Review of trades of the Owl Smart Levels strategy for the week from November 27 to December 1, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from November 27 to December 1, 2023.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

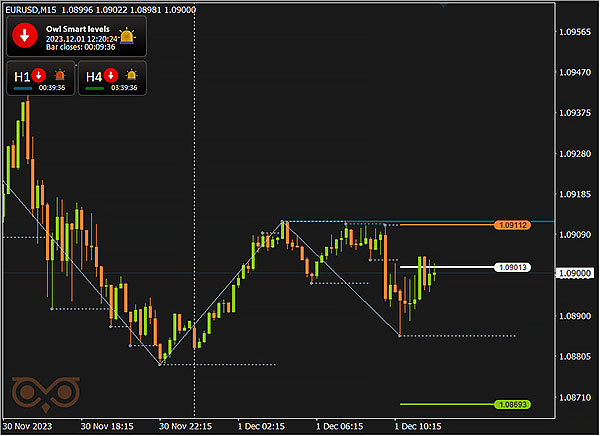

EURUSD review

The first trade on this currency pair was opened on the signal of the Owl Smart Levels indicator during the last trading week session on Friday at 11:30 and closed at TakeProfit, bringing a profit of 48$.

Fig. 1. EURUSD SELL 0.15, OpenPrice = 1.09013, StopLoss = 1.09112, TakeProfit = 1.08693, Profit = $48.48.

The second trade on this financial instrument occurred on the same day at 18:45 and was closed according to the rule of closing all trades on Friday at 16:00 GMT, bringing a minimal profit.

Fig. 2. EURUSD SELL 0.07, OpenPrice = 1.08775, StopLoss = 1.09003, TakeProfit = 1.08039, Profit = $1.32.

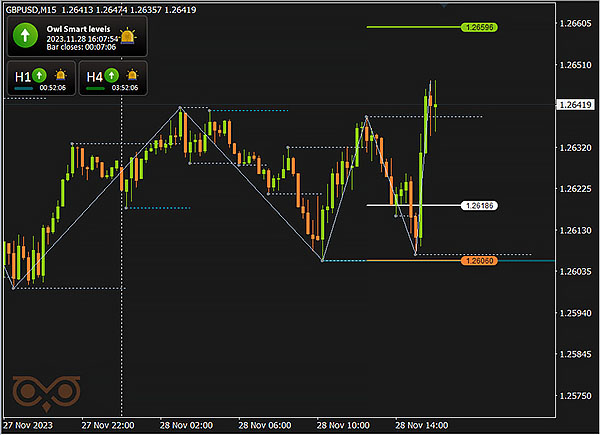

GBPUSD review

The first trade on this currency pair was opened on the Owl signal on Tuesday at 14:00 and closed at TakeProfit, bringing a profit of 48$.

Fig. 3. GBPUSD BUY 0.12, OpenPrice = 1.26186, StopLoss = 1.26060, TakeProfit = 1.26596, Profit = $48.81.

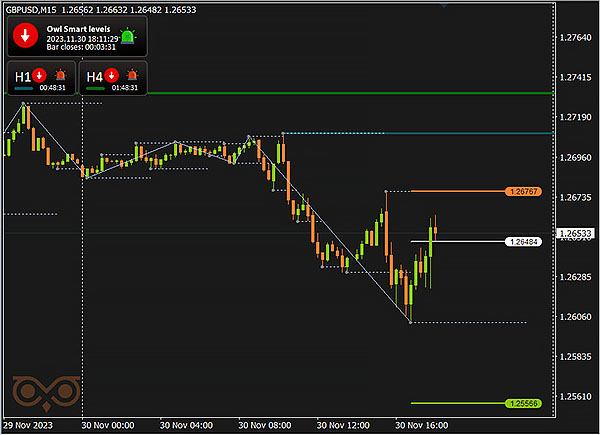

The second trade on this financial instrument occurred a day later on Thursday at 18:45 and was closed according to the rule of closing all trades at 19:00 GMT, bringing a profit of 14$.

Fig. 4. GBPUSD SELL 0.05, OpenPrice = 1.26484, StopLoss = 1.26767, TakeProfit = 1.25566, Profit = $14.36.

AUDUSD review

The first and the only trade on this currency pair was opened on the Owl signal during the last trading week session on Friday at 10:00. According to the rule of the strategy based on the Owl Smart Levels indicator, a trade is not opened if the indicator gives a signal to set StopLoss closer than 50 pips at five-digit quotes. The trade was opened because the stop was a little bit further from the opening price, at a distance of 56 pips, and closed at StopLoss, bringing a loss of 15$.

Fig. 5. AUDUSD SELL 0.27, OpenPrice = 0.66077, StopLoss = 0.66133, TakeProfit = 0.65895, Profit = -$15.

Results:

There were 5 trades during the last trading week. All major currencies, which are traded using the Owl Smart Levels indicator, lost their momentum of development this week. Positive signals, which came from the Fed and economic indicators and supported the growth of these currencies, were used up during the previous weeks. The market stopped in its development and moved to trading in a sideways corridor. As a rule, indicators and trading systems show the best results in a trending market and perform poorly or unstably during trading in a sideways direction. But despite the loss of the market's purposeful movement, the Owl Smart Levels indicator performed well last week and showed excellent results, bringing 9.8% return on deposit for the week. The detailed data is in the final table.

We will see how the trading will look like and how the market will behave, as well as what trades will be offered to us to open Owl Smart Levels on Monday, during the upcoming trading week.

See other reviews of the Owl Smart Levels strategy:

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.