All Blogs

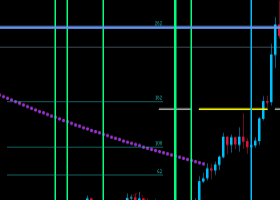

Pivot (invalidation): 1.1275 Our preference Short positions below 1.1275 with targets at 1.1220 & 1.1190 in extension. Alternative scenario Above 1.1275 look for further upside with 1.1300 & 1.1325 as targets...

Minimum balance required If deposit $100 use cent account, If deposit $500 use cent account, If deposit $900 use cent account, If deposit $1000 use micro account FXMH Expert Advisor works for this: Currency pairs: EUR/USD Timeframe: M5 Leverage: 1:500 Parameter settings for EUR/USD, M5 MINIM_DAIL...

Heiken Ashi Scanner Heikin-Ashi charts , developed by Munehisa Homma in the 1700s. Munehisa Honma was a rice merchant from Sakata, Japan who traded in the Dojima Rice market in Osaka during the Tokugawa Shogunate. He is considered to be the father of the candlestick chart...

Additional trading signals of the All-in-One Trade Indicator (AOTI) simplify market analysis and help us both to open positions and to fix profits...

In the currencies market, the US dollar edges lower. In the dearth of important economic data and event, the EURUSD looks set for further gains. Due later this morning, the latest Ifo survey will likely confirm an improved business sentiment in Germany...

Mounting anxiety that the second wave contagion would dent the pace of business reopening and the massive fiscal, monetary stimuli are a sweet blend for technology stocks. Nasdaq (+0...

Pivot (invalidation): 40.65 Our preference Short positions below 40.65 with targets at 39.75 & 39.00 in extension. Alternative scenario Above 40.65 look for further upside with 41.20 & 41.65 as targets...

Pivot (invalidation): 17.7700 Our preference Long positions above 17.7700 with targets at 18.0700 & 18.1600 in extension. Alternative scenario Below 17.7700 look for further downside with 17.6400 & 17.5300 as targets...

Pivot (invalidation): 1760.00 Our preference Long positions above 1760.00 with targets at 1777.00 & 1787.00 in extension. Alternative scenario Below 1760.00 look for further downside with 1752.00 & 1745.00 as targets...

Pivot (invalidation): 3154.00 Our preference Short positions below 3154.00 with targets at 3077.00 & 3017.00 in extension. Alternative scenario Above 3154.00 look for further upside with 3184.00 & 3220.00 as targets...

Pivot (invalidation): 12330.00 Our preference Long positions above 12330.00 with targets at 12616.00 & 12760.00 in extension. Alternative scenario Below 12330.00 look for further downside with 12157.00 & 12040.00 as targets...

Pivot (invalidation): 6.8350 Our preference Long positions above 6.8350 with targets at 6.8580 & 6.8720 in extension. Alternative scenario Below 6.8350 look for further downside with 6.8250 & 6.8140 as targets...

Pivot (invalidation): 0.6975 Our preference Short positions below 0.6975 with targets at 0.6920 & 0.6890 in extension. Alternative scenario Above 0.6975 look for further upside with 0.7000 & 0.7025 as targets...

Pivot (invalidation): 1.3525 Our preference Long positions above 1.3525 with targets at 1.3570 & 1.3590 in extension. Alternative scenario Below 1.3525 look for further downside with 1.3505 & 1.3485 as targets...

Pivot (invalidation): 0.9455 Our preference Short positions below 0.9455 with targets at 0.9425 & 0.9415 in extension. Alternative scenario Above 0.9455 look for further upside with 0.9470 & 0.9495 as targets...

Pivot (invalidation): 106.35 Our preference Long positions above 106.35 with targets at 106.70 & 106.85 in extension. Alternative scenario Below 106.35 look for further downside with 106.20 & 106.05 as targets...

Pivot (invalidation): 1.2535 Our preference Short positions below 1.2535 with targets at 1.2495 & 1.2470 in extension. Alternative scenario Above 1.2535 look for further upside with 1.2560 & 1.2585 as targets...

Pivot (invalidation): 1.1345 Our preference Short positions below 1.1345 with targets at 1.1300 & 1.1280 in extension. Alternative scenario Above 1.1345 look for further upside with 1.1375 & 1.1400 as targets...

The EURUSD rebounded a touch above 1.1160, the critical Fibonacci support, and extended gains to 1.1280 in Asia. Technically, the pair remains in the mid-term bullish trend above this level. Cable tested the 1.25 offers after having dipped at 1.2335 on Monday...