Seasonal trading, a strategy rooted in historical patterns, has gained popularity among investors seeking to maximize their returns. In this article, we will explore the world of seasonal trading, its principles, and how you can harness these patterns to your advantage.

Understanding Seasonal Trading

Seasonal trading is the practice of buying and selling financial instruments based on recurring patterns that tend to happen during specific times of the year. This strategy has a deep historical origin and can be traced back to agricultural cycles. The fundamental idea is that certain assets tend to perform predictably at certain times.

Identifying Seasonal Trends

Recognizing seasonal trends is crucial for successful seasonal trading. These patterns can be seen in various asset classes, including stocks, commodities, and currencies. For instance, the "Santa Claus Rally" is a well-known phenomenon in stock markets, where equities tend to perform well during the holiday season.

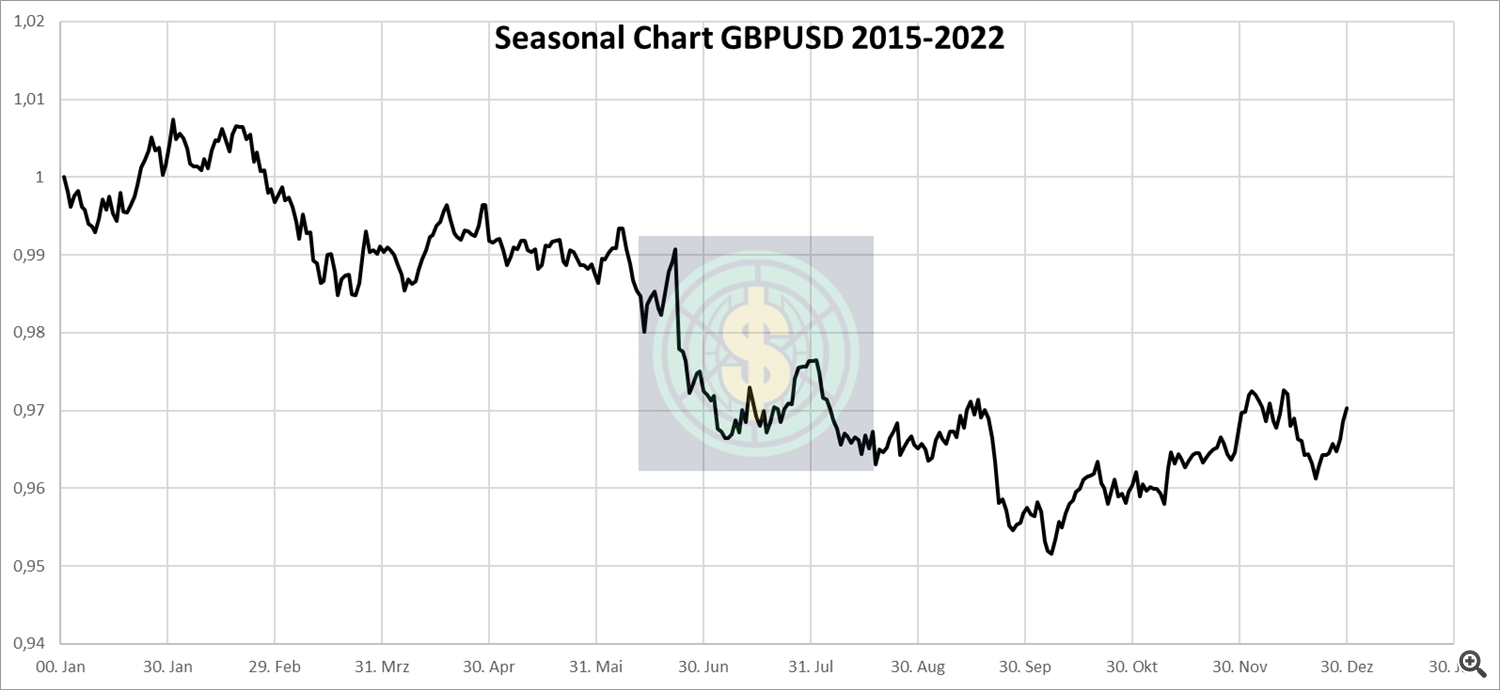

Below is shown the average price movement of GBPUSD for the years 2015-2022. You can see a clear tendence that at the end of the year the trend is shifting and more money is floating into the British Pound. In the middle of february this money is floating back into the US Dollar.

Benefit from the fact that some things will never change, and as humans, we repeat things year after year and proceed in roughly the same way. This also applies to investing in the stock markets or moving funds in the Forex markets.

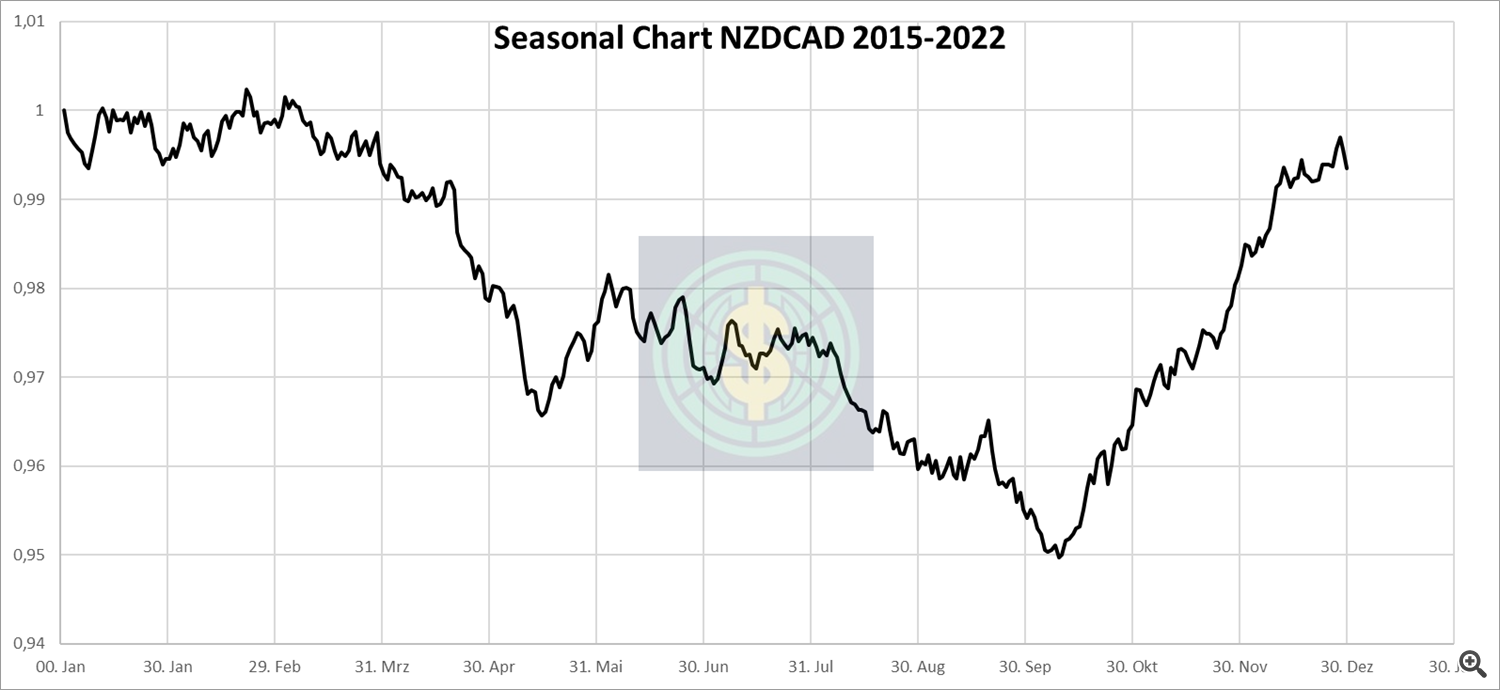

One more example of a seasonal chart for NZDCAD for the years 2015-2022 :

Tools and Resources for Seasonal Traders

As a seasonal trader, it's essential to have the right tools and resources at your disposal. There are software platforms, data providers, and research reports specifically designed for seasonal traders. Access to reliable and up-to-date data is the lifeblood of this strategy, as it enables you to make informed decisions.

Building a Seasonal Trading Strategy

A successful seasonal trading strategy encompasses various elements. These include identifying assets with predictable seasonal patterns, developing a disciplined approach to trading, and implementing effective risk management strategies. Diversification is also crucial to spread risk.

Practical Tips for Seasonal Traders For those considering seasonal trading, here are some practical tips. First and foremost, comprehensive research is key. Be prepared to adapt your strategy as market conditions change. Stay disciplined and avoid common mistakes, such as overtrading and ignoring risk management principles.

Conclusion

In conclusion, seasonal trading offers an intriguing path to potentially higher returns. However, it's not without risk, and success requires dedication and a thorough understanding of the markets. If you choose to explore seasonal trading, do so with caution and commit to ongoing research and learning. The opportunity for significant returns is there for those who approach it wisely.

Click here to explore our seasonal trading expert advisor: https://www.mql5.com/de/market/product/107358