All Blogs

Nomura is expecting the first Fed hike in December and explaining about it: the FOMC will not raise rates this week during September FOMC: "Even without a decision to raise short-term interest rates, markets will have a lot to digest. We will get a new round of forecasts from FOMC participants...

On Thursday the greenback edged lower against the yen after the Bank of Japan decided to stand pat on the monetary policy which spurred demand for the Japanese currency...

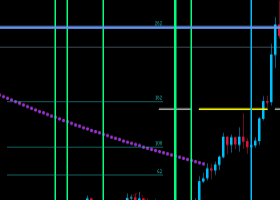

For today R4 - 0.7318 / R3 - 0.7285 / R2 - 0.7250 / R1 - 0.7216 SPOT 0.7136 S1 - 0.7063 / S2 - 0.7030 / S3 - 0.6946 / S4 - 0.6898 BUY AT 0.7100 FOR 0.7250; STOP AT 0.7030 How to trade support & resistance levels To see more ideas, check my blog Or follow on Twitter...

Market analysts in Bloomberg review foresee rate trek in mid 2016. Sonia advances recommend rate increment in November 2016. The pound succumbed to a second day versus the dollar before a report on Tuesday that financial analysts conjecture will indicate U.K...

Austria, Slovakia and Netherlands bulking up police watches. Restoring checks could have financial effect in long haul...

One-hundred-year bonds have dove 15% since June issue. S&P brought down Petrobras' FICO score to garbage a week ago...

On the other hand simply taking the succumb to one? Previous UBS merchant Tom Hayes leaving Westminster Magistrates on June 20, 2013, subsequent to showing up in court...

You may need to keep this rundown convenient. Goldman Sachs financial analysts may not anticipate that the Federal Reserve will raise premium rates until December, yet the bank's value strategists are now planning customers for what might be the first trek in about 10 years...

Aussie snaps advance as RBA highlights dangers to worldwide viewpoint. U.S. value list fates higher as Fed's rate choice weavers. The yen deleted misfortunes as the Bank of Japan left financial approach unaltered...

EURUSD - "The long-term bearish outlook for EUR/USD may come back into light should the Fed keep a 2015 liftoff on the table, and signs for an looming rate hike may put the exchange rate under pressure as interest rate expectations pickup...

USDCAD: USDCAD continues to remain in a consolidation mode having been trapped in a range below its key resistance zone at 1.3352. A break either way must occur to trigger directional moves. Resistance resides at the 1.3300 level where a break will target the 1.3350 level...

The following are UBS' latest short-term (mostly intraday) trading strategies for EUR/USD, USD/JPY, and GBP/USD. EUR/USD: traded bid last week and ended with a short squeeze...

Raging wildfires in California have killed one person as firemen struggle to fight the spreading blazes amid a state of emergency. Hundreds of houses have been charred, with devastating photos showing homes completely gutted, only their foundations left standing...

By Thursday, market players will have the answer to the most burning question of the recent times: Will the Federal Reserve pull the trigger on the first interest-rate hike since 2006...

Morgan Stanley made weekly forecast for USD in fundamental/technical mixed way expecting strong USD against the other currency for example: "We remain bullish on USD, particularly against EM and commodity currencies. We expect no hikes at the upcoming Fed meeting...

Current trend In the end of last week, the Pound strengthened against the USD and gained back most of the losses of early September. However, macroeconomic statistics remain ambiguous. In particular, the GBP was pressured by poor data on Industrial Production that in June shrank by 0...

GBPUSD: With GBP turning lower at its key resistance zone at 1.5450/7 today, there is risk of more weakness as long as that zone continues to hold. This development is coming on the back of our earlier warning of how significant that level will be...

Morgan Stanley made weekly forecast for EUR in fundamental/technical mixed way expecting bearish EUR: "We remain bearish on EUR over the medium term but see reason for some support in the near term. EURUSD continues to be inversely correlated with risk appetite...