All Blogs

Hello everyone, this is a quick guide, please read through. If you still have any questions, please contact me...

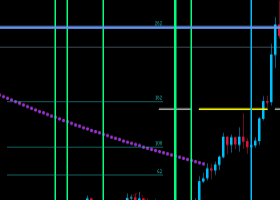

Pivot (invalidation): 75.40 Our preference Short positions below 75.40 with targets at 73.90 & 73.35 in extension. Alternative scenario Above 75.40 look for further upside with 75.95 & 76.45 as targets...

Pivot (invalidation): 14.7000 Our preference Short positions below 14.7000 with targets at 14.4200 & 14.3400 in extension. Alternative scenario Above 14.7000 look for further upside with 14.8000 & 14.9100 as targets...

Pivot (invalidation): 1205.50 Our preference Short positions below 1205.50 with targets at 1195.50 & 1189.50 in extension. Alternative scenario Above 1205.50 look for further upside with 1208.50 & 1211.00 as targets...

Pivot (invalidation): 2912.00 Our preference Short positions below 2912.00 with targets at 2893.00 & 2883.50 in extension. Alternative scenario Above 2912.00 look for further upside with 2917.75 & 2931.00 as targets...

Pivot (invalidation): 12350.00 Our preference Short positions below 12350.00 with targets at 12175.00 & 12115.00 in extension. Alternative scenario Above 12350.00 look for further upside with 12405.00 & 12465.00 as targets...

Pivot (invalidation): 6.1210 Our preference Long positions above 6.1210 with targets at 6.2155 & 6.2630 in extension. Alternative scenario Below 6.1210 look for further downside with 6.0590 & 6.0270 as targets...

Pivot (invalidation): 0.7085 Our preference Short positions below 0.7085 with targets at 0.7050 & 0.7035 in extension. Alternative scenario Above 0.7085 look for further upside with 0.7100 & 0.7115 as targets...

Pivot (invalidation): 1.2885 Our preference Long positions above 1.2885 with targets at 1.2940 & 1.2975 in extension. Alternative scenario Below 1.2885 look for further downside with 1.2855 & 1.2810 as targets...

Pivot (invalidation): 0.9895 Our preference Long positions above 0.9895 with targets at 0.9935 & 0.9970 in extension. Alternative scenario Below 0.9895 look for further downside with 0.9860 & 0.9830 as targets...

Pivot (invalidation): 113.75 Our preference Long positions above 113.75 with targets at 114.05 & 114.25 in extension. Alternative scenario Below 113.75 look for further downside with 113.50 & 113.30 as targets...

Pivot (invalidation): 1.2995 Our preference Long positions above 1.2995 with targets at 1.3040 & 1.3060 in extension. Alternative scenario Below 1.2995 look for further downside with 1.2970 & 1.2950 as targets...

Pivot (invalidation): 1.1490 Our preference Long positions above 1.1490 with targets at 1.1520 & 1.1545 in extension. Alternative scenario Below 1.1490 look for further downside with 1.1460 & 1.1430 as targets...

With the cryptocurrency market falling, the noble yellow metal can become one of the most attractive tools for financial traders and speculators. Gold instead of Bitcoin...

Inflation in Turkey blew out expectations, with the core reading up to 24.5% and producer prices hitting 46%. Oddly, TRY is stable, which must mean markets are confident the Central Bank of Turkey will fix it. So the CBT must hike...

Strong economic data sent US yields higher across the board. 10-year treasuries surged to 3.225%, adding 0.12% overnight. USD bulls charged, bidding up the greenback versus developed and developing currencies alike. Worries of a slowdown trade tensions were nowhere to be found...

Pivot (invalidation): 75.60 Our preference Long positions above 75.60 with targets at 76.90 & 77.30 in extension. Alternative scenario Below 75.60 look for further downside with 74.90 & 74.25 as targets...

Pivot (invalidation): 14.7100 Our preference Short positions below 14.7100 with targets at 14.4200 & 14.3400 in extension. Alternative scenario Above 14.7100 look for further upside with 14.8200 & 14.9100 as targets...

Pivot (invalidation): 1202.00 Our preference Short positions below 1202.00 with targets at 1194.00 & 1189.00 in extension. Alternative scenario Above 1202.00 look for further upside with 1205.00 & 1208.00 as targets...