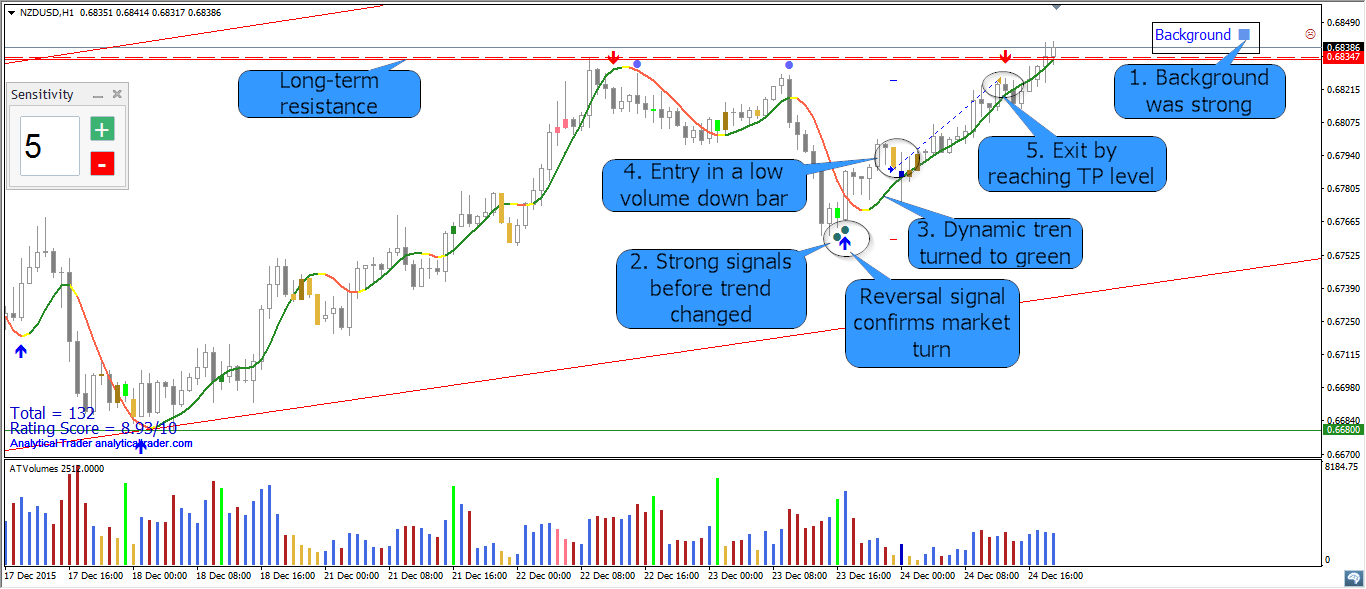

NZDUSD is moving in a trading range. The area between the upper and lower trend lines is known as the trading range. In VSA terms, the (sideways) market is trading within its range, and will continue to do so until applied (selling or buying) effort makes it break out.

A trader who uses VSA principles will analyse price action in the top and bottom quarters of the trading range, because important observations take place in these areas, as the price heads for the supply or support lines.

The area above the supply (higher) trend line is known as overbought and the area below the support (lower) trend line is referred to as oversold.

One more important line in this chart – long-term resistance. Price already several times reversed near this line. Therefore, it is important to observe price behavior near this area.

1. Background was strong.

2. Strong signals (2 Minor Demand signals) before trend changed. Reversal signal also confirms market turn in this place.

3. Dynamic trend turned from red to green.

4. Entry in a low volume down-bar. Stop-loss below previous low.

5. Exit by reaching TP level.

Total: + 37 Pips