Current trend

The markets are hit by a new wave of uncertainty. Since the beginning of the week, prices of copper are rapidly falling. Copper widely perceived as the general indicator of world economic outlook, and therefore markets now assume the world economy outlook is getting worse. Hence, we had a spike in the Yen and the US government bonds interest.

Today, markets were presented another reason to worry – the Chinese Manufacturing PMI came out worse than expected, which shows that the Chinese economy is cooling down. The Australian Dollar, on the other hand, is largely dependent on metal exports and China is one of the biggest consumers of metals. Therefore, there are all reasons to expect a further fall in the pair.

Support and resistance

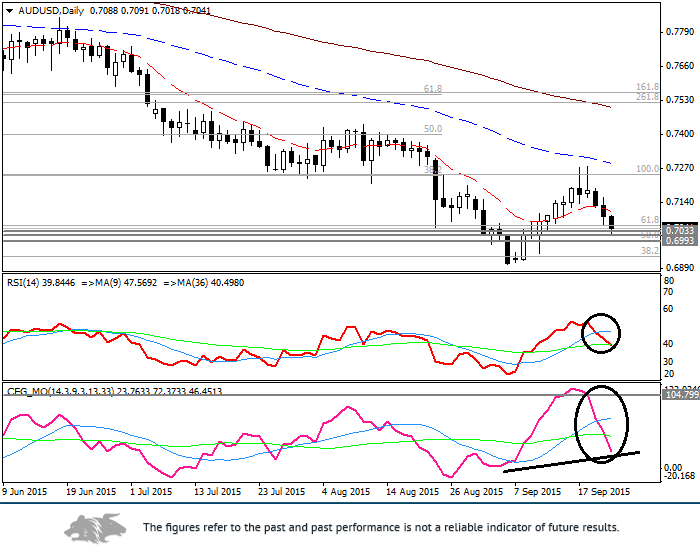

On the weekly chart, the price bounced off the strong resistance at 0.7200 and is heading down. The RSI has failed the support level for the second time and is now approaching its moving averages. The Composite, however, is on its way up thus diverging with the RSI and the price. Both indicators have their short MA’s below the long one, which indicates some weakness of the market.

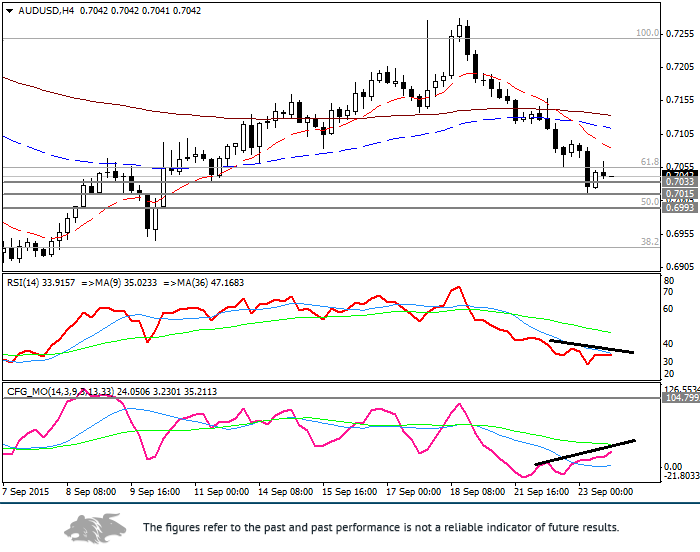

The daily chart shows short MA’s above the long once. The Composite travelled much longer distance than the RSI, warning us that there might be a consolidation ahead. On the 4-hour chart, the Composite diverged with the price and the RSI and is about to test its long MA. That is a solid looking picture for a strong move down unless it breaks through the MA.

Support levels: 0.7032 (medium confluence zone), 0.7014 (medium confluence), 0.6993 (strong confluence), 0.6276 (strongest confluence).

Resistance levels: 0.7084 (high volume trade), 0.7171 (high volume trade), 0.7209 (strong confluence), 1.1317 (strong confluence).

Trading tips

Open short positions from current levels with targets at 0.7033, 0.7015, 0.6996, 0.6950 and stop-loss at 0.7089. Validity – 1-2 days.

Long positions can be opened form the level of 0.7180 with the target at 0.7273 and stop-loss at 0.7125. Validity – 2-3 days.