ramkumar1992 / Profile

Friends

33

Requests

Outgoing

ramkumar1992

Published post Banks

The Reserve Bank of India on Monday said bank accounts will not become inoperative if a dividend cheque has been credited in it in the previous two years...

Share on social networks · 1

87

ramkumar1992

The Reserve Bank of India on Monday said bank accounts will not become inoperative if a dividend cheque has been credited in it in the previous two years.

"Since dividend on shares is credited to Savings Bank accounts as per the mandate of the customer, the same should be treated as a customer induced transaction.

"As such, the account should be treated as operative account as long as the dividend is credited to the Savings Bank account," the central bank said in a notification.

A bank account becomes inoperative or dormant if no credit or debit transaction has been conducted for a period of two years.

RBI further said that the account should be treated as operative account as long as the dividend is credited to the Savings Bank account.

This clarification has been issued in view of the doubts raised by some bankers whether an account in which only dividend has been credited can be treated as inoperative after two years

"Since dividend on shares is credited to Savings Bank accounts as per the mandate of the customer, the same should be treated as a customer induced transaction.

"As such, the account should be treated as operative account as long as the dividend is credited to the Savings Bank account," the central bank said in a notification.

A bank account becomes inoperative or dormant if no credit or debit transaction has been conducted for a period of two years.

RBI further said that the account should be treated as operative account as long as the dividend is credited to the Savings Bank account.

This clarification has been issued in view of the doubts raised by some bankers whether an account in which only dividend has been credited can be treated as inoperative after two years

ramkumar1992

RBI initiates inspection of Syndicate Bank

The RBI has initiated an inspection of the accounts of Syndicate Bank, whose CMD S K Jain was recently arrested by the CBI for allegedly taking a bribe.

The RBI has initiated an inspection of the accounts of Syndicate Bank, whose CMD S K Jain was recently arrested by the CBI for allegedly taking a bribe.

ramkumar1992

Gold may rebound as extreme bearishness sets in

CHAPEL HILL, N.C. (MarketWatch) — What does contrarian analysis have to say about gold now?

Time

Gold - Electronic (COMEX) Dec 2014

7 Jul

21 Jul

4 Aug

18 Aug

1 Sep

15 Sep

US:GCZ4$1,200$1,250$1,300$1,350

It was two weeks ago when I reported that sentiment analysis, at long last, was on the side of the bulls — at least for a tradeable rally. Yet, far from rallying, bullion today is $18 per ounce lower — a nine-month low — than it was then.

Does this mean contrarian analysis was wrong? Have contrarians reconsidered their bullish turn?

No is the answer, on both counts.

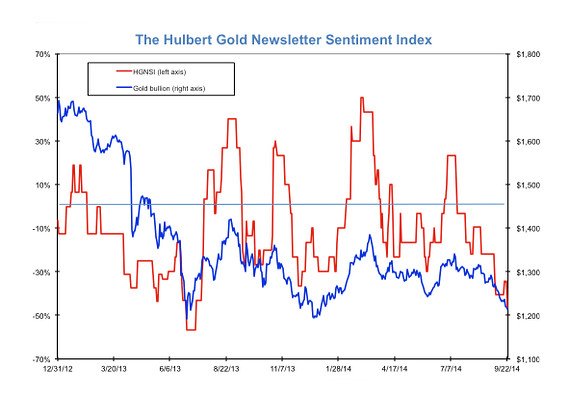

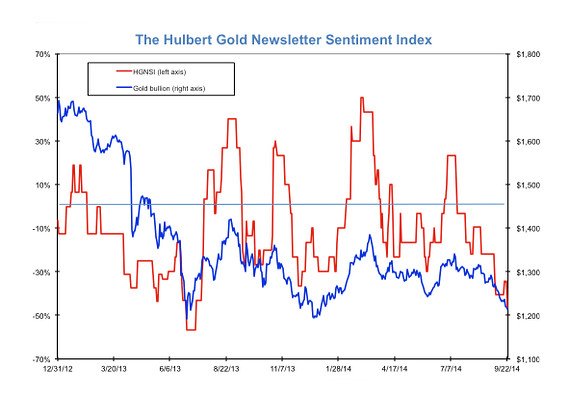

Consider the average recommended gold market exposure level among a subset of short-term gold market timers tracked by the Hulbert Financial Digest (as measured by the Hulbert Gold Newsletter Sentiment Index, or HGNSI). This average currently stands at minus 46.9%, which means that the average short-term gold timer is now allocating nearly half his clients’ gold-oriented portfolios to going short.

That is an aggressively bearish posture, which is unlikely to be profitable according to contrarian analysis.

Two weeks ago, when I last wrote about gold sentiment, the HGNSI stood at minus 40.6%. So contrarians are even more bullish today than they were then.

There’s been only one time in the past 30 years when the HGNSI got any lower than it is today. That came in June 2013, when the HGNSI fell to minus 56.7%. As you can see from the accompanying chart, gold soon — within a matter of a couple weeks — began a rally that, by late August, had tacked more than $200 on to the price of an ounce of gold.

Notice that gold’s 2013 summer rally didn’t begin immediately after the HGNSI dropped to the levels we’re seeing today. That’s hardly a criticism, of course, since no trading system can pick the market’s turning points with pinpoint accuracy.

Nevertheless, according to the econometric tests to which I have subjected the 30 years’ worth of my sentiment data, the gold market performs appreciably better following low HGNSI readings rather than it does high ones. Contrarian analysis hasn’t always worked, needless to say, but it’s more successful than it is a failure.

The time frame over which the HGNSI has its greatest explanatory power, according to my econometric tests, is one to three months. That means, assuming contrarian analysis will get its recent call right, gold will be higher during the last quarter of this year than it is today.

How long will gold’s rally last and how far will gold rise? The answer depends on how quickly the currently bearish gold timers jump on the bullish bandwagon. In the summer of 2013, for example, the HGNSI remained below minus 40% for nearly a month after the rally began, during which time gold rose more than $100.

That suggested that the bearishness that then prevailed was stubbornly held, which is a bullish omen according to contrarian analysis. If the gold timers exhibit similar stubbornness in coming weeks, contrarians would expect gold’s next rally to be that much stronger.

In contrast, if the gold timers instead are quick to become bullish again, gold’s rally will most likely be that much weaker.

Fortunately, contrarians don’t need to forecast, letting the sentiment data tell the story themselves.

CHAPEL HILL, N.C. (MarketWatch) — What does contrarian analysis have to say about gold now?

Time

Gold - Electronic (COMEX) Dec 2014

7 Jul

21 Jul

4 Aug

18 Aug

1 Sep

15 Sep

US:GCZ4$1,200$1,250$1,300$1,350

It was two weeks ago when I reported that sentiment analysis, at long last, was on the side of the bulls — at least for a tradeable rally. Yet, far from rallying, bullion today is $18 per ounce lower — a nine-month low — than it was then.

Does this mean contrarian analysis was wrong? Have contrarians reconsidered their bullish turn?

No is the answer, on both counts.

Consider the average recommended gold market exposure level among a subset of short-term gold market timers tracked by the Hulbert Financial Digest (as measured by the Hulbert Gold Newsletter Sentiment Index, or HGNSI). This average currently stands at minus 46.9%, which means that the average short-term gold timer is now allocating nearly half his clients’ gold-oriented portfolios to going short.

That is an aggressively bearish posture, which is unlikely to be profitable according to contrarian analysis.

Two weeks ago, when I last wrote about gold sentiment, the HGNSI stood at minus 40.6%. So contrarians are even more bullish today than they were then.

There’s been only one time in the past 30 years when the HGNSI got any lower than it is today. That came in June 2013, when the HGNSI fell to minus 56.7%. As you can see from the accompanying chart, gold soon — within a matter of a couple weeks — began a rally that, by late August, had tacked more than $200 on to the price of an ounce of gold.

Notice that gold’s 2013 summer rally didn’t begin immediately after the HGNSI dropped to the levels we’re seeing today. That’s hardly a criticism, of course, since no trading system can pick the market’s turning points with pinpoint accuracy.

Nevertheless, according to the econometric tests to which I have subjected the 30 years’ worth of my sentiment data, the gold market performs appreciably better following low HGNSI readings rather than it does high ones. Contrarian analysis hasn’t always worked, needless to say, but it’s more successful than it is a failure.

The time frame over which the HGNSI has its greatest explanatory power, according to my econometric tests, is one to three months. That means, assuming contrarian analysis will get its recent call right, gold will be higher during the last quarter of this year than it is today.

How long will gold’s rally last and how far will gold rise? The answer depends on how quickly the currently bearish gold timers jump on the bullish bandwagon. In the summer of 2013, for example, the HGNSI remained below minus 40% for nearly a month after the rally began, during which time gold rose more than $100.

That suggested that the bearishness that then prevailed was stubbornly held, which is a bullish omen according to contrarian analysis. If the gold timers exhibit similar stubbornness in coming weeks, contrarians would expect gold’s next rally to be that much stronger.

In contrast, if the gold timers instead are quick to become bullish again, gold’s rally will most likely be that much weaker.

Fortunately, contrarians don’t need to forecast, letting the sentiment data tell the story themselves.

: