E-commerce site EBay has announced the plans to split off its payments system PayPal hub into a separate firm. News of the move has boosted EBay shares 7.5 per cent up. Billionaire investor Carl Icahn has praised the decision -that was a move he has pushed for much of the year.

PayPal revenues are growing 19% twice as fast as the ones of EBay. Its payment system is available in 203 markets worldwide and is expected to process one billion mobile payments this year.

PayPal's annual revenue is $7.2bn (£4.5bn), while eBay's is $9.9bn and is growing at 10% a year.

"A thorough strategic review...

shows that keeping eBay and PayPal together beyond 2015 clearly becomes

less advantageous to each business strategically and competitively,"

EBay's chief executive John Donahoe said.

Spinning off PayPal into a separate publicly traded company next year marks a sharp reversal for EBay, which spent a lot of time, energy and money earlier this year fighting Mr. Icahn and the premise that eBay would be better as two.

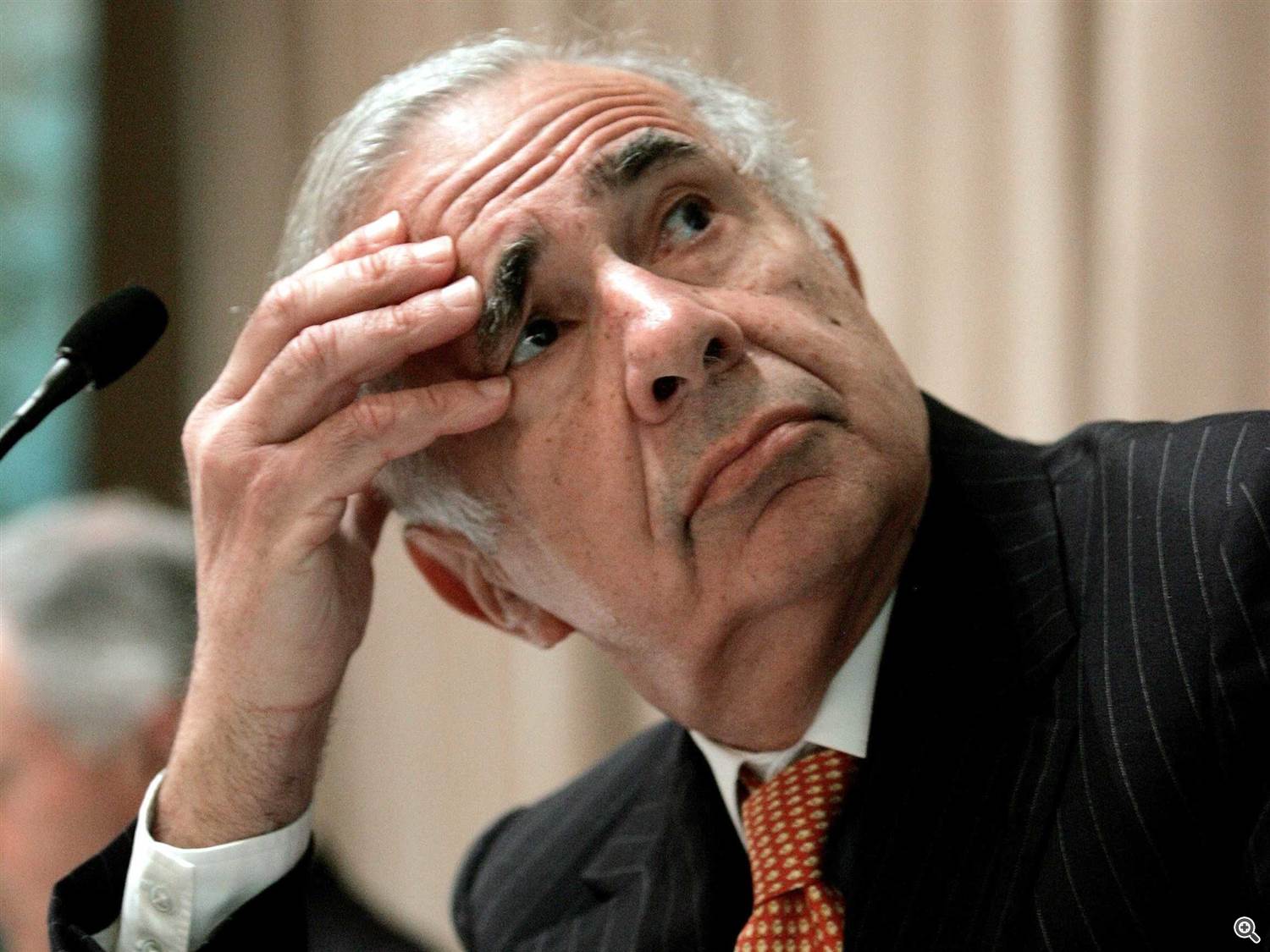

Carl Icahn, photo credit: Business Insider

Mr. Icahn has taken a bigger role within eBay as it faces fresh competition in the payments sector from Apple Inc.AAPL +0.64%, which introduced this month a new mobile-payment service hoping to shake up the industry.

Below is what Carl Icahn said on the division:

“We are happy that eBay’s board and management have acted responsibly concerning the separation – perhaps a little later than they should have, but earlier than we expected. As I have said in the past and have continued to maintain, it is almost a ‘no brainer’ that these companies should be separated to increase the value of these great assets and thus to meaningfully enhance value for all shareholders. It also continues to be my belief that the payments industry, of which PayPal is an important part, must be consolidated – either through acquisitions made by PayPal or a merger between PayPal and another strong player in the industry. It is possible that this could be accomplished through a reverse Morris Trust structure because, in light of the development of strong competition such as the advent of Apple Pay, the sooner these consolidations take place, the better. As one of the largest shareholders of eBay, I intend to have discussions in the near future with John Donahoe who, as I have said in the past and continue to believe, has the interest of enhancing value for all shareholders as his major concern.”