All Blogs

Promised the 1.3 Trillion. Had long been another life outside Earth into question in the minds of many people. Include Yuri Milner, who announced his plans to spend the money amounting to USD100 million (USD 1.3 trillion) to find the answer...

This trading week ended with some interesting result for EURUSD: seems - the ranging time is finished for this pair, and we can expect the bearish breakdown for the next week for example. EURUSD D1 price is on primary bearish with secondary ranging between 1.1113 resistance and 1...

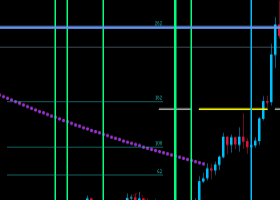

W1 price is located to be below yearly Central Pivot at 17.41 and above S1 Pivot at 12.66: The price is on bearish ranging between yearly Central Pivot at 17.41 and S1 Pivot at 12.66; The price is breaking descending triangle pattern with 14...

BUMN housing, Perumnas will build a new town worth Rp30 trillion in Medan, North Sumatra. This long-term project will be developed in the next 10 years. Marketing Director Perumnas Muhammad Nawir said the new town was now in the stage of submission of licensing...

On Friday the euro climbed versus the greenback, with investors eyeing U.S. nonfarm payrolls report due later in the day. The pound was slightly lower after data on U.K. trade deficit...

Weekly digest compiles the latest news from the world of stocks and finance, currency and commodity news, as well as interesting informative articles for traders. News of the week: September vs December rate hike. What is the consensus...

XAU/USD: ranging below yearly Central Pivot. This pair is on bearish ranging below Central Pivot at 1237.48 for trying to break S1 Pivot at 1082.97 on close weekly bar for the bearish trend to be continuing. The key target in our case is 1077...

I generally do not follow EUR/USD, but the strategy of BUY low and SELL high is applicable to any type of instrument. You can check out my other posts on forex gold prices...

Current trend The USD/JPY pair stabilised after the publication of the Bank of Japan Minutes and prior to the publication of the key US statistics. As expected, the Bank of Japan kept its key interest rate at 0%. The quantitative easing program also left unchanged at 80 trillion yen a year...

W1 price is bearish market condition for breaking S1 Pivot at 1082.97 from above to below for the bearish trend to be continuing. If this 1082.97 target is broken by close weekly bar so the next target will be S2 Pivot at 977.50. The price is located between yearly Central Pivot at 1237...

On Friday the euro fell against the greenback after rising to extend modest gains from the previous session, and U.S. Treasury prices jumped ahead of Friday's report on the employment situation in the U.S...

The Royal Bank of Scotland (RBS) made forecast concerning the following coming high impacted news events: Non-Farm Payrolls (or Non-Farm Employment Change) - they made a forecast for non-farm payroll growth of 250K in July, above the listed consensus of 225K...

While there is no doubt that gold is on a SELL trend, i see the possibility of a retracement in MN time frame. As of now, there are some indications from level 3 set up but there is no confirmation yet. It is for this reason that i have kept the BUY order open adamantly without closing it...

Credit Suisse made a forecast for Non-Farm Employment Change for this week with detailed explanation about what to expect for example: "We continue to see an asymmetry in favor of the USD going into Friday’s US employment data...

CRUDE OIL: Though maintaining its broader weakness, Crude Oil may see a recovery higher on correction in the days ahead. Resistance is located at the 46.00 level where a break will expose the 47.00 level. A break below here will aim at the 48.00 level and then the 49.00 level...

The BAD: this YEAR is very bad years after a decade of much benefit in emerging markets, said Harvard Kennedy School economists, Carmen Reinhart, one of the world's leading experts on the financial crisis and the country's economy growing...

Stocks on Wall Street ended mostly higher on Wednesday (Thursday morning GMT), after the u.s. economic data varies, but a disappointing earnings report from Disney pressed the Dow lower. Dow Jones Industrial Average slumped 10,22 points (0.06 percent) to close at 17.540, 47...

Prime Minister Alexis Tsipras said, Greece was increasingly approaching the conclusion of a deal with the lender for a multi-billion euro bailout, which he said will end the doubt in respect of the position of Athens in the euro zone...

Private sector jobs growth in the U.S. slowed in last July, but the increase in the service industry to the highest level in the past decade shows the movement of the economy that is increasingly strengthened The Fed to raise rates this year...