EUR/USD Forecast: Dollar Gains, but Can it Last?

The EUR/USD pair fell for a second consecutive week, extending the

retracement from the year high at 1.1615, down to the 1.1300 region. The

common currency was under pressure even though there were no major

market catalyst until this Friday. The dollar got a boost from strong

Retail Sales figures that surprised to the upside, rising more than

expected when the market was betting on a soft reading, and an uptick

in Consumer confidence in April, up to 95.8 against previous 89.

The dollar gained in an uncertain market, as uncertainty was the one and only reason behind these days' moves.

Will the FED raise rates in June? or the BOJ ease, or Britain leave the

EU? Has the worldwide economic slowdown ended, or is it just worsening

in the Q2? None of those questions have a clear answer, and none will

get an easy one any time soon. All eyes are now in June, with hopes that

things will be clearer then.

The upcoming week will be quite interest anyway from the fundamental

point of view, as several major economies will release employment and

inflation data, which can begin to clear the clouds, but don't bet too

much on it. Overall, worth noticing that most of dollar gains have been

not because of a strong self macroeconomic background.

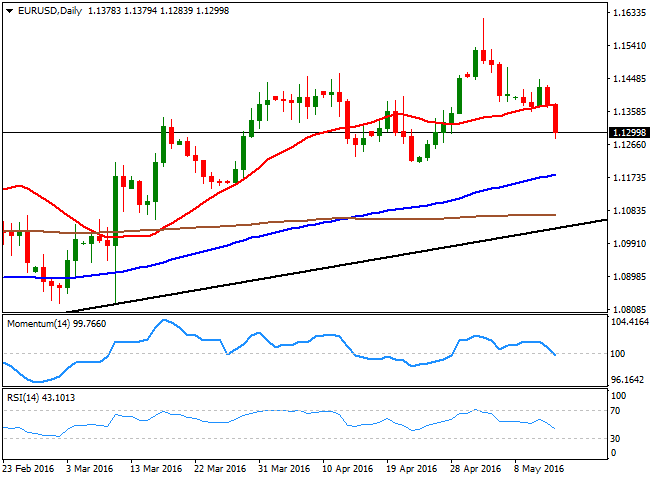

From a technical point of view, the risk remains towards the downside

for the EUR/USD pair for this upcoming week, as in the daily chart, the

price has accelerated below its 20 SMA, whilst the technical indicators

have crossed below their mid-lines, although some additional

follow-through would confirm the decline. Nevertheless, the pair is well

above a daily ascendant trend line, while the 100 DMA, stands around

1.1180, above the 200 DMA and with a nice upward slope, being the

probable bearish target on a break below 1.1250. The decline can extend down to 1.1120, the probable bottom for next week, if the dollar keeps rallying.

The 1.1400/20 region is the immediate resistance, followed by 1.1460 a

strong static resistance level. Gains above this last are unlikely, but

if somehow market enters in dollar's sell-off mode, the rally can extend

beyond 1.1500.