor and its products.

WSF

1. How to choose a forex trading system wisely.

Many traders don't spend enough time researching the EAs market. Sadly, the EAs market is flooded with SCAMS - 90% of EAs are sold by marketers instead of traders and developers. Because marketers know how to attract your attention with big words and promises, many people fall into this trap.

What should you do?

Look at the results, do not listen to words only. Backtests are good, but live results are the only thing that matters. Look for third party verified results - myfxbook.com is great for this purpose. Look for a long enough performance record - at least six months or more. Pay attention to the balance curve - if it is completely flat, STAY AWAY – it means that this is a "no-stop-loss" system, "martingale", or just another reckless system!

A healthy EA equity curve looks like a nice market trend - it goes up, but has some corrections/drawdown periods as well. Look at the number of trades - less than 100 trades is not representative enough. As a final step, look around in forums to check up on the reputation of a vendor and its products.

WSF

소셜 네트워크에 공유 · 2

Vitor Gomes

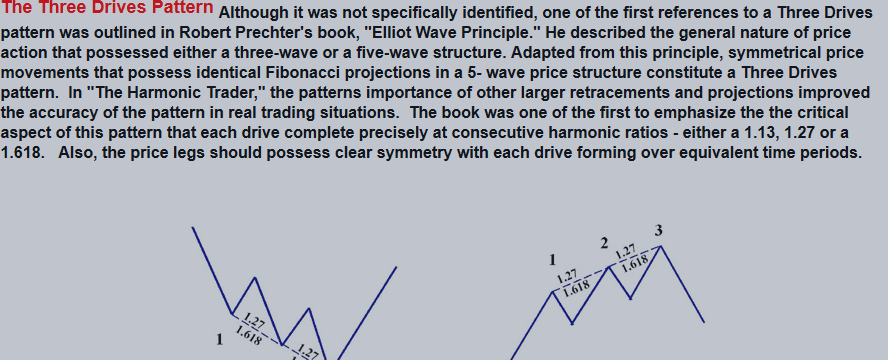

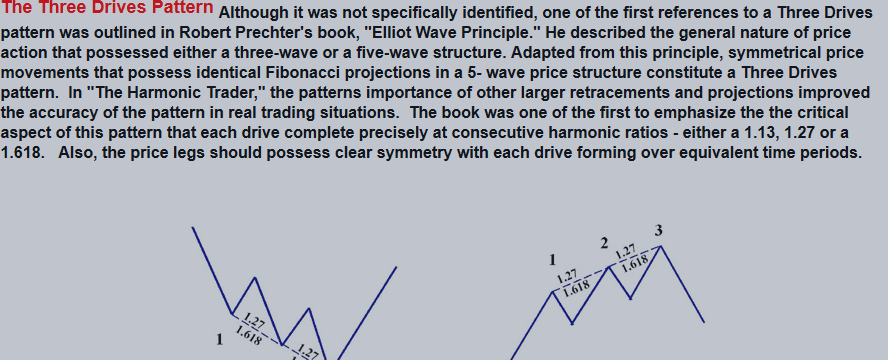

The Three Drives Pattern, Although it was not specifically identified, one of the first references to a Three Drives pattern was outlined in Robert Prechter’s book, “Elliot Wave Principle.” He described the general nature of price action that possessed either a three-wave or a five-wave structure...

소셜 네트워크에 공유 · 7

272

Vitor Gomes

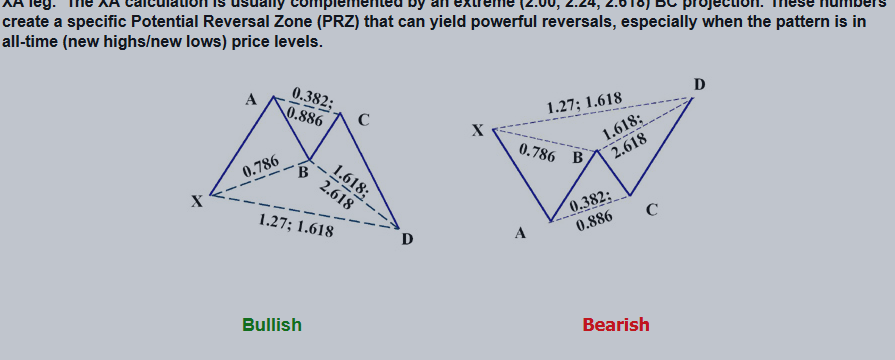

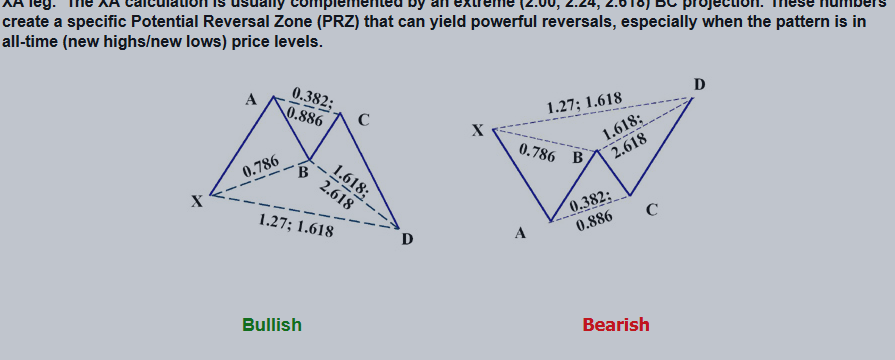

Gartley

Vitor Gomes

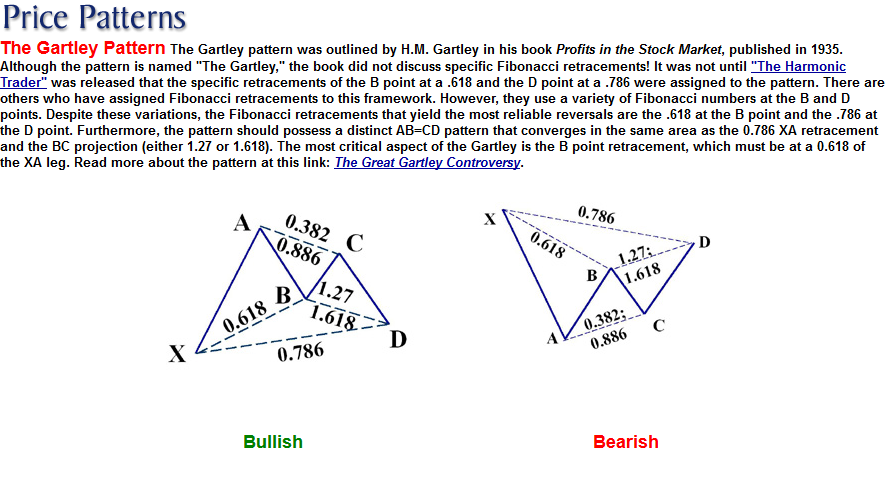

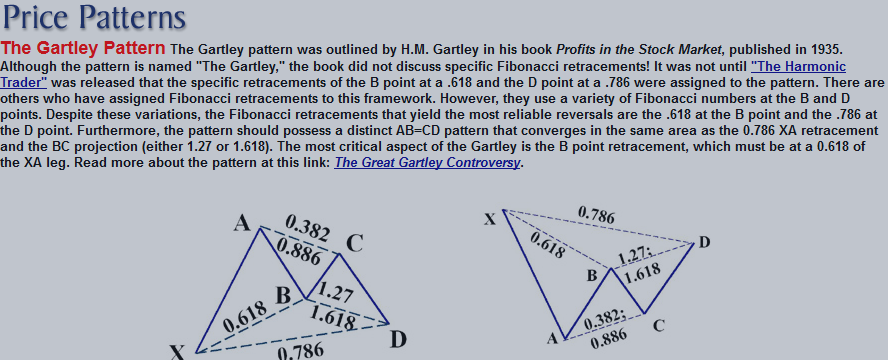

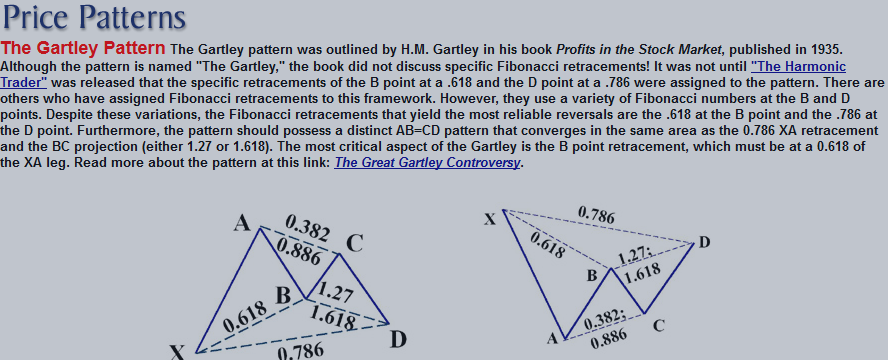

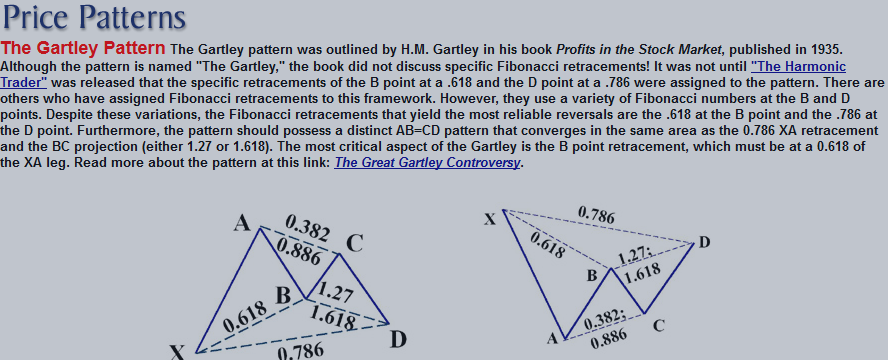

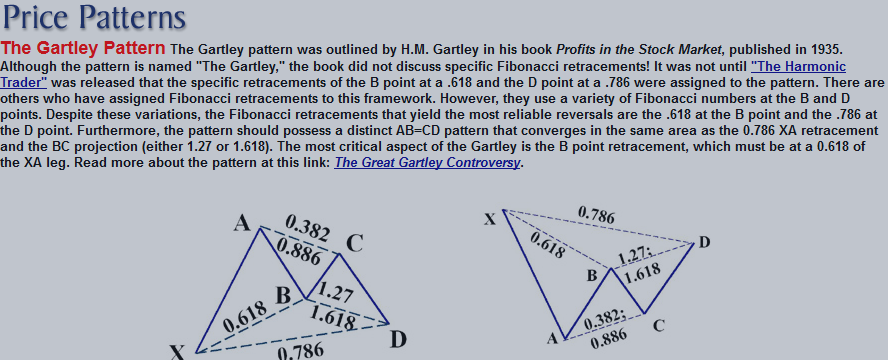

The Gartley Pattern The Gartley pattern was outlined by H.M. Gartley in his book Profits in the Stock Market, published in 1935. Although the pattern is named "The Gartley," the book did not discuss specific Fibonacci retracements...

2

Vitor Gomes

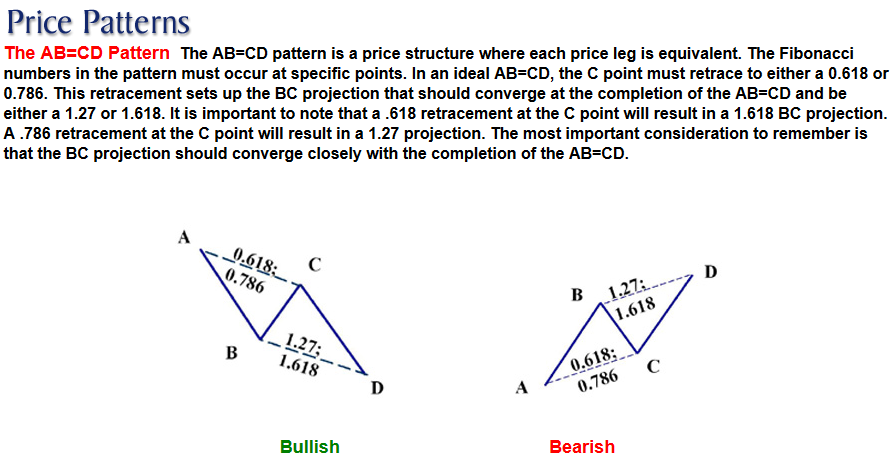

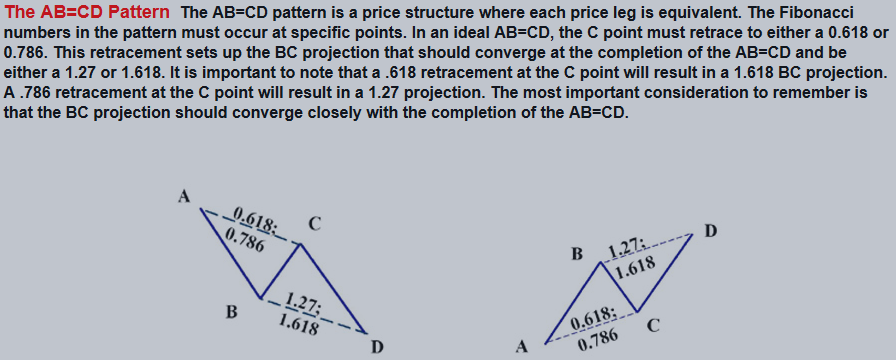

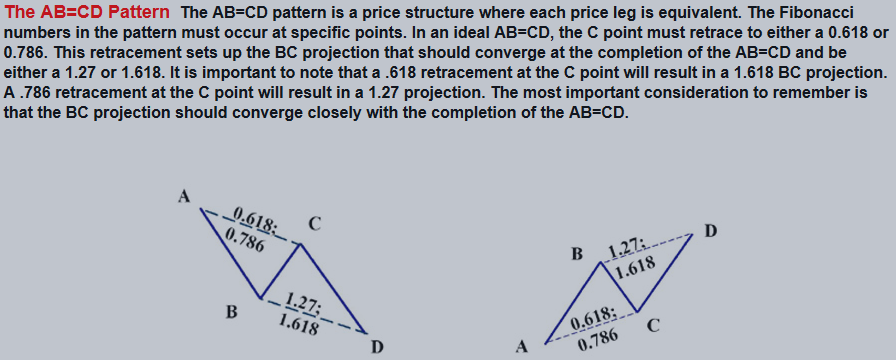

The AB=CD Pattern The AB=CD pattern is a price structure where each price leg is equivalent. The Fibonacci numbers in the pattern must occur at specific points. In an ideal AB=CD, the C point must retrace to either a 0.618 or 0.786...

소셜 네트워크에 공유 · 6

218

Vitor Gomes

The Gartley Pattern The Gartley pattern was outlined by H.M. Gartley in his book Profits in the Stock Market, published in 1935. Although the pattern is named "The Gartley," the book did not discuss specific Fibonacci retracements...

소셜 네트워크에 공유 · 4

260

Vitor Gomes

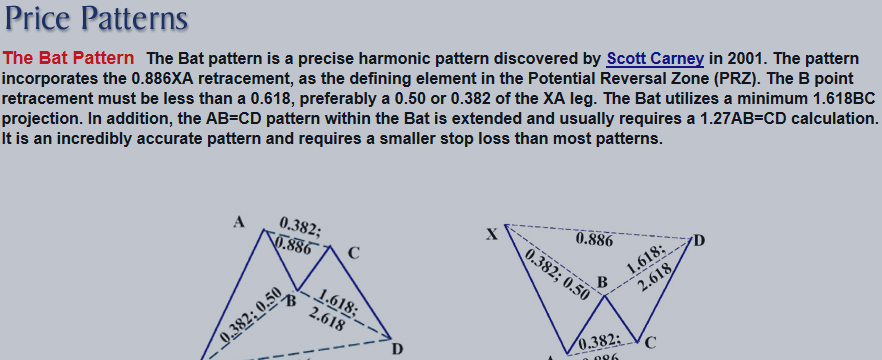

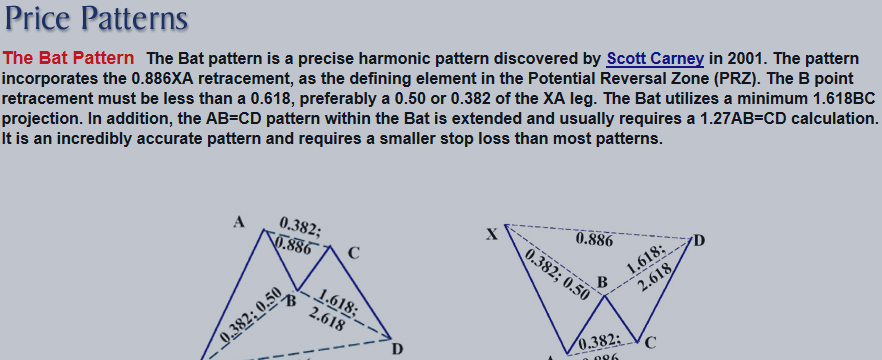

The Bat Pattern The Bat pattern is a precise harmonic pattern discovered by Scott Carney in 2001. The pattern incorporates the 0.886XA retracement, as the defining element in the Potential Reversal Zone (PRZ). The B point retracement must be less than a 0.618, preferably a 0.50 or 0...

소셜 네트워크에 공유 · 6

249

Vitor Gomes

The Butterfly Pattern The general extension structure of the Butterfly pattern was discovered by Bryce Gilmore. However, the exact alignment of ratios was defined in Scott Carney's 1998 book, "The Harmonic Trader." This has become the industry standard for the structure...

소셜 네트워크에 공유 · 6

177

3

Vitor Gomes

VG Forex Trader uses

Multi Strategy

Trading with expert Advisor (Automated Trading)

different systems

eur/usd, usd/jpy, usd/cad, aud/usd, nzd/usd, gbp/usd, usd/chf

Stop/Loss, T/P and Trailing Stop

Different time frame

Different risks and money managements

www. myfxbook.com/members/rudrashakti/vg-forex-trader-i/1289711

My Website - www.vgforextrader.com

Multi Strategy

Trading with expert Advisor (Automated Trading)

different systems

eur/usd, usd/jpy, usd/cad, aud/usd, nzd/usd, gbp/usd, usd/chf

Stop/Loss, T/P and Trailing Stop

Different time frame

Different risks and money managements

www. myfxbook.com/members/rudrashakti/vg-forex-trader-i/1289711

My Website - www.vgforextrader.com

소셜 네트워크에 공유 · 3

: