Tutorial Video Digest: MACD - How To Use MACD Indicator for Technical Analysis and for Trading

1. General Information

One of the most common technical indicators that is used by day traders

in the financial markets can be seen in the Moving Average Convergence

Divergence -- more commonly referred to as the MACD. But one mistake

that many new traders make is that they will simply start using this

indicator without really understanding how it functions or makes its

calculations. This can lead to costly mistakes that should have been

completely avoidable. So, it makes sense to study the logic and

calculations behind the MACD (and all other indicators) in order to more

accurately configure your day trading positions and generate gains on a

consistent basis.

The Moving Average Convergence Divergence (MACD) Defined

Anyone with any experience in the forex markets and in technical

analysis strategies has likely heard a great deal about the Moving

Average Convergence Divergence (MACD). But what exactly does the MACD

tell us -- and how is it calculated? Without an understanding of these

areas, it can be difficult to see trading signals as they emerge. Here,

will deconstruct the MACD indicator and explain how and why it is

commonly used.

“In its most basic form,” said Haris Constantinou, markets analyst, “the

MACD is a momentum indicator that is designed to follow existing trends

and find new ones.” The MACD does this by showing the differences and

relationships between a two-level combination of moving averages and

price activity itself.

MACD Calculations

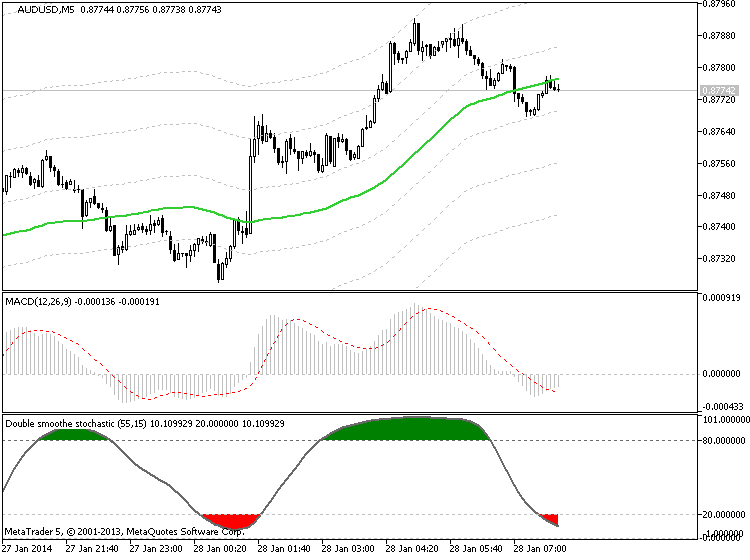

To determine and calculate the MACD, we must subtract a 26 period

Exponential Moving Average (EMA) from a 12 period EMA. Then, a 9 period

EMA of the MACD is plotted, and this becomes the Signal Line for the

indicator. The Signal Line is plotted over the MACD and this will be

used as the trigger reading for trading signals (both buy signals and

sell signals). These elements form the basis of the MACD construction,

and it is important to have a strong understanding of these elements if

you plan on using the indicator in your daily trading.

Three Common Approaches to the MACD

Now that we understand the basics of how the MACD is calculated, it is a

good idea to look at some of the common ways that the MACD is viewed by

traders so that we can get a sense of how exactly the indicator is used

to identify trading opportunities. There are a few different ways the

indicator can be interpreted, and the three of the most common methods

proven to be the most effective for traders include

- Crossovers,

- Divergences,

- and in identifying Overbought / Oversold conditions

2. How to use MACD indicator - something to read

- MACD Strategy Center Line Crossover Bullish Signal and Bearish Signal

- MACD Oscillator Technical Analysis Fast Line and Signal Line

- MACD Technical Analysis Buy and Sell Signals

- MACD Whipsaws and Fake Out Signals on Bearish and Bullish Territory

- MACD Indicator Fast Line and Center Line Crossover

- MACD Classic Bullish and Bearish Divergence

- MACD Hidden Bullish and Bearish Divergence

- Scalping with MACD

3. Technical Analysis Indicator MACD part one

4. Technical Analysis Indicator MACD part two